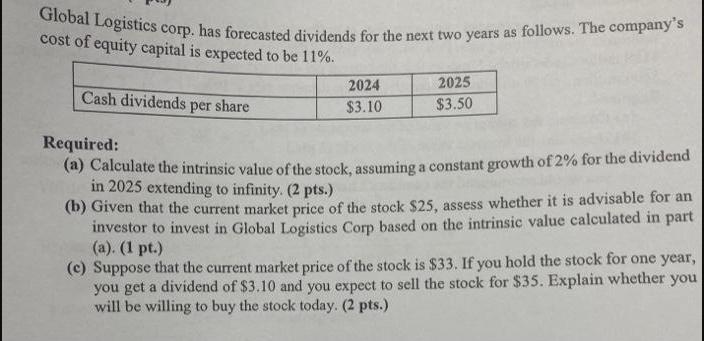

Question: Global Logistics corp. has forecasted dividends for the next two years as follows. The company's cost of equity capital is expected to be 11%.

Global Logistics corp. has forecasted dividends for the next two years as follows. The company's cost of equity capital is expected to be 11%. Cash dividends per share 2024 $3.10 2025 $3.50 Required: (a) Calculate the intrinsic value of the stock, assuming a constant growth of 2% for the dividend in 2025 extending to infinity. (2 pts.) (b) Given that the current market price of the stock $25, assess whether it is advisable for an investor to invest in Global Logistics Corp based on the intrinsic value calculated in part (a). (1 pt.) (c) Suppose that the current market price of the stock is $33. If you hold the stock for one year, you get a dividend of $3.10 and you expect to sell the stock for $35. Explain whether you will be willing to buy the stock today. (2 pts.)

Step by Step Solution

There are 3 Steps involved in it

a To calculate the intrinsic value of the stock we can use the Gordon Growth Model also known as the Dividend Discount Model DDM The formula for the i... View full answer

Get step-by-step solutions from verified subject matter experts