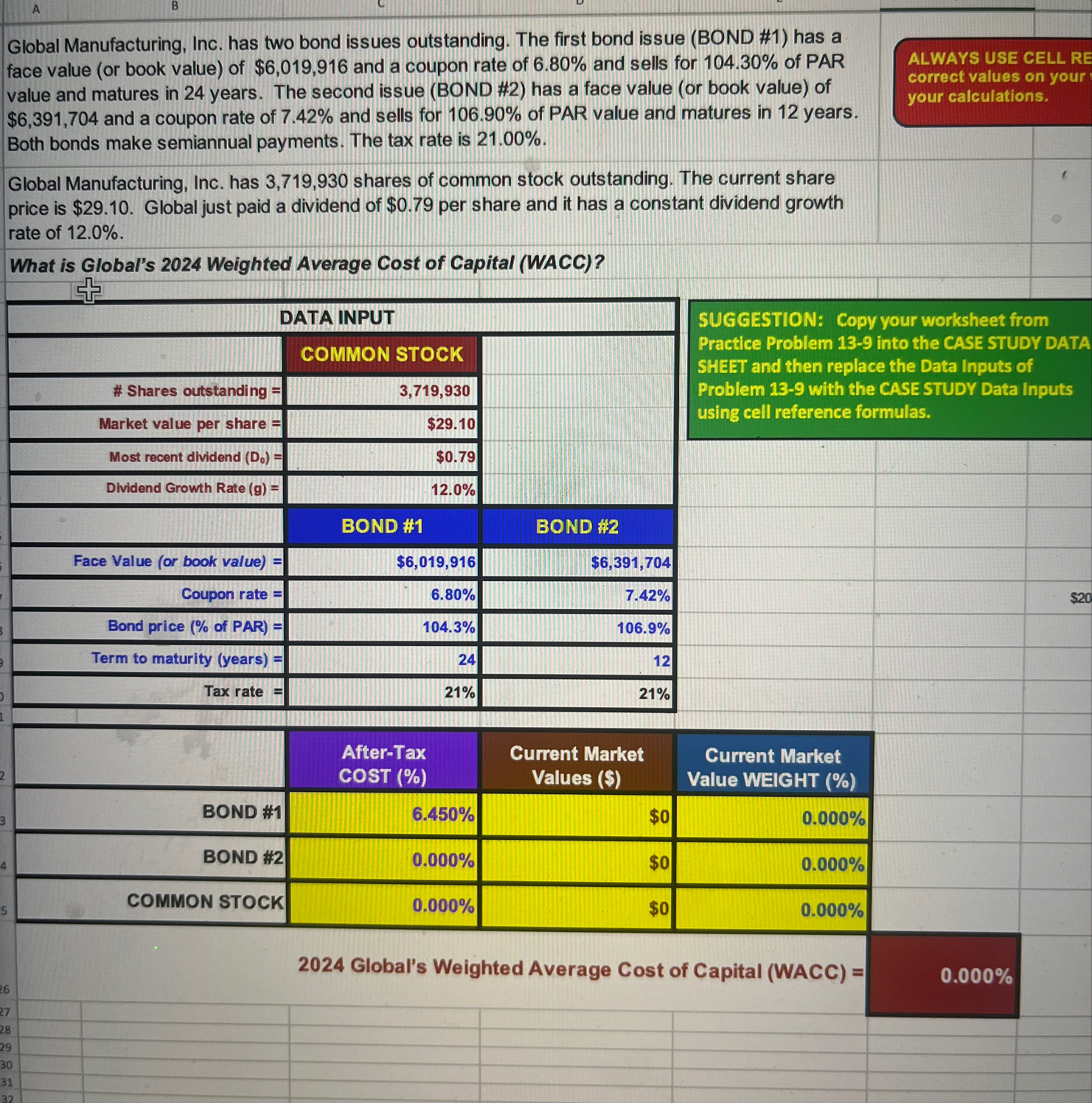

Question: Global Manufacturing, Inc. has two bond issues outstanding. The first bond issue ( BOND # 1 ) has a face value ( or book value

Global Manufacturing, Inc. has two bond issues outstanding. The first bond issue BOND # has a face value or book value of $ and a coupon rate of and sells for of PAR value and matures in years. The second issue BOND # has a face value or book value of $ and a coupon rate of and sells for of PAR value and matures in years.

ALWAYS USE CELL RE

correct values on your

your calculations. Both bonds make semiannual payments. The tax rate is

Global Manufacturing, Inc. has shares of common stock outstanding. The current share price is $ Global just paid a dividend of $ per share and it has a constant dividend growth rate of

What is Global's Weighted Average Cost of Capital WACC

tableDATA INPUTCOMMON STOCK,# Shares outstanding Market value per share $Most recent dividend $Dividend Growth Rate gBOND #BOND #Face Value or book value$$Coupon rate Bond price of PARTerm to maturity yearsTax rate

SUGGESTION: COpy your worksheet from

Practice Problem into the CASE STUDY DATA

SHEET and then replace the Data Inputs of

Problem with the CASE STUDY Data Inputs

using cell reference formulas.

tabletableAfterTaxCOST tableCurrent MarketValues $tableCurrent MarketValue WEICHT BOND #$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock