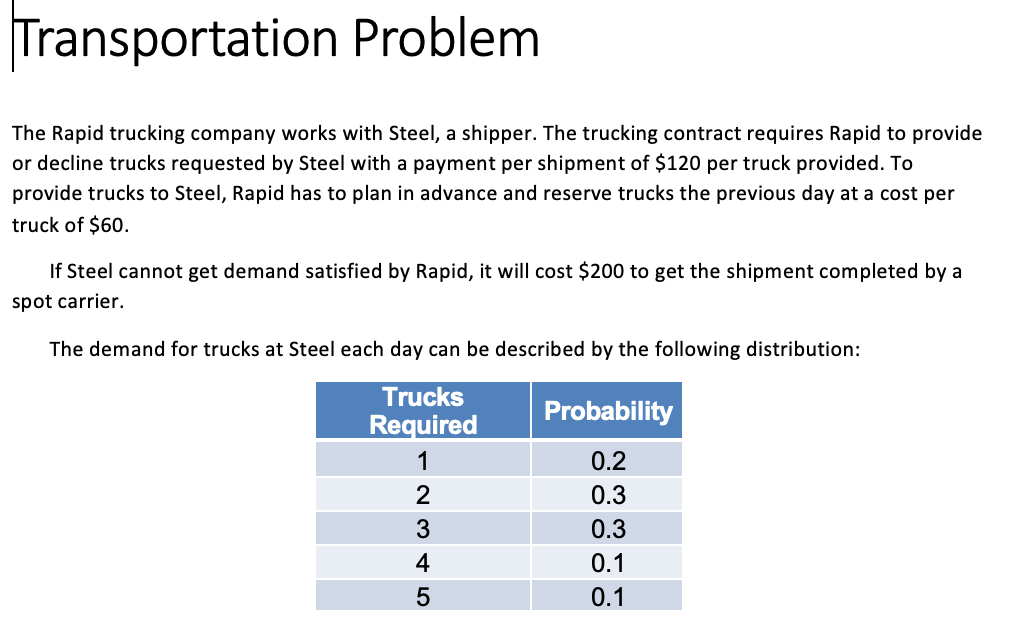

Question: Global supply chain management, please help with the excel question below Thank you COORDINATING FREIGHT DATA Manufacture (Steel) Transporter (Rapid) Truck cost: $ 120.00 Truck

Global supply chain management,

please help with the excel question below

Thank you

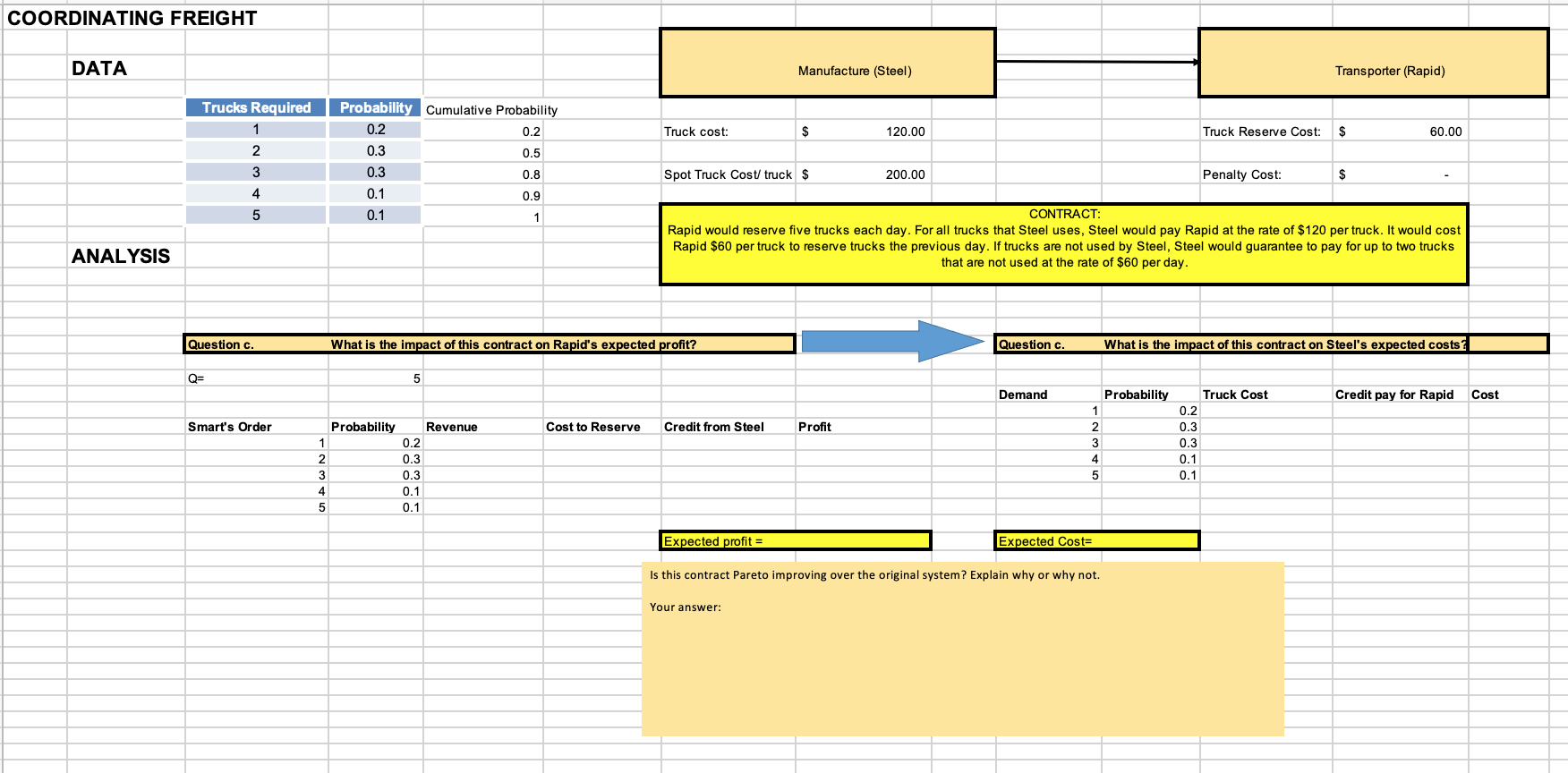

COORDINATING FREIGHT DATA Manufacture (Steel) Transporter (Rapid) Truck cost: $ 120.00 Truck Reserve Cost: $ 60.00 Trucks Required 1 2 3 4 Probability Cumulative Probability 0.2 0.2 0.3 0.5 0.3 0.8 0.1 0.9 0.1 1 Spot Truck Cost/ truck $ 200.00 Penalty Cost: $ 5 CONTRACT: Rapid would reserve five trucks each day. For all trucks that Steel uses, Steel would pay Rapid at the rate of $120 per truck. It would cost Rapid $60 per truck to reserve trucks the previous day. If trucks are not used by Steel, Steel would guarantee to pay for up to two trucks that are not used at the rate of $60 per day. ANALYSIS Question c. What is the impact of this contract on Rapid's expected profit? Question c. What is the impact of this contract on Steel's expected costs? Q= 5 Demand Probability Credit pay for Rapid Cost Smart's Order Probability Revenue Cost to Reserve Credit from Steel Profit Truck Cost 0.2 0.3 0.3 0.1 0.1 1 2 1 2 3 4 5 0.2 0.3 0.3 0.1 0.1 3 4 5 Expected profit = Expected Costs Is this contract Pareto improving over the original system? Explain why or why not. YourStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts