Question: Go to sheet assignment1+ in the Chapter 2 Excel file. Compute the Coca-Cola's enterprise value in 2020 using the discounted cash flow approach in Chapter

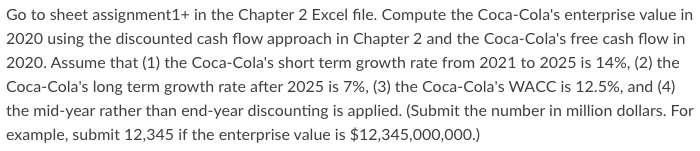

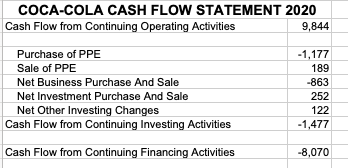

Go to sheet assignment1+ in the Chapter 2 Excel file. Compute the Coca-Cola's enterprise value in 2020 using the discounted cash flow approach in Chapter 2 and the Coca-Cola's free cash flow in 2020. Assume that (1) the Coca-Cola's short term growth rate from 2021 to 2025 is 14%, (2) the Coca-Cola's long term growth rate after 2025 is 7%, (3) the Coca-Cola's WACC is 12.5%, and (4) the mid-year rather than end-year discounting is applied. (Submit the number in million dollars. For example, submit 12,345 if the enterprise value is $12,345,000,000.) COCA-COLA CASH FLOW STATEMENT 2020 Cash Flow from Continuing Operating Activities 9,844 Purchase of PPE -1,177 Sale of PPE 189 Net Business Purchase And Sale -863 Net Investment Purchase And Sale 252 Net Other Investing Changes 122 Cash Flow from Continuing Investing Activities -1,477 Cash Flow from Continuing Financing Activities -8,070

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts