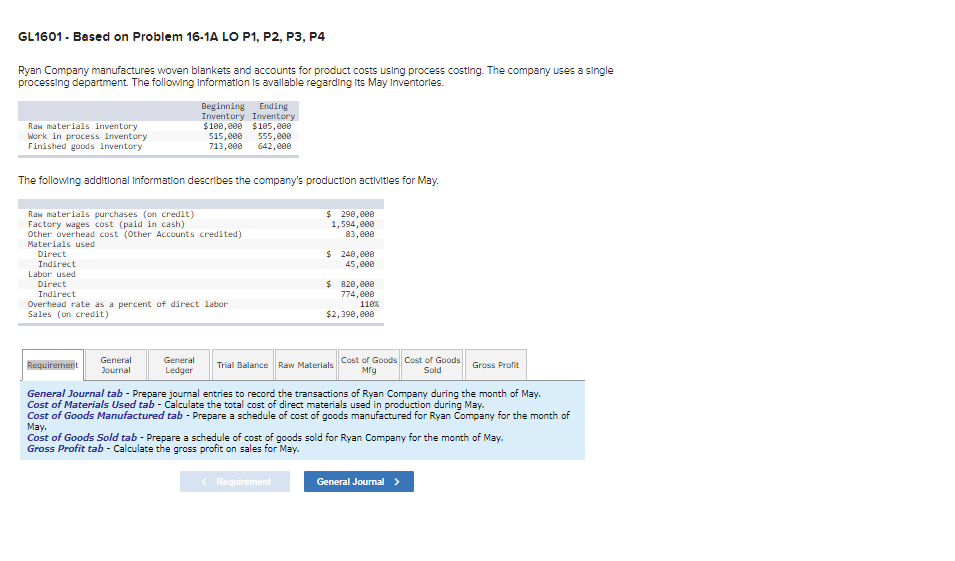

Question: GL1601 - Based on Problem 16-1A LO P1, P2, P3, P4 Ryan Company manufactures woven blankets and accounts for product costs using process costing. The

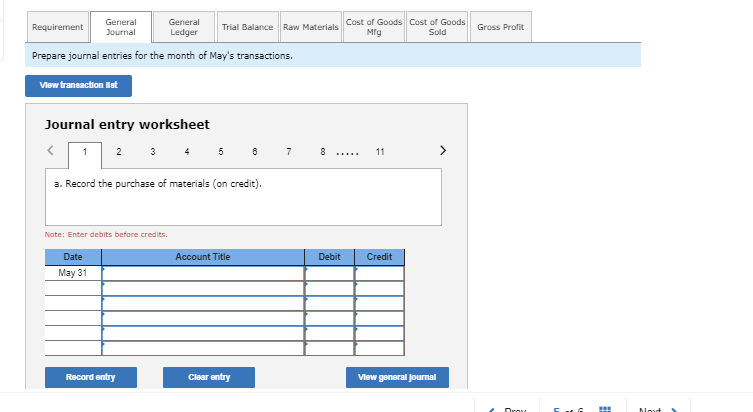

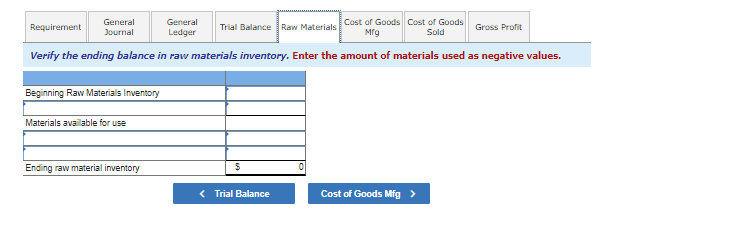

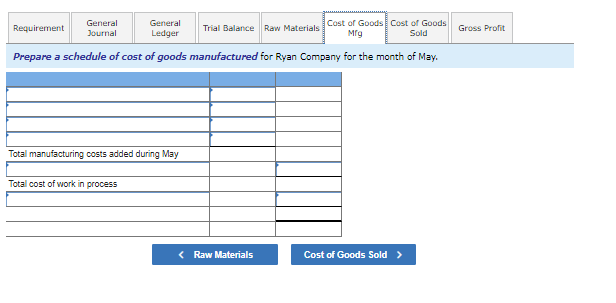

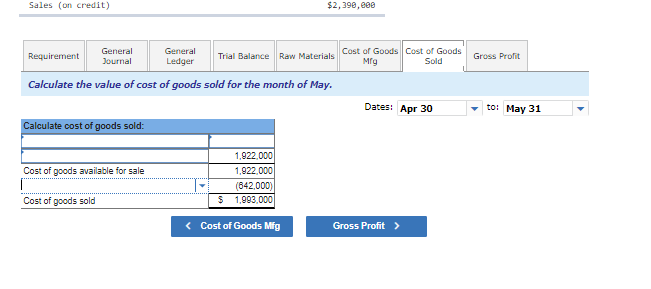

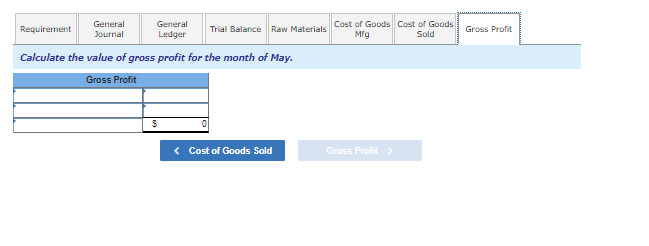

GL1601 - Based on Problem 16-1A LO P1, P2, P3, P4 Ryan Company manufactures woven blankets and accounts for product costs using process costing. The company uses a single processing department. The following information Is availlable regarding its May Inventorles Beginning Inventory Inventory $100,00 $105,e08 515,e0e 713,e08 Ending Raw materials inventory Work in process inventory Finished goods inventory 555,e00 642,eee The following additional Information describes the company's production actlvitles for May $ 290,eee 1,594,ee8 83,e00 Raw materials purchases (on credit) Factory wages cost (paid in cash) Other overhead cost (Other Accounts credited) Materials used Direct $ 240,000 Indirect 45,e00 Labor used $ 820,e00 774,e00 Direct Indirect Overhead rate as a percent of direct labor Sales (on credit) 116 $2,398,e00 General Journal General Cost of Goods Cost of Goods Requirement Trial Balance Raw Materials Gross Profit Ledger Mfg Sold General Journal tab Prepare journal entries to record the transactions of Ryan Company during the month of May. Cost of Materials Used tab - Calculate the total cost of direct materials used in production during May. Cost of Goods Manufactured tab Prepare a schedule of cost of goods manufactured for Ryan Company for the month of May Cost of Goods Sold tab Prepare a schedule of cost of Gross Profit tab Calculate the gross profit on sales for May. sold for Ryan Company for the month of May. Requirement General Journal Cost of Goods Cost of Goods Mfg General Journal General Ledger Raw Materials Requirement Trial Balance Gross Profit Sold Prepare journal entries for the month of May's transactions View transaction Hst Journal entry worksheet 2 3 4 5 6 7 11 a. Record the purchase of materials (on credit) Note: Enter debits before credits. Date Account Title Debit Credit May 31 Record entry Clear entry View general Journal Drou. Novdt Raw Materiale Cost of Goods Cost of Goods Mfq General Journal General Gross Profit Requirement Trial Balance Ledger Sold Verify the ending balance in raw materials inventory. Enter the amount of materials used as negative values. Beginning Raw Materials Inventory Materials available for use Ending raw material inventory Trial Balance Cost of Goods Mfg General Ledger General Cost of Goods Cost of Goods Gross Profit Requirement Trial Balance Raw Materials Journal Mrg Sold Prepare a schedule of cost of goods manufacttured for Ryan Company for the month of May Total manufacturing costs added during May Total cost of work in process Raw Materials Cost of Goods Sold Sales (on credit) $2,390,e08 Raw Materials Cost of Goods Cost of Goods Mfq General General Ledger Requirement Trial Balance Gross Profit Journal Sold Calculate the value of cost of goods sold for the month of May. Dates: Apr 30 to: May 31 Calculate cost of goods sold: 1,922,000 Cost of goods available for sale 1,922,000 (642,000) 1,993,000 Cost of goods sold Gross Profit> Cost of Goods Mfg General Journal General Ledger Cost of Goods Cost of Goods Requirement Trial Balance Raw Materials Gross Profit Mrg Sold Calculate the value of gross profit for the month of May. Gross Profit Gross Profit Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts