Question: GLOBAL BUSINESS STRATEGY 1. How do potential trade tensions between China and the US effect this business model? DIGITAL ECONOMY Small Factories - Big Innovation

GLOBAL BUSINESS STRATEGY

1. How do potential trade tensions between China and the US effect this business model?

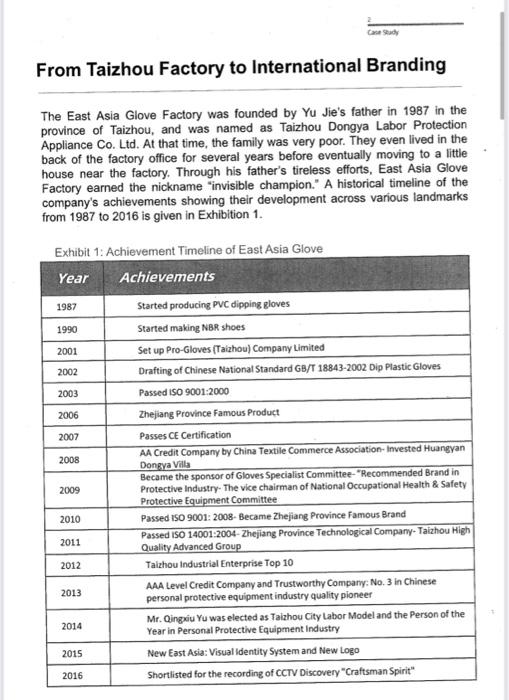

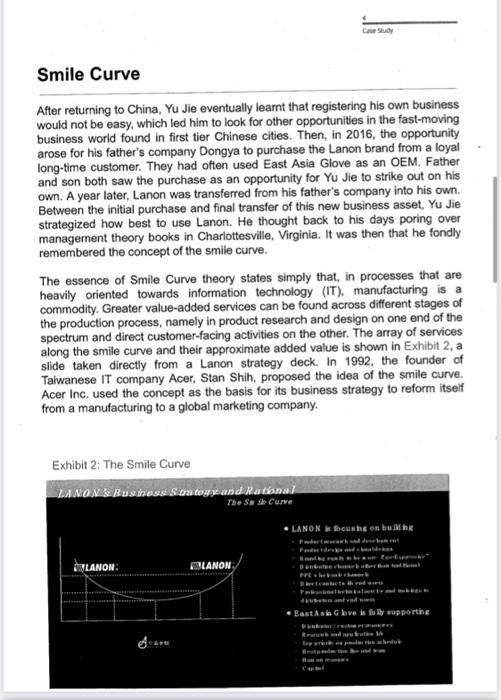

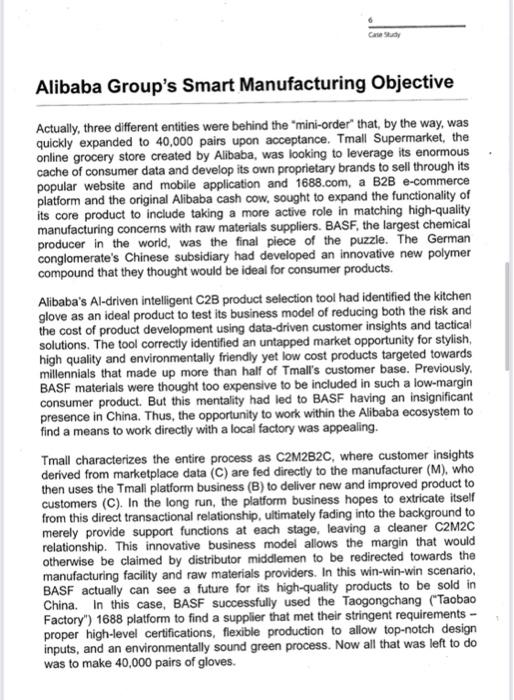

DIGITAL ECONOMY Small Factories - Big Innovation 2019.9 The labor protection appliance glove on the stage of London Fashion Show Case Study Introduction Founded in 1987 in the early capitalist era of Deng Xiaoping's China, Dongya Shoutao (East Asia Glove Factory) is a stodgy old manufacturing facility in Taizhou, Zhejiang Province. Though today it is a snappy five-hour drive frorn Taizhou into Shanghai if traffic flows in your favor, the factory was not always so close to the emerging financial center of East Asia. On July 6, 2013, construction on the Jiashao Bridge, now the world's longest and widest cable-stayed bridge, was completed right at the point where Hangzhou's famously tidal Qiantang River widens enough to be named Hangzhou Bay. China's massive long-term investment in infrastructure since its opening up" in 1978 has succeeded in knitting together the entire 3-province region of Zhejiang-Shanghai-Jiangsu into a global economic powerhouse. Over more than three decades since East Asia Glove started, the factory certainly benefited from the unprecedented economic growth in its home country. That expansion had led to many brands using the factory as an original equipment manufacturer (OEM) for their branded products. The factory had operated at an almost 100% utilization rate for years. But by 2019, a large percentage of the factory's 80 million gloves per year capacity was dedicated to low-margin orders with long-time customers, many of them state-owned. The factory owners realized that they had come to a crossroads. Growth in their old business model was flatlining. But while factory general manager Yu Jie was on vacation in the United States, a highly specialized "mini order" for just 5,000 pairs of gloves came in that nevertheless greatly piqued his interest. Although the requirements for this order were very high for its relatively small size, he surmised that the customers could be of extremely high quality. He had heard rumors of huge name-brand companies placing small "fishing" orders like this as a test to find partners with a longer term approach. Yu decided to rearrange his production schedule to accommodate the order, and in the course of doing so, may have changed the trajectory of his business forever. Case Study From Taizhou Factory to International Branding The East Asia Glove Factory was founded by Yu Jie's father in 1987 in the province of Taizhou, and was named as Taizhou Dongya Labor Protection Appliance Co. Ltd. At that time, the family was very poor. They even lived in the back of the factory office for several years before eventually moving to a little house near the factory, Through his father's tireless efforts, East Asia Glove Factory earned the nickname "invisible champion." A historical timeline of the company's achievements showing their development across various landmarks from 1987 to 2016 is given in Exhibition 1. 1990 Exhibit 1: Achievement Timeline of East Asia Glove Year Achievements 1987 Started producing PVC dipping gloves Started making NBR shoes 2001 Set up Pro-Gloves (Taizhou) Company Limited 2002 Drafting of Chinese National Standard GB/T 18843-2002 Dip Plastic Gloves 2003 Passed ISO 9001:2000 2006 Zhejiang Province Famous Product 2007 Passes CE Certification AA Credit Company by China Textile Commerce Association Invested Huangyan 2008 Dongya Villa Became the sponsor of Gloves Specialist Committee-Recommended Brand in 2009 Protective industry. The vice chairman of National Occupational Health & Safety Protective Equipment Committee 2010 Passed ISO 9001: 2008- Became Zhejiang Province Famous Brand 2011 Passed ISO 14001:2004- Zhejiang Province Technological Company-Taizhou High Quality Advanced Group 2012 Taizhou Industrial Enterprise Top 10 AAA Level Credit Company and Trustworthy Company: No. 3 in Chinese 2013 personal protective equipment industry quality pioneer Mr. Qingxiu Yu was elected as Taizhou City Labor Model and the Person of the 2014 Year in Personal Protective Equipment Industry 2015 New East Asia: Visual Identity System and New Logo 2016 Shortlisted for the recording of CCTV Discovery"Craftsman Spirit Case Study In the past, the factory was operating using the old-style push type model of manufacturing, in which dealer estimates of customer demands trigger production of goods. The customer data for these estimates is sometimes months old by the time the estimates arrive at the manufacturer. The products may not even have any associated channel resources for distribution. This old production process is about selling to small shops all over the country via a vast network of middle-man distributors. The East Asian Glove Factory operated as deliverymen with very little contact with the end-user. This business model is sometimes called "make-to-stock" because the production is not based on actual customer demand. The purpose of the manufacturer in this model is simply to provide inventory for the distributor. As far as the factory is concerned, there is no focus on the end customer. As a boy, Yu Jie remembers fondly helping his father to test the gloves once they came off the production line. He was a dutiful son that did well in his studies. After graduating from college with his bachelor's degree, Yu was not willing to take over the factory but was more inclined to innovate his own business. He completed an MBA in marketing and general management from Darden School of Business, University of Virginia. He acquired skills in polymer technology, new product development, e-commerce management and chemicals. With this training, he knew that it would not be easy to transform the East Asia Glove Factory factory. He learnt that the current industries need to change their existing philosophies, processes, practices and work culture to survive in today's hypercompetitive environment. By 2019, the managers and staff at East Asia Glove factory had amassed 32 years of industry connections and tacit experience. Together they had stabilized their annual manufacturing output at 80 million pairs of gloves. Although the company was operating at a utilization rate of close to 100%, margins were thin. There was always enormous pressure to discover means to make existing processes more efficient, which provided the initial impetus for Yu to get so excited about the potential of the "mini order." He was seeking a means to reorient factory production toward consumer upgrade products with higher margins. That dream turned into a reality when the East Asia Glove Factory was approached by Ali Xiao'er (In ancient China, the waiters call themselves "Xiao'er' as a modest title), providing an opportunity to cooperate with a large multinational corporation as their key supplier. Yu Jie intuitively understood the opportunity. Cases Smile Curve After returning to China, Yu Jie eventually learnt that registering his own business would not be easy, which led him to look for other opportunities in the fast-moving business world found in first tier Chinese cities. Then, in 2016, the opportunity arose for his father's company Dongya to purchase the Lanon brand from a loyal long-time customer. They had often used East Asia Glove as an OEM, Father and son both saw the purchase as an opportunity for Yu Jie to strike out on his own. A year later, Lanon was transferred from his father's company into his own. Between the initial purchase and final transfer of this new business asset, Yu Jie strategized how best to use Lanon. He thought back to his days poring over management theory books in Charlottesville, Virginia. It was then that he fondly remembered the concept of the smile curve. The essence of Smile Curve theory states simply that, in processes that are heavily oriented towards information technology (IT), manufacturing is a commodity. Greater value-added services can be found across different stages of the production process, namely in product research and design on one end of the spectrum and direct customer-facing activities on the other. The array of services along the smile curve and their approximate added value is shown in Exhibit 2, a slide taken directly from a Lanon strategy deck. In 1992, the founder of Taiwanese IT company Acer, Stan Shih, proposed the idea of the smile curve. Acer Inc. used the concept as the basis for its business strategy to reform itself from a manufacturing to a global marketing company. Exhibit 2: The Smile Curve LANON & Business Strategy and Rational TheSecure LANON focus on bu WWLANON: MILANON Basts be fully supporthe 4 In het Nam Case Study By divesting the Lanon brand (Lan Lang) from its manufacturing facility, Yu was able to implement the smile curve strategy that initially attracted his attention at business school, without completely disrupting the East Asia Glove factory. In 2017, Yu Jie became the Chief Executive Officer of Lanon, a company separate from his father's East Asia Glove Factory. However, Lanon still relied on the family factory to serve as OEM for many of its brands. By separating the 2 concerns, Yu could focus on establishing modern distribution channels based on eCommerce and social media; he established online stores on Amazon, 1688.com, Taobao, Tmall & JD.com. He redesigned existing products and innovated new ones. Some were manufactured at the old Taizhou facility. Some were not. He streamlined the packaging and logistics processes for the gloves produced by his company. As a newly minted CEO, Yu Jie had to make many significant decisions. For the orders that Lanon placed with East Asia Glove at least, the manufacturing process was overhauled. Smart manufacturing became the new company credo. But integrating all of these new concepts into an old-line manufacturing process was not easy. Yu knew he could jumpstart the transformation of the Lanon brand, and by extension, eventually his family's factory, only if he could find the right business partners. When he learned of that 5,000 pair "mini order" while he was on vacation, he nearly jumped out of his shoes. He had an inkling that that order would completely change the fate of his company forever. He was right. He just didn't know how right he was until he found out which huge multinational companies were actually behind that order. Case Study Alibaba Group's Smart Manufacturing Objective Actually, three different entities were behind the "mini-order that, by the way, was quickly expanded to 40,000 pairs upon acceptance. Tmall Supermarket, the online grocery store created by Alibaba, was looking to leverage its enormous cache of consumer data and develop its own proprietary brands to sell through its popular website and mobile application and 1688.com, a B2B e-commerce platform and the original Alibaba cash cow, sought to expand the functionality of its core product to include taking a more active role in matching high-quality manufacturing concerns with raw materials suppliers. BASF, the largest chemical producer in the world, was the final piece of the puzzle. The German conglomerate's Chinese subsidiary had developed an innovative new polymer compound that they thought would be ideal for consumer products. Alibaba's Al-driven intelligent C2B product selection tool had identified the kitchen glove as an ideal product to test its business model of reducing both the risk and the cost of product development using data-driven customer insights and tactical solutions. The tool correctly identified an untapped market opportunity for stylish high quality and environmentally friendly yet low cost products targeted towards millennials that made up more than half of Tmall's customer base. Previously, BASF materials were thought too expensive to be included in such a low-margin consumer product. But this mentality had led to BASF having an insignificant presence in China. Thus, the opportunity to work within the Alibaba ecosystem to find a means to work directly with a local factory was appealing. Tmall characterizes the entire process as C2M2B2C, where customer insights derived from marketplace data (C) are fed directly to the manufacturer (M), who then uses the Tmall platform business (B) to deliver new and improved product to customers (C). In the long run, the platform business hopes to extricate itself from this direct transactional relationship, ultimately fading into the background to merely provide support functions at each stage, leaving a cleaner C2M2C relationship. This innovative business model allows the margin that would otherwise be claimed by distributor middlemen to be redirected towards the manufacturing facility and raw materials providers. In this win-win-win scenario, BASF actually can see a future for its high-quality products to be sold in China. In this case, BASF successfully used the Taogongchang ("Taobao Factory') 1688 platform to find a supplier that met their stringent requirements proper high-level certifications, flexible production to allow top-notch design inputs, and an environmentally sound green process. Now all that was left do was to make 40,000 pairs of gloves. 7 Case Study Rather than being intimidated by these big players, Yu Jie was immediately ready to take his gloves off and get to work. Lanon accepted the challenge of delivering the order within 2 weeks. From order acceptance to delivery of the full order into 26 warehouses in time for Alibaba's 618 Shopping Festival, the collaborative project took 12 intense days including product manufacturing. Numerous cross- functional teams constantly collaborated on DingTalk, Alibaba's chat software, during this time. Two joint site visits were made to Taizhou. Time was a crucial factor in the entire process since China's domestic markets are highly competitive. Utilizing this workflow meant that East Asia Glove Factory had to forsake, even if for only a little while, its previous strategy of focusing on industrial-grade gloves. However, under the guidance of rich Alibaba datasets from e-commerce platforms, they could almost develop an expertise in a certain market before they even produced one glove. For instance, before production and marketing, they already knew that customers from different regions have various glove preferences. Japan likes thin; China likes thick. Americans like longer gloves (30 cm) than the Chinese do (28 cm). The US market prefers bright and bold colors; Japan likes light colors; China is more of a mix. The data that Tmall provided, based on other consumer product categories like suitcases and thermos bottles, predicted that cleaning gloves using the colors popularized by Italian painter Giorgio Morandi would be a hit with millennials. For a look at his palette, please see Exhibit 3. Big Data analytics provided further insights into size requirements (mostly small and medium because the customers would be women), thickness (thin because the sales would occur in the summer), price (benchmarked according to other similar products), production volume and regional inventory stocks (both calculated off previous sales data of similar products). With this granular level of detail, the Lanon brand does "not sell the gloves it manufactures, but rather sells glove solutions to its customers." Exhibit 3: The Color Palette of Giorgio Morandi Morandi color experiment Original color palette Coler Mata Revised Bringing the Gloves to Market The story of East Asia Glove and Tmall is an example of the new reverse sourcing model. In this approach, Tmall Supermarket analyses and summarizes the data available on Ali platform, and determines the current new consumer demand. Then 1688 evaluates the prospects for different products and looks for ideal manufacturers that can meet anticipated demand, thereby reducing risk and cost to both counterparties in the transaction. Once paired, the platform releases a "safety card" which serves as a building block for long-term cooperation with the company. This C2B, or customer-data-to-business, reverse sourcing model led 1688 to suggest that BASF work with East Asia Glove to fill consumer demand for cleaning gloves with elements of fashion and environmental consciousness. Case Study BASF was selected based on the criteria that it provides green and environmentally friendly raw materials, while East Asia Glove Company is the largest PVC glove manufacturing company in China. Each of the three companies performed their roles well. East Asia Glove functioned as the OEM for a new Tmall private label brand called Miaomanfen (**), while the Tmall platform itself managed the sales promotion during the 618 Shopping Festival. The package deal included marketing 40,000 gloves on the e-commerce platform where the first 20,000 pairs were offered for free, while the rest sold at 12 RMB per pair, which represented a healthy 15% margin on each pair sold. Lanon finalized the design and marketing decisions in a co-design process with Alibaba team members. The biggest challenge was the process of choosing the product packaging from an array of seven different packet designs. The packaging had to accommodate different glove colors and look good whether the gloves were for summer (robin's egg blue) or winter (purple with an added layer inside). On June 14, the Tmall e-commerce platform began to market the gloves. They received such an overwhelming response that more than 20,000 pairs of gloves were sold in just two days, even before the Shopping Festival's official start Integrating upstream supply of raw materials directly with a manufacturer keying off real-time insights from Big Data and other resources is an entirely new C2M2B2C business model. From end to end, customer demand directs the entire process. Raw materials are purchased from large-scale chemical plants and processed in high-quality source factories according to requirements of the customers, who did not even know that they wanted the goods before they saw them but, upon seeing them on offer in their phone app, immediately respond to their aesthetic. What the businesses had sought to sell out in two weeks were, in the end, sold in two days. Future Growth and Expansion The opportunity provided to small and medium-sized businesses that warm to this type of smart manufacturing are quite large. Working with leading companies to understand their data analytics process to guide production and marketing decisions is enormously beneficial to their own self-improvement. After Yu's experience for the 618 Shopping Festival, he immediately ordered his managers to begin compiling their own datasets based on consumer ratings of their own and competitor products. Care Sudy They might not have the technical expertise on staff to automate this process at the moment, but the understanding of its importance and the interdisciplinary techniques that they absorbed during the 12-day rush to fill the Tmall order will certainly help the company to upgrade their own Wahoo brand products. By leveraging these digital technologies and understanding in real time the impact of rapid changes that occur in the economic and operating environment, Yu Jie has developed a keen sense of how to look out for new growth opportunities. After the 618 event, Lanon upgraded their partnership with Sumitomo in Japan, successfully expanding upon a 13-year relationship with Sumitomo as their OEM. Instead of losing the business to cheaper labor in Malaysia, Yu's recent experience allowed him to see the opportunity of co- branding high quality gloves with their long-time partner, qualifying his knowledge beyond OEM and into the realm of collaboration as he enters this relationship as an expert in China brand strategy. In fact, Yu Jie has used the force and affordability of Malaysia's raw materials and labor to his advantage, establishing a factory giving East Asia Glove Factory an advantage. Responding to the swaying rhythms of the market and ever-changing customer demands is almost second nature to the young CEO now. Whereas his father's era preferred to seek out large orders with low margins, he is shifting even more resources to better facilitating manufacturing for small-batch orders. This strategy shift should maximize sales margins while minimizing inventory carry costs, placing him further up the smile curve. He is also not blindly confining himself to the Alibaba ecosystem, but he is looking into other co-branding deals where East Asia Glove might serve as OEM for other big Chinese internet companies like Netease or JD. Lanon has, in fact, already joined the Amazon Accelerator, which provides tools to build and market brands in the large, developed market of the United States. To that end, he has even started his own brand there: Pacific. Showing their label at the world-renowned London Fashion Week, Exhibit 4. Put simply. Jie has moved up in the value chain significantly from an OEM company in China, to using his expertise to co-brand a label and most recently showcasing his brand globally. 11 Case Study Exhibit 4 : London Fashion Week His friends and colleagues often ask him if he is worried about the future of manufacturing in China. He always responds that he has never been worried. He believes, "In China, we have a lot of great factories that make great products. But they were used by other companies to make products for foreign brands. The key now is for those factories to change their business model, to capture the value for themselves