Question: Go to assignment2 sheet in the Chapter 3 Excel file. Compute the 60 monthly log returns of Coca-Cola and S&P 500 using their 61 monthly

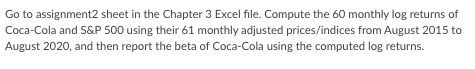

Go to assignment2 sheet in the Chapter 3 Excel file. Compute the 60 monthly log returns of Coca-Cola and S&P 500 using their 61 monthly adjusted prices/indices from August 2015 to August 2020, and then report the beta of Coca-Cola using the computed log returns. Coca-Cola Stock Price 2015-2020 Date Adj Close % Return 8/1/15 39.32 9/1/15 40.12 10/1/15 42.35 11/1/15 42.62 12/1/15 42.96 1/1/16 42.92 2/1/16 43.13 3/1/16 46.39 4/1/16 44.80 5/1/16 44.60 6/1/16 45.33 7/1/16 43.63 8/1/16 43.43 9/1/16 42.32 10/1/16 42.40 11/1/16 40.35 12/1/16 42.00 1/1/17 41.57 2/1/17 41.96 3/1/17 42.44 4/1/17 43.15 5/1/17 45.47 6/1/17 44.85 7/1/17 45.84 8/1/17 45.55 9/1/17 45.01 10/1/17 45.98 11/1/17 45.77 12/1/17 45.88 1/1/18 47.59 2/1/18 43.22 3/1/18 43.43 4/1/18 43.21 5/1/18 43.00 6/1/18 43.86 7/1/18 46.63 8/1/18 44.57 9/1/18 46.19 10/1/18 47.88 11/1/18 50.40 12/1/18 47.35 1/1/19 48.13 2/1/19 45.34 3/1/19 46.86 4/1/19 49.06 5/1/19 49.13 6/1/19 50.92 7/1/19 52.63 8/1/19 55.04 9/1/19 54.44 10/1/19 54.43 11/1/19 53.40 12/1/19 55.35 1/1/20 58.40 2/1/20 53.49 3/1/20 44.25 4/1/20 45.89 5/1/20 46.68 6/1/20 44.68 7/1/20 47.24 8/1/20 49.53 Go to assignment2 sheet in the Chapter 3 Excel file. Compute the 60 monthly log returns of Coca-Cola and S&P 500 using their 61 monthly adjusted prices/indices from August 2015 to August 2020, and then report the beta of Coca-Cola using the computed log returns. Coca-Cola Stock Price 2015-2020 Date Adj Close % Return 8/1/15 39.32 9/1/15 40.12 10/1/15 42.35 11/1/15 42.62 12/1/15 42.96 1/1/16 42.92 2/1/16 43.13 3/1/16 46.39 4/1/16 44.80 5/1/16 44.60 6/1/16 45.33 7/1/16 43.63 8/1/16 43.43 9/1/16 42.32 10/1/16 42.40 11/1/16 40.35 12/1/16 42.00 1/1/17 41.57 2/1/17 41.96 3/1/17 42.44 4/1/17 43.15 5/1/17 45.47 6/1/17 44.85 7/1/17 45.84 8/1/17 45.55 9/1/17 45.01 10/1/17 45.98 11/1/17 45.77 12/1/17 45.88 1/1/18 47.59 2/1/18 43.22 3/1/18 43.43 4/1/18 43.21 5/1/18 43.00 6/1/18 43.86 7/1/18 46.63 8/1/18 44.57 9/1/18 46.19 10/1/18 47.88 11/1/18 50.40 12/1/18 47.35 1/1/19 48.13 2/1/19 45.34 3/1/19 46.86 4/1/19 49.06 5/1/19 49.13 6/1/19 50.92 7/1/19 52.63 8/1/19 55.04 9/1/19 54.44 10/1/19 54.43 11/1/19 53.40 12/1/19 55.35 1/1/20 58.40 2/1/20 53.49 3/1/20 44.25 4/1/20 45.89 5/1/20 46.68 6/1/20 44.68 7/1/20 47.24 8/1/20 49.53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts