Question: gnment Help Save & E Che Problem 8-23 Schedule of Expected Cash Collections; Cash Budget LO8-2 Lo8-8) The president of the retailer Prime Products has

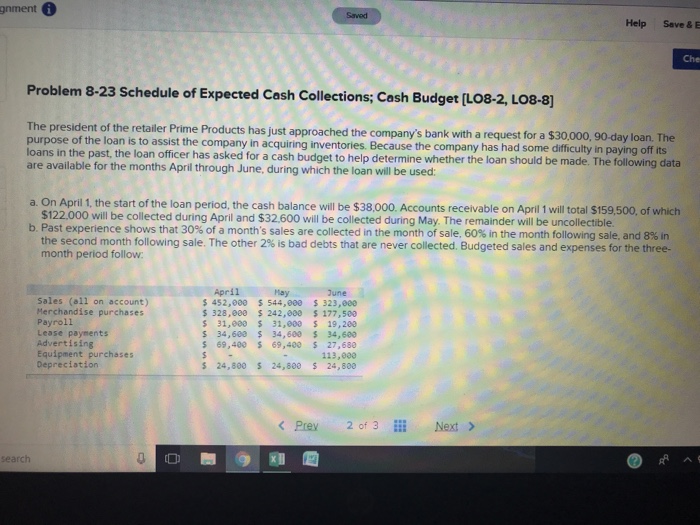

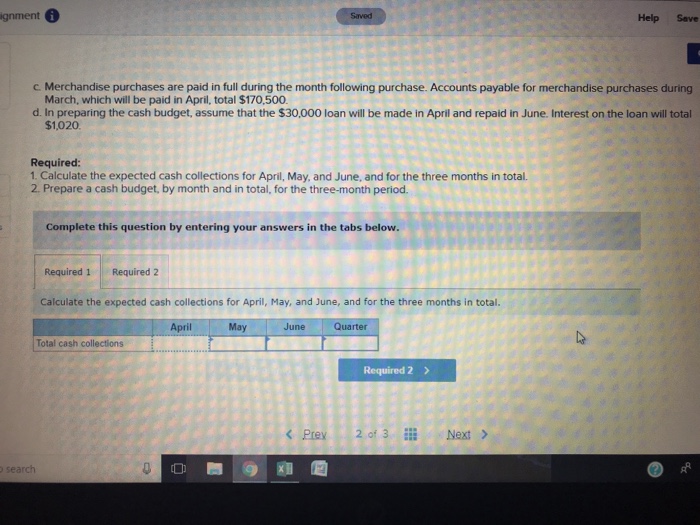

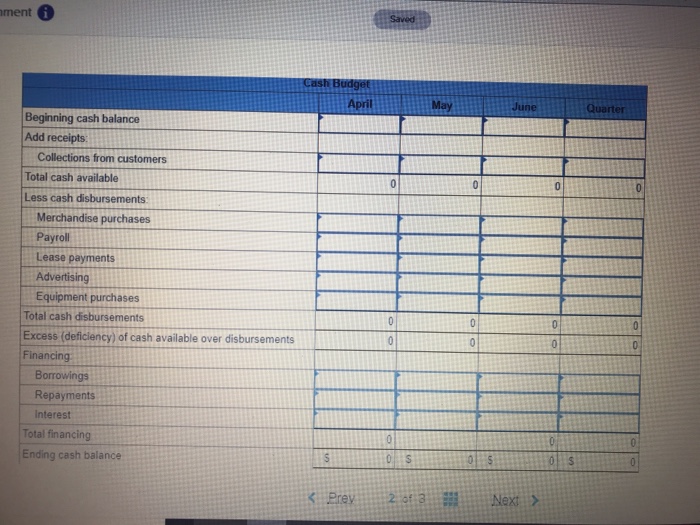

gnment Help Save & E Che Problem 8-23 Schedule of Expected Cash Collections; Cash Budget LO8-2 Lo8-8) The president of the retailer Prime Products has just approached the company's bank with a request for a $30,000, 90-day loan. The purpose of the loan is loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its a. On April 1, the start of the loan period, the cash balance will be $38,000. Accounts receivable on April 1 will total $159,500, of which $122.000 will be collected during April and $32.600 will be collected during May. The remainder will be uncollectible b. Past experience shows that 30% of a month's sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the three- month period follow April Sales (a1l on account) Merchandise purchases Payroll Lease payments Advertising Equipment purchases Depreciation Hay 452,000 544,000 323,00 328,00e 242,00 177,500 s 31,eao 31,e00 19,200 S 34,6034,600 34,600 69,400 69,40 27,688 113,000 s 24,800 24,800 24,800 search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts