Question: Go - Go Growth Ltd ( GGG ) manufactures and sells various agricultural products and equipment. GGG is currently considering manufacturing a fertiliser

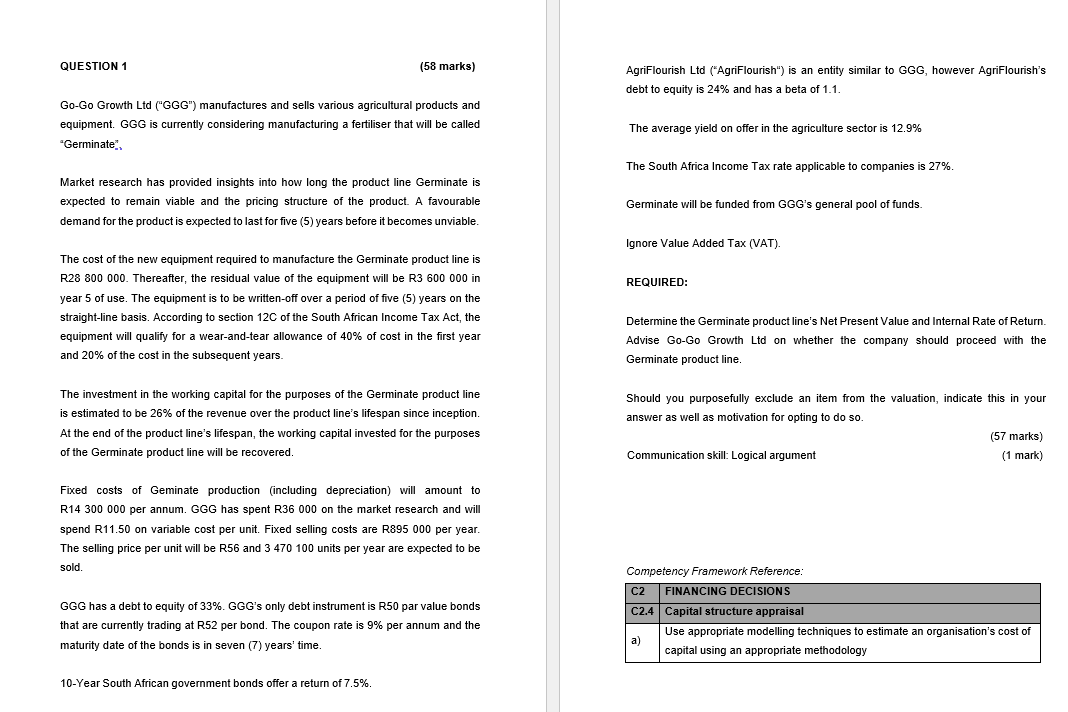

GoGo Growth Ltd GGG manufactures and sells various agricultural products and equipment. GGG is currently considering manufacturing a fertiliser that will be called a Germinate Market research has provided insights into how long the product line Germinate is expected to remain viable and the pricing structure of the product. A favourable demand for the product is expected to last for five years before it becomes unviable. The cost of the new equipment required to manufacture the Germinate product line is R Thereafter, the residual value of the equipment will be R in year of use. The equipment is to be writtenoff over a period of five years on the straightline basis. According to section C of the South African Income Tax Act, the equipment will qualify for a wearandtear allowance of of cost in the first year and of the cost in the subsequent years. The investment in the working capital for the purposes of the Germinate product line is estimated to be of the revenue over the product line's lifespan since inception. At the end of the product line's lifespan, the working capital invested for the purposes of the Germinate product line will be recovered. Fixed costs of Geminate production including depreciation will amount to R per annum. GGG has spent R on the market research and will spend R on variable cost per unit. Fixed selling costs are R per year. The selling price per unit will be R and units per year are expected to be sold. GGG has a debt to equity of GGGs only debt instrument is R par value bonds that are currently trading at R per bond. The coupon rate is per annum and the maturity date of the bonds is in seven years' time. AgriFlourish Ltd AgriFlourish is an entity similar to GGG however AgriFlourish's debt to equity is and has a beta of The average yield on offer in the agriculture sector is The South Africa Income Tax rate applicable to companies is Germinate will be funded from GGGs general pool of funds. Ignore Value Added Tax VAT REQUIRED: Determine the Germinate product line's Net Present Value and Internal Rate of Return. Advise GoGo Growth Ltd on whether the company should proceed with the Germinate product line. Should you purposefully exclude an item from the valuation, indicate this in your answer as well as motivation for opting to do so Communication skill: Logical argument Put it in a year cash flow statement, first one for NPV second one for Tax Competency Framework Reference:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock