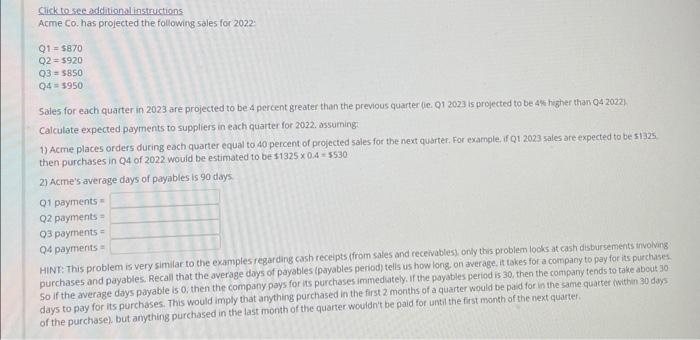

Question: Glick to sec dodditional instructions Acme Co, has prolected the following sales for 2022 . Q1=5870Q2=5920Q3=5850Q4=5950 5ale5 for each quarter in 2023 are projected to

Glick to sec dodditional instructions Acme Co, has prolected the following sales for 2022 . Q1=5870Q2=5920Q3=5850Q4=5950 5ale5 for each quarter in 2023 are projected to be 4 percent greater than the previous quarter lic. Q1 2023 is projected to be 4 \&. higher than Q4 2022 . Calculate expected payments to suppliers in each quarter for 2022. assuming 1) Acme places orders during each quarter equal to 40 percent of projected sales for the next quarter. For exarnple. if q1 2023 sales are expected to be 51325 then purchases in Q4 of 2022 would be estimated to be $13250.4=5530 2) Acme's average days of payables is 90 days. Q1 payments = Q2 payments = Q3payments = HINR: This problem is very similar to the examples regarding cash receipts (from sales and receivablest) only this problem locks at cash disbursements involving Q4 paymerits = purchases and payables. Recall that the average doys of payables (payables period) tells us how long, on werage, it takes for a compaey to pay for its purchases So if the average days payable is 0 , then the company pays for its purchases immedately, If the payables period is 30 , then the company tends to take abeut 30 . days to pay for its purchases. This would imply that amything purchased in the first 2 months of a quarter would be paid for in the same quarter bithin 30 doys of the purchase). but amything purchased in the last month of the quarter wouldn't be paid for until the fast month of the next quarter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts