Question: GL0404 - Based on Problem 4-6A LO P4 Need help on: -debits & credits amounts, balance sheet, income statement. (Statement of owner's equity will automatically

GL0404 - Based on Problem 4-6A LO P4 Need help on:

-debits & credits amounts, balance sheet, income statement.

(Statement of owner's equity will automatically input data)

Thank you

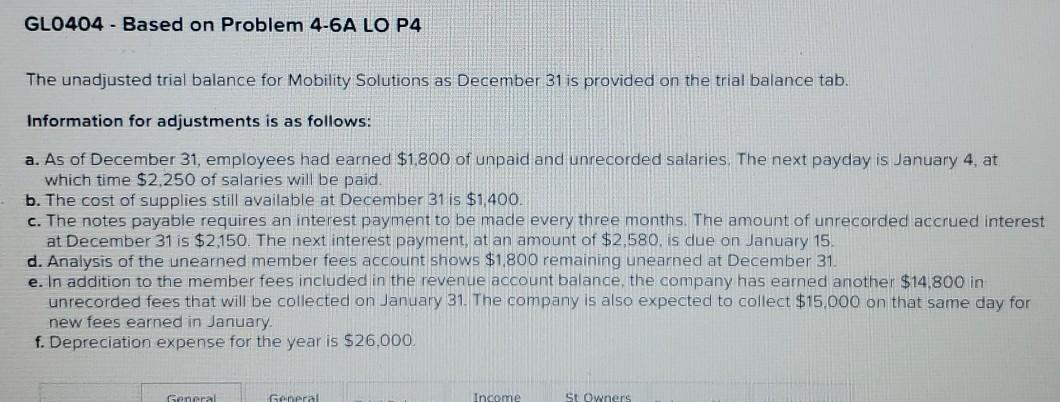

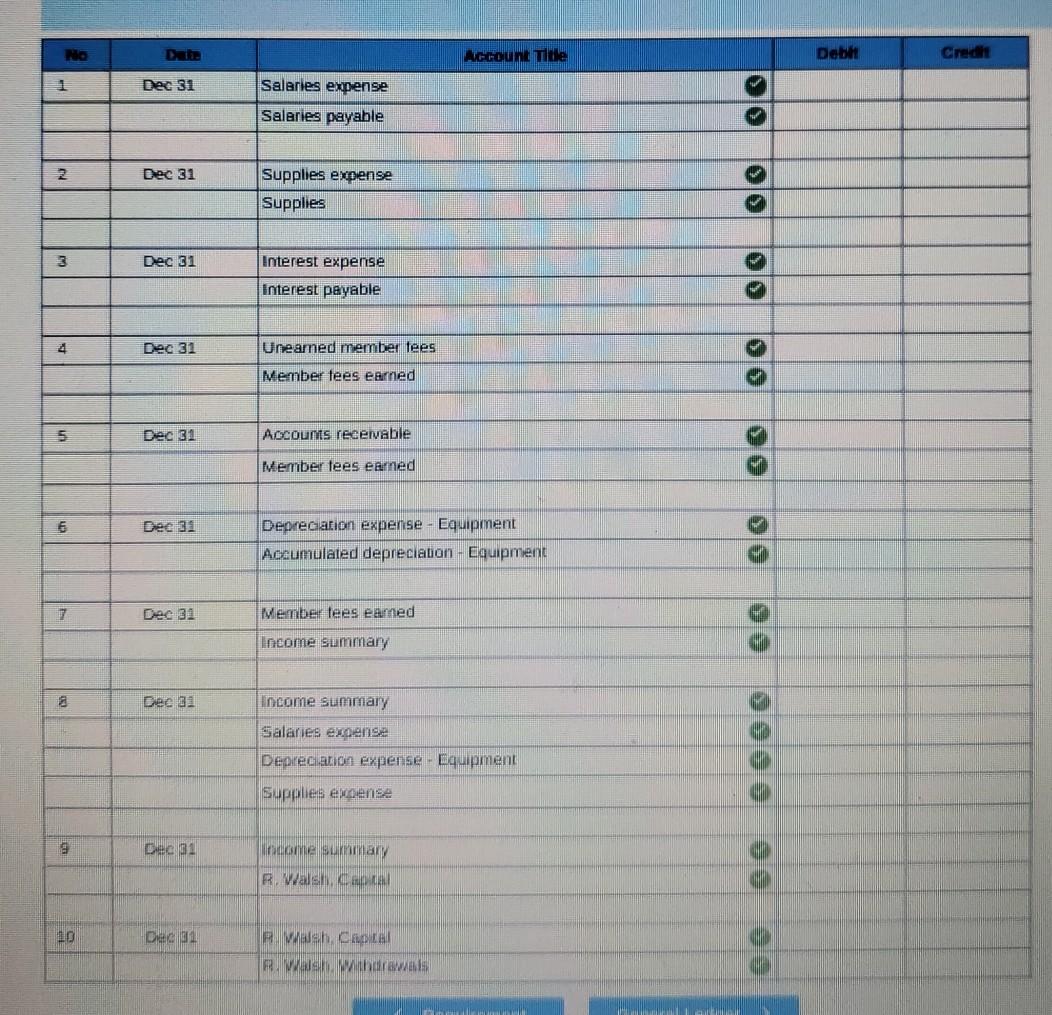

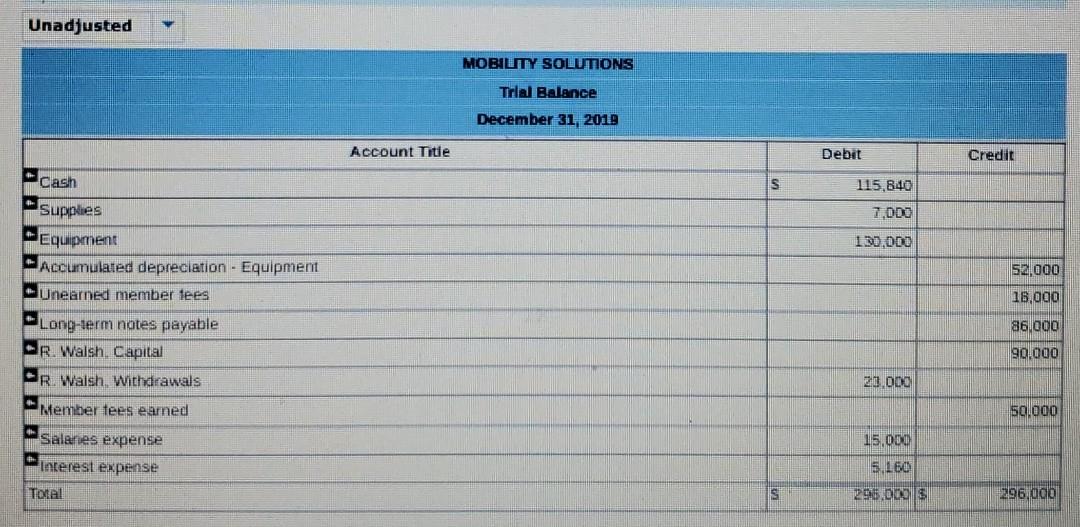

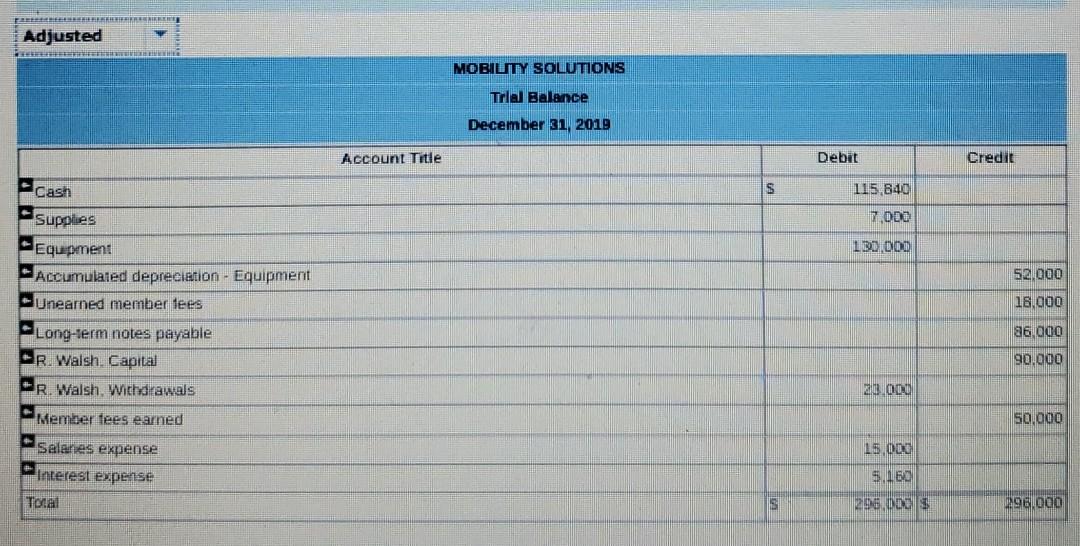

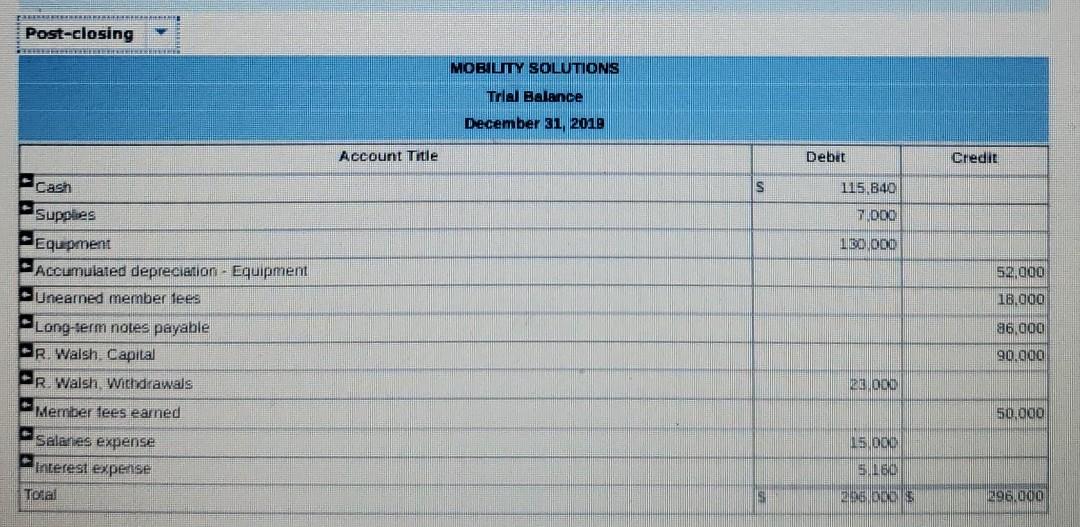

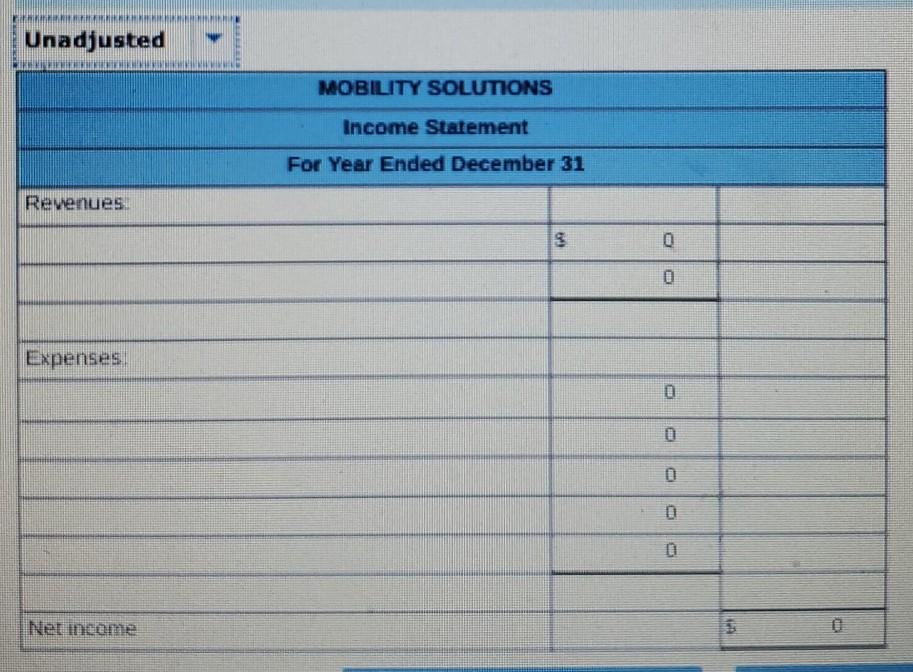

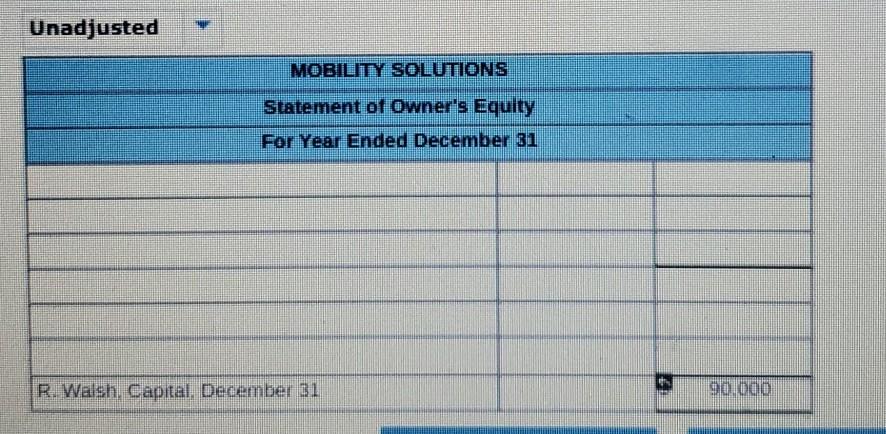

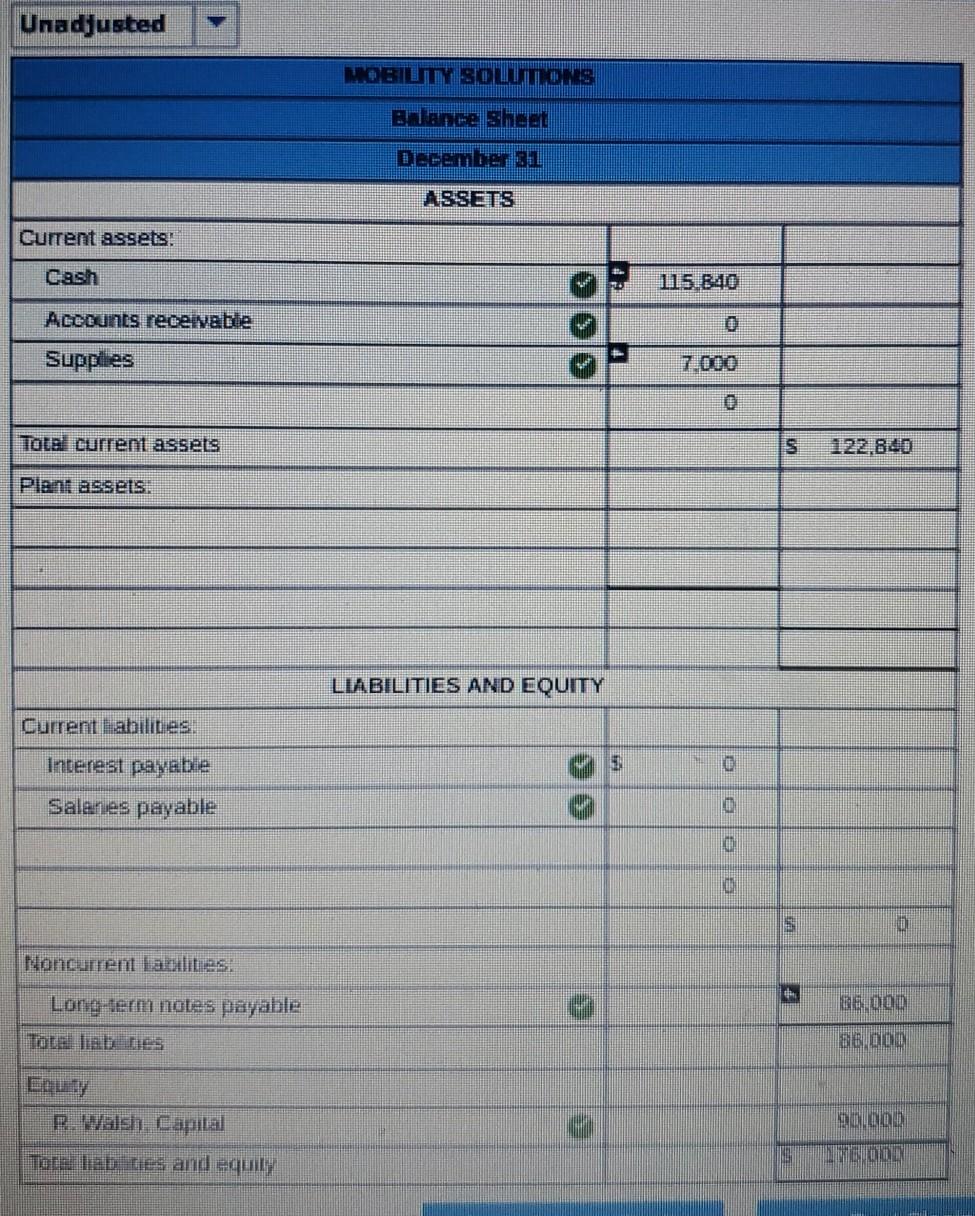

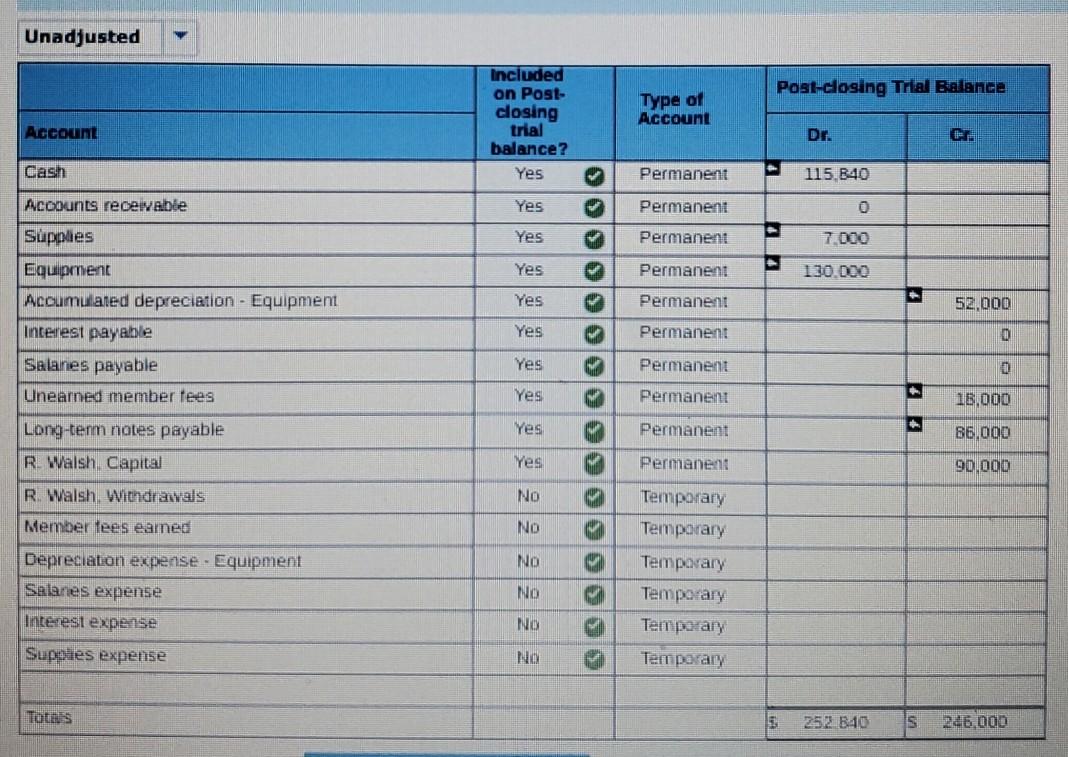

GLO404 - Based on Problem 4-6A LO P4 The unadjusted trial balance for Mobility Solutions as December 31 is provided on the trial balance tab. Information for adjustments is as follows: a. As of December 31, employees had earned $1.800 of unpaid and unrecorded salaries. The next payday is January 4, at which time $2,250 of salaries will be paid. b. The cost of supplies still available at December 31 is $1,400. c. The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $2,150. The next interest payment, at an amount of $2,580, is due on January 15. d. Analysis of the unearned member fees account shows $1.800 remaining unearned at December 31. e. In addition to the member fees included in the revenue account balance, the company has earned another $14,800 in unrecorded fees that will be collected on January 31. The company is also expected to collect $15,000 on that same day for new fees earned in January f. Depreciation expense for the year is $26.000 General General Income SL Owners NO Account Time Debit Cred 1 Dec 31 Salaries expense Salaries payable 2 Dec 31 Supplies expense Supplies 3 Dec 31 Interest expense Interest payable Dec 31 Unearned member fees Member fees earned 5 Dec 31 Accounts receivable Member lees earned Dec 31 Depreciation expense - Equipment Accumulated depreciation - Equipment 7 Dec 31 Member lees eamed Income summary B Dec 30 income summary Salaries expense Depreciation expense - Equipment Supples expense OOO De 31 nome summary R. Walsh Catal 0 0 20 Dec 01 B Wash Capa R. Wel witharawani Unadjusted MOBILITY SOLUTONS Trial Balance December 31, 2018 Account Title Debat Credit Cash S 115,840 7.DDO 130.000 Suppies Equipment Accumulated depreciation - Equipment Unearned member lees 52.000 15.000 86,000 Long-term notes payable R. Walsh, Capital R. Walsh, withdrawals 90.000 20 000 Member tees earned 50.000 Salanes expense Interest expense 15.000 5.160 295.000 TOTA! S 296.000 Adjusted MOBILTY SOLUTIONS Trial Balance December 31 2019 Account Title Debat Credit Cash S 115,840 7.000 100,000 52 000 Supplies Equpment Accumulated depreciation - Equipment Unearned member dees Long-term notes payable Sr. Walsh, Capital - R. Walsh. Withdrawals 18.000 | 86 000 90.000 20.000 Member fees earned 50.000 Salanes expense Interest Expense 15.000 5.160 296.00 $ Total 198.000 Post-closing MOBILITY SOLUTIONS Trial Balance December 31, 2018 Account Title Debit Credit Cash S 115,840 7 000 100 000 52.000 18,000 Supplies Equpment Accumulated depreciation - Equipment Unearned member lees Long-term notes payable R. Walsh Capital R. Walsh Withdrawals Member lees earned 86,000 90.000 20.000 50.000 15 000 Salanes expense Interest Expense 5.80 Tolai 26, 295.000 HIER Unadjusted MOBILITY SOLUTIONS Income Statement For Year Ended December 31 Revenues $ 0 o Expenses 0 0 0 Net income 3 Unadjusted MOBILITY SOLUTIONS Statement of Owner's Equity For Year Ended December 31 R. Walsh, Capital. December 31 90.000 Unadjusted MOBILY SOLILLONS Blance Sheet December i ASSETS Current assets! Cash 115.840 Accounts receivable 0 Suppies 7.000 Total current assets IS 122.840 Plan assets LIABILITIES AND EQUITY Current abilities. fo Interest payable Salanes payable ON S Noncurrent landlines: 8000 Long-term notes payable TO liat les 36.000 R. Walsh, Capital 200 Tote babies and equip DOWN Unadjusted Post-closing Trial Balance Included on Post- closing trial balance? Yes Type of Account Account Dr. Cash Permanent 115.840 Acoounts recewabe Yes Permanent 0 Yes Permanent 7.000 D D Yes Permanent 130.000 Yes + Permanent 52.000 Yes Permanent 0 Yes Permanent . Supplies Equipment Accumulared depreciation - Equipment Interest payable Salanes payable Unearned member tees Long-term notes payable R. Walsh, Capital R. Walsh Withdrawals Member lees earned Yes Permanent 18.000 Yes Permanent 86.000 Yes Permanent 90,000 No 0 No NO Temporary Temporary Temporary Temporary Temporary Temporary Depreciation expense - Equipment Salanes expense Interest expense Supples expense NO NO M TOLBES 252 B40 246,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts