Question: Global Testing Geneva Ltd. Background: - The Global Testing Geneva (GTG) was established in Switzerland in 1893, by two brothers who married into a wealthy

Global Testing Geneva Ltd.

Background: -The Global Testing Geneva (GTG) was established in Switzerland in 1893, by two brothers who married into a wealthy family organization. The company had developed as a global organization for inspection and testing with 40,000 employees worldwide. The core service that was provided was inspection of International trade to ensure that governments collected the appropriate amount of customs duty and minimized illegal profiteering by customs officers. The company had also acquired a professional certification organization that reviewed ISO 9000 standards requirement and implemented ISO 9000 standard systems. As the result of the inspection services, the organization had increased as a global organization across a number of countries. In the 1990s, the granddaughter of one of the founders who now was the CEO of the company introduced a strategy of corporate entrepreneurship across all international subsidiary organisations. In New Zealand, the company was founded on the back of traditional inspection and testing with most of the organization focused on the testing of primary products such as wool agricultural products, coal, steel and minerals. The annual revenue for the group was low at $25m NZD. On one occasion the CEO of GTG New Zealand, while held up in a traffic delay, noticed the signage on the back of a vehicle as Medlab, Auckland with a tag line of "testing for life". Immediately recognizing an opportunity, he followed the vehicle, recognising that the word testing was the core activity of the organization, not only in New Zealand, but worldwide. As the result of this inquisitive and entrepreneurial approach, GTG NZ was granted permission by head office in Geneva to actively pursue the acquisition of pathology laboratories across New Zealand.

Your role.

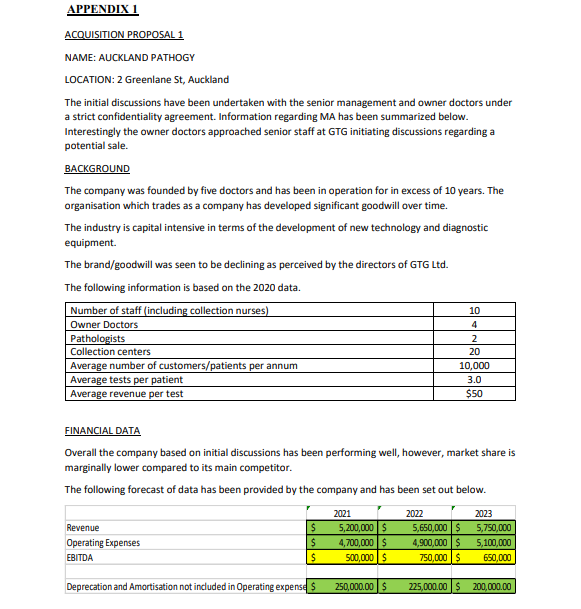

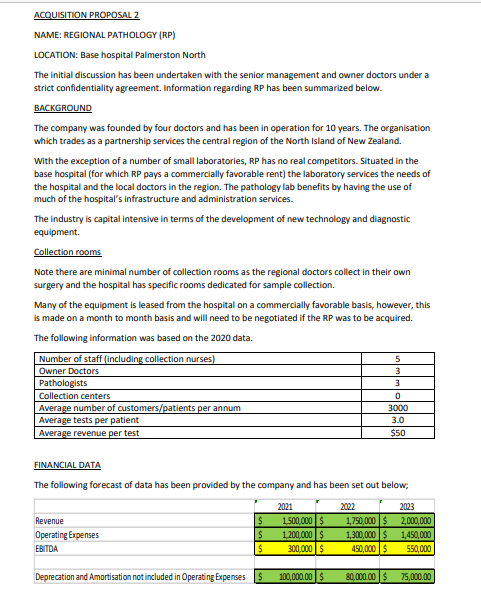

You have just accepted the role. Being an expatriate from Australia to New Zealand, you act as the Finance Manager for GTG New Zealand Ltd. Your first task is to assist with the analysis of two potential pathology laboratory acquisitions. There are two specific acquisition targets as follows. 1. Auckland Pathology 2. Regional Pathology The current ownership of each pathology business is by a few doctor- pathologists working in a partnership arrangement at each organisation. No doctors have a cross ownership or partnership in the other business.

Business Model

While the acquisition process was quite clear, the technicalities involving acquiring a professional health services organization involving pathology was quite complex. The key issue that GTG New Zealand faced was that it did not have doctors on their staff and were ill qualified to run a testing laboratory which involved decisions that could have potential high risk effects on individuals' health. As a result of negotiations with the government Health Department, it was identified that an alternative business model could be adopted to achieve the required involvement of qualified medical doctors. The proposed acquisition corporate venturing model involved establishing a separate legal entity to act as the acquisition vehicle. The owner doctors transferred their partnership share of the assets into the vehicle. And they received shares amounting to 33% of the value of the acquisition vehicle. GTG NZ held the majority of the remaining 67% of the acquisition vehicle as a majority shareholder. The details for each of the pathology labs are attached in Appendix One and Two.

Your Task

As the finance manager, your task is to assess which of the potential acquisition targets was more suitable for GTG Limited. For you to accomplish this task, you will be required to adhere to the specific acquisition guidelines policies of GTG Limited in Geneva.

You will be required to:

1. Determine the free cash flows from each of the potential acquisition targets, for each of the next 3 years, 2021, 2022 and 2023 (10 marks)

2. Evaluate the proposals.

a. For each proposed acquisition, calculate the net present value based on the cash flow you calculated in answering question 1 above, and the proposed acquisition price provided in each case.

In order to calculate the net present value in relation to each of the selected proposals, the organization requires a minimum of the weighted average cost of Capital. Currently this is 5% plus a risk premium of 2%. This will satisfy shareholders return in Geneva. (20 marks)

3. Finance the acquisitions

a. The company wishes to fund the acquisition using a bond issue. Assuming the bonds will be issued for 5 years with a coupon rate of 6.5%, and GTG New Zealand wishes to raise $1,000,000. Determine the price and number of bonds to be issued given that the market rate for similar bonds is 8%. (20 marks)

4. Prepare a board report (1 page) that the directors of GTG New Zealand and Geneva can review. The report should highlight your recommendations based on your calculations. In addition, raise any concerns or aspects you may have other than quantitative analysis that may assist in the evaluation of the potential acquisition. Note only one of the acquisitions opportunities can be selected. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts