Question: gn Layout References Mailings Review View Help Acrobat Table Design Layout Comment 11 ab X , X Styles Editing Create and Share Request Dictate Editor

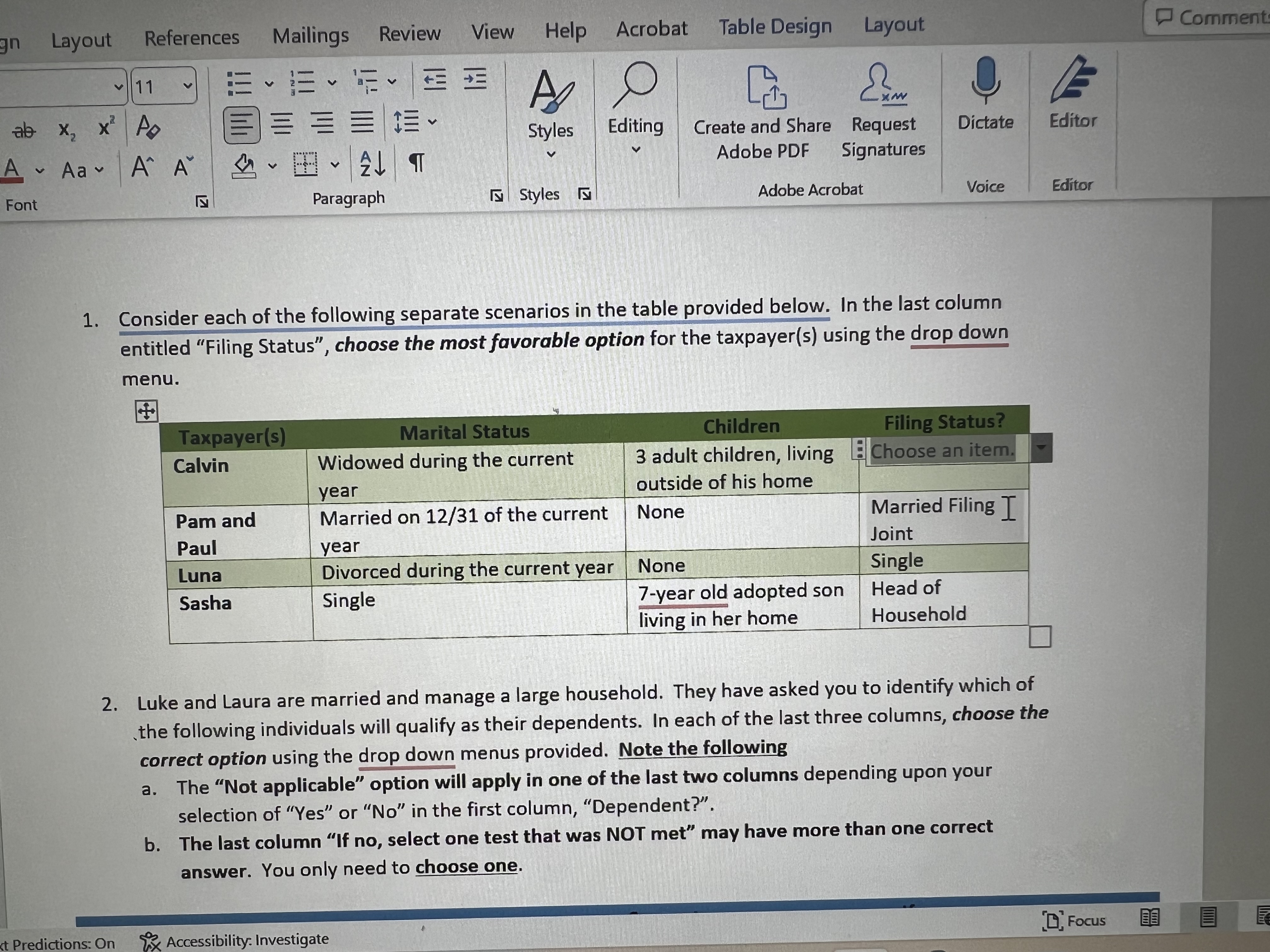

gn Layout References Mailings Review View Help Acrobat Table Design Layout Comment 11 ab X , X Styles Editing Create and Share Request Dictate Editor A ~ Aav A A Adobe PDF Signatures Font Paragraph Styles Adobe Acrobat Voice Editor 1. Consider each of the following separate scenarios in the table provided below. In the last column entitled "Filing Status", choose the most favorable option for the taxpayer(s) using the drop down menu. Taxpayer(s) Marital Status Children Filing Status? Calvin Widowed during the current 3 adult children, living Choose an item. year outside of his home Pam and Married on 12/31 of the current None Married Filing I Paul year Joint Luna Divorced during the current year None Single Sasha Single 7-year old adopted son Head of living in her home Household 2. Luke and Laura are married and manage a large household. They have asked you to identify which of the following individuals will qualify as their dependents. In each of the last three columns, choose the correct option using the drop down menus provided. Note the following a. The "Not applicable" option will apply in one of the last two columns depending upon your selection of "Yes" or "No" in the first column, "Dependent?". b. The last column "If no, select one test that was NOT met" may have more than one correct answer. You only need to choose one. Predictions: On Accessibility. Investigate Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts