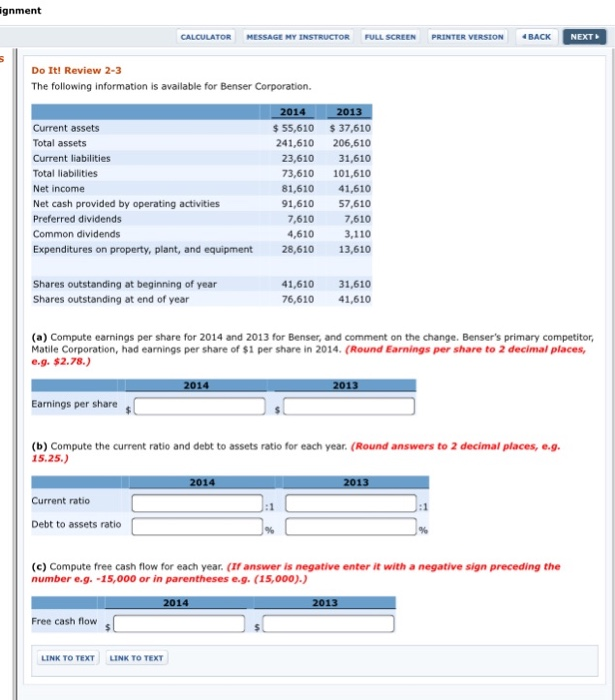

Question: gnment CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION 4BACK NEXT b Do It! Review 2-3 The following information is available for Benser Corporation 014

gnment CALCULATOR MESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION 4BACK NEXT b Do It! Review 2-3 The following information is available for Benser Corporation 014 Current assets Total assets Current liabilities Total liabilities Net income Net cash provided by operating activities Preferred dividends Common dividends Expenditures on property, plant, and equipment $55,610 37,610 241,610 206,610 23,610 31,610 73,610 101,610 81,610 41,610 91,610 57,610 7,610 3,110 13,610 7,610 4,610 28,610 Shares outstanding at beginning of year Shares outstanding at end of year 1,610 31,610 76,610 41,610 (a) Compute earnings per share for 2014 and 2013 for Benser, and comment on the change. Benser's primary competitor, Matile Corporation, had earnings per share of $1 per share in 2014. (Round Earnings per share to 2 decimal places, e.9. $2.78.) Earnings per share (b) Compute the current ratio and debt to assets ratio for each year. (Round answers to 2 decimal places,e.g 15.25.) Current ratio Debt to assets ratio (c) Compute free cash flow for each year. (If answer is negative enter it with a negative sign preceding the number e.g. -15,000 or in parentheses e.g. (15,000).) Free cash flow LINK TO TEXTLINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts