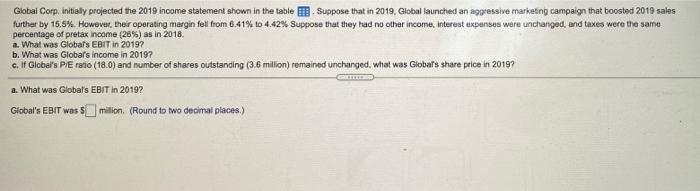

Question: Global Corp. Initially projected the 2019 income statement shown in the table. Suppose that in 2019. Global launched an aggressive marketing campaign that boosted 2019

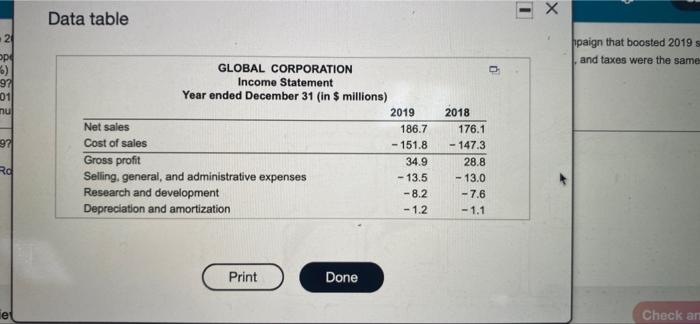

Global Corp. Initially projected the 2019 income statement shown in the table. Suppose that in 2019. Global launched an aggressive marketing campaign that boosted 2019 sales further by 15.5%. However, their operating margin fell from 6,41% to 4.42% Suppose that they had no other income, Interest expenses were unchanged, and taxes were the same percentage of protax income (26%) as in 2018 a. What was Global's EBIT in 2019? b. What was Global's income in 20197 c. If Global's PIE ratio (18.0) and number of shares outstanding (3.6 million) remained unchanged, what was Globals share price in 2019? a. What was Global's EBIT in Tin 2018? Global's EBIT was $milion, (Round to wo decimal places.) Data table 2 paign that boosted 2019 and taxes were the same 0 opd 6) 9? 01 nul 92 GLOBAL CORPORATION Income Statement Year ended December 31 (in $ millions) 2019 Net sales 186.7 Cost of sales -151.8 Gross profit 34.9 Selling, general, and administrative expenses -13.5 Research and development -8.2 Depreciation and amortization - 1.2 2018 176.1 - 147.3 28.8 - 13.0 -7.6 - 1.1 RO Print Done le Check an ] their ar TU iec (269 2011 in 2 and 0.2 - 1.2 12.0 -1.1 7.1 - 2018 TOSCarraneruovorprrone Depreciation and amortization Operating income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net income Earnings per share: Diluted earnings per share: n. 12.0 - 7.7 4.3 - 1.1 3.2 $0.89 $0.86 7.1 -4.6 2.5 -0.6 1.9 $0.53 $0.50 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts