Question: Global macro hedge fund managers: O a. do not use leverage as part of their investment process. O b. cannot invest in derivative securities. O

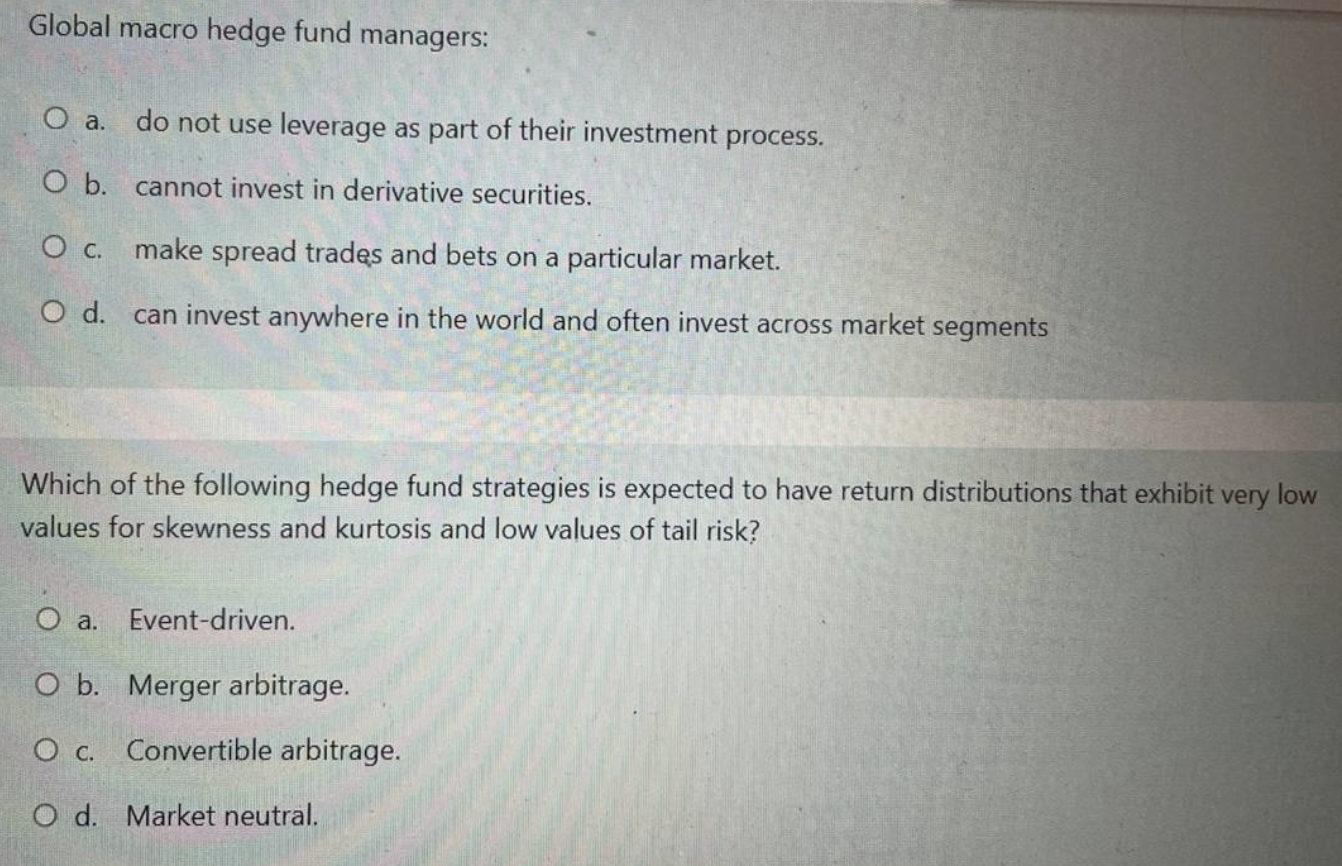

Global macro hedge fund managers: O a. do not use leverage as part of their investment process. O b. cannot invest in derivative securities. O c. make spread trades and bets on a particular market. O d. can invest anywhere in the world and often invest across market segments Which of the following hedge fund strategies is expected to have return distributions that exhibit very low values for skewness and kurtosis and low values of tail risk? O a. Event-driven. O b. Merger arbitrage. O c. Convertible arbitrage. O d. Market neutral

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts