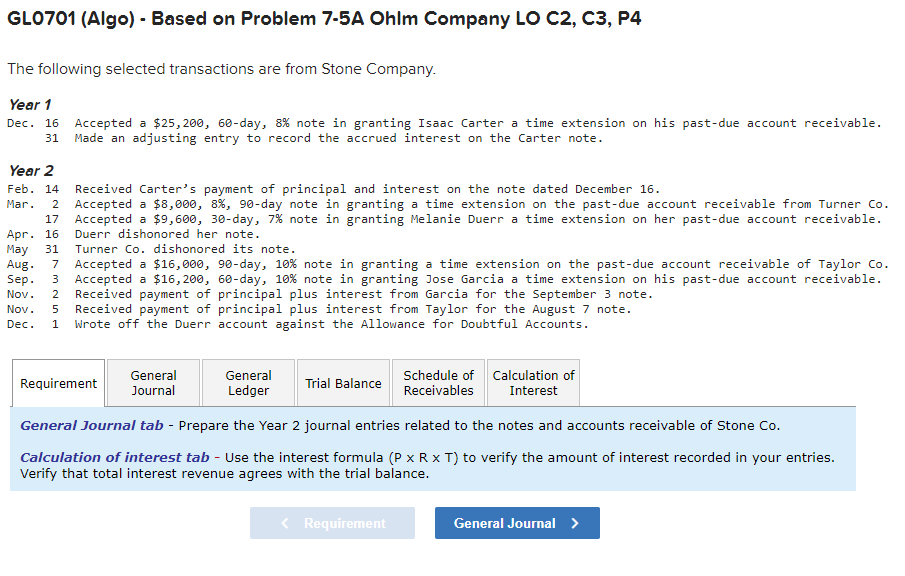

Question: GL0701 (Algo) - Based on Problem 7-5A Ohlm Company LO C2, C3, P4 The following selected transactions are from Stone Company. Year 1 Dec. 16

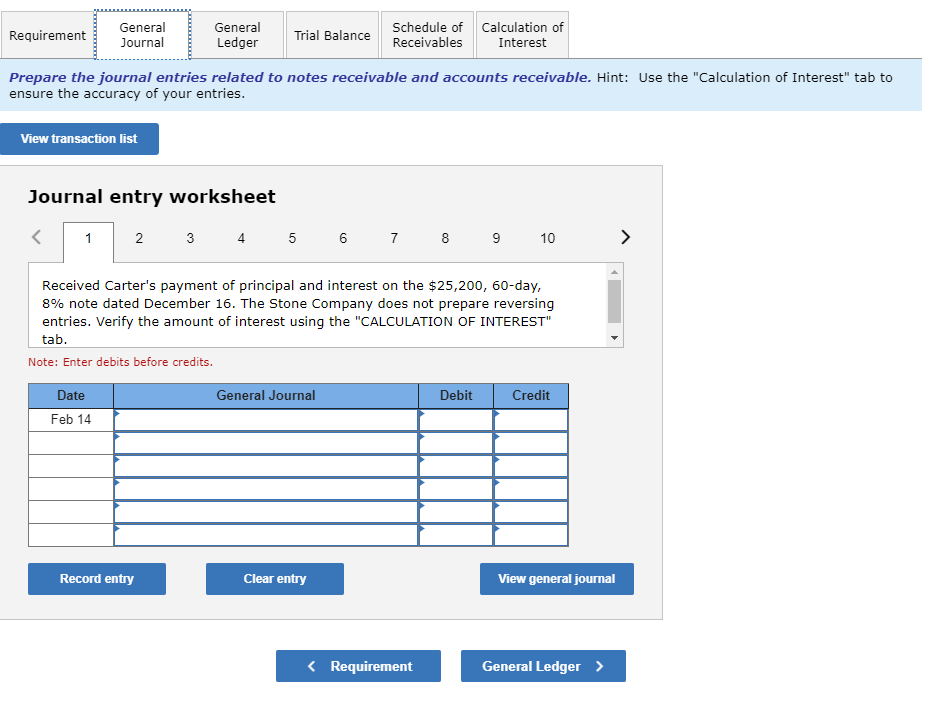

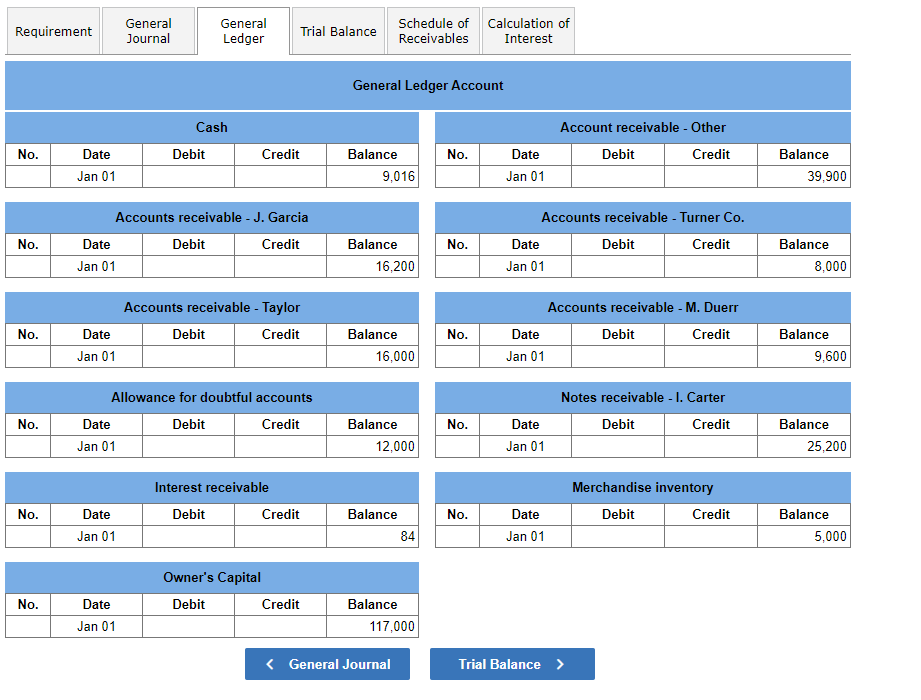

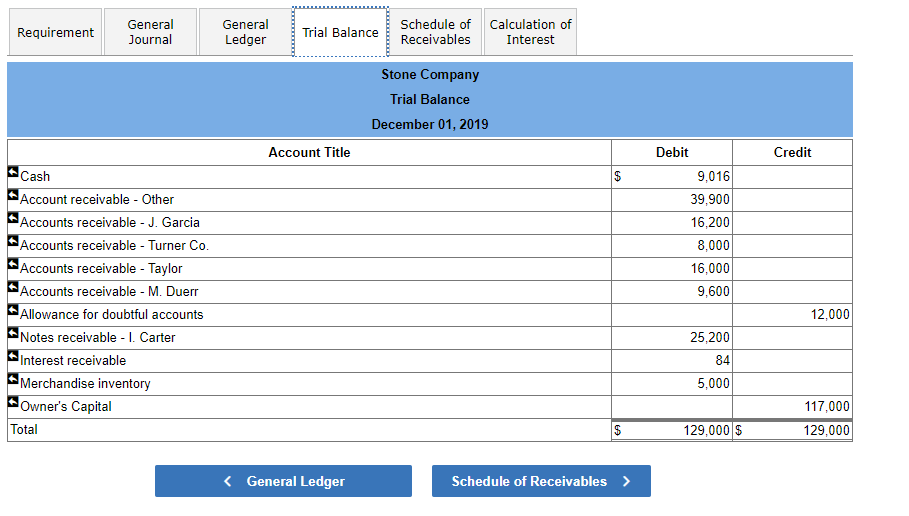

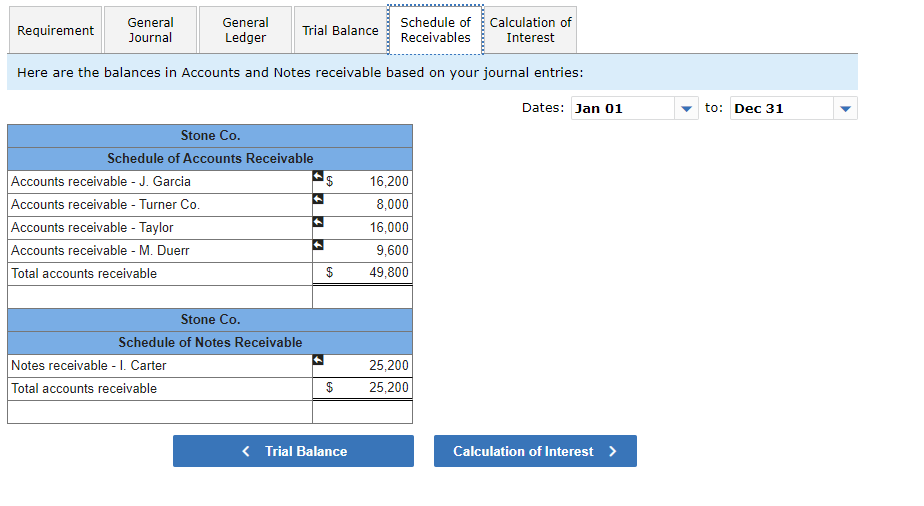

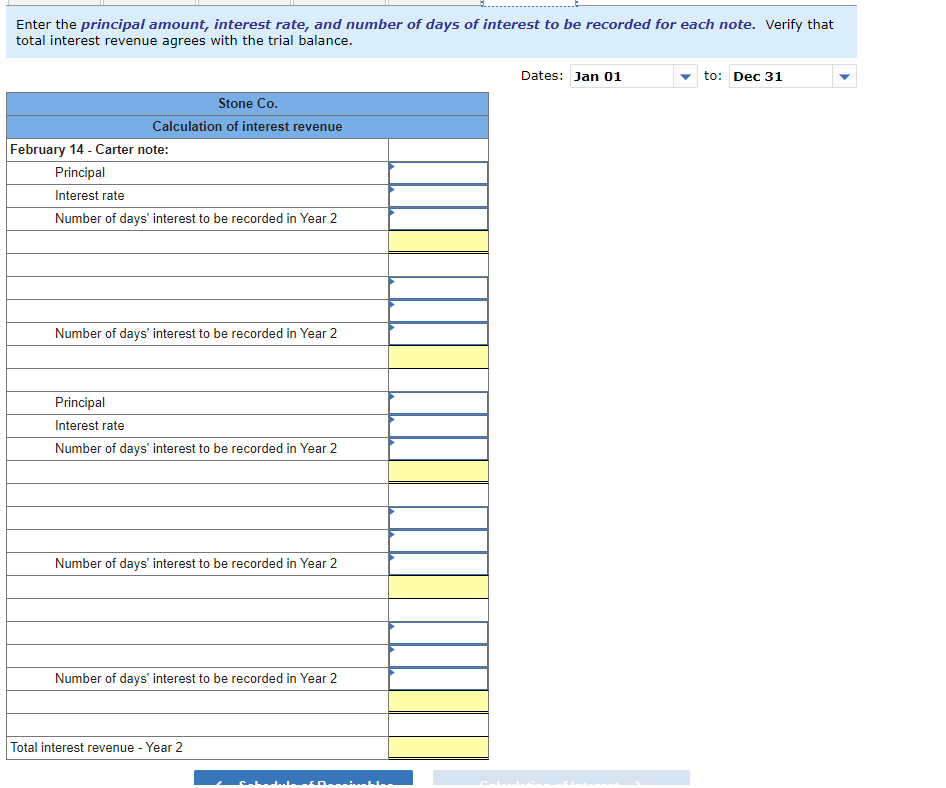

GL0701 (Algo) - Based on Problem 7-5A Ohlm Company LO C2, C3, P4 The following selected transactions are from Stone Company. Year 1 Dec. 16 Accepted a $25,200, 60-day, 8% note in granting Isaac Carter a time extension on his past-due account receivable. Made an adjusting entry to record the accrued interest on the Carter note. 31 Year 2 Feb. 14 Received Carter's payment of principal and interest on the note dated December 16. Mar. 2 Accepted a $8,000, 8%, 90-day note in granting a time extension on the past-due account receivable from Turner Co. 17 Accepted a $9,600, 30-day, 7% note in granting Melanie Duerr a time extension on her past-due account receivable. Apr. 16 Duerr dishonored her note. May 31 Turner Co. dishonored its note. Aug. 7 Accepted a $16,690, 90-day, 10% note in granting a time extension on the past-due account receivable of Taylor Co. Sep. 3 Accepted a $16,200, 60-day, 10% note in granting Jose Garcia a time extension on his past-due account receivable. Nov. Received payment of principal plus interest from Garcia for the September 3 note. Received payment of principal plus interest from Taylor for the August 7 note. Wrote off the Duerr account against the Allowance for Doubtful Accounts. Nov. Dec. 2 5 1 Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Receivables Interest General Journal tab - Prepare the Year 2 journal entries related to the notes and accounts receivable of Stone Co. Calculation of interest tab - Use the interest formula (P x RXT) to verify the amount of interest recorded in your entries. Verify that total interest revenue agrees with the trial balance. Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Receivables Interest Prepare the journal entries related to notes receivable and accounts receivable. Hint: Use the "Calculation of Interest" tab to ensure the accuracy of your entries. View transaction list Journal entry worksheet 1 3 3 4 5 6 7 8 9 10 > N Received Carter's payment of principal and interest on the $25,200, 60-day, 8% note dated December 16. The Stone Company does not prepare reversing entries. Verify the amount of interest using the "CALCULATION OF INTEREST" tab. Note: Enter debits before credits. General Journal Debit Credit Date Feb 14 Record entry Clear entry View general journal Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Receivables Interest General Ledger Account Cash Debit Account receivable - Other Debit Credit | No. Credit No. Date Jan 01 Balance 9,016 Date Jan 01 Balance 39,900 No. Accounts receivable - J. Garcia Date Debit Credit Jan 01 No. Balance 16,200 Accounts receivable - Turner Co. Date Debit Credit Jan 01 Balance 8,000 Accounts receivable - Taylor Debit Credit No. No. Date Jan 01 Balance 16,000 Accounts receivable - M. Duerr Date Debit Credit Jan 01 Balance 9,600 Allowance for doubtful accounts Date Debit Credit Jan 01 Notes receivable - 1. Carter Debit Credit No. No. Balance 12,000 Date Jan 01 Balance 25,200 Interest receivable Merchandise inventory Debit Credit No. Debit Credit No. Date Jan 01 Balance 84 Date Jan 01 Balance 5,000 Owner's Capital Debit Credit No. Date Jan 01 Balance 117,000 Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Receivables Interest Stone Company Trial Balance December 01, 2019 Account Title Credit $ Debit 9,016 39,900 16,200 8,000 16,000 9,600 Cash Account receivable - Other Accounts receivable - J. Garcia Accounts receivable - Turner Co. Accounts receivable - Taylor Accounts receivable - M. Duerr Allowance for doubtful accounts Notes receivable - 1. Carter Interest receivable Merchandise inventory Owner's Capital Total 12,000 25,200 84 5,000 117,000 129,000 $ 129,000 $ Requirement General Journal General Ledger Trial Balance Schedule of Calculation of Receivables Interest Here are the balances in Accounts and Notes receivable based on your journal entries: Dates: Jan 01 to: Dec 31 Stone Co. Schedule of Accounts Receivable Accounts receivable - J. Garcia Accounts receivable - Turner Co. Accounts receivable - Taylor Accounts receivable - M. Duerr Total accounts receivable 1 tt 16,200 8,000 16,000 9,600 49,800 + $ Stone Co. Schedule of Notes Receivable Notes receivable - I. Carter Total accounts receivable 25,200 25,200 $ Enter the principal amount, interest rate, and number of days of interest to be recorded for each note. Verify that total interest revenue agrees with the trial balance. Dates: Jan 01 to: Dec 31 Stone Co. Calculation of interest revenue February 14 - Carter note: Principal Interest rate Number of days' interest to be recorded in Year 2 Number of days' interest to be recorded in Year 2 Principal Interest rate Number of days' interest to be recorded in Year 2 Number of days' interest to be recorded in Year 2 Number of days' interest to be recorded in Year 2 Total interest revenue - Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts