Question: Goal programming is a very useful technique for decision making in the complex task of formulating a public-sector investment program, given the existence of multiple

Goal programming is a very useful technique for decision making in the complex task of formulating a public-sector investment program, given the existence of multiple objectives. Quantitative targets need to be set to provide objective measures of the potential of each investment program towards the attainment of the nations development objectives. The goal program then seeks to minimize the effect of the inevitable deviations from the desired target levels of attainment.

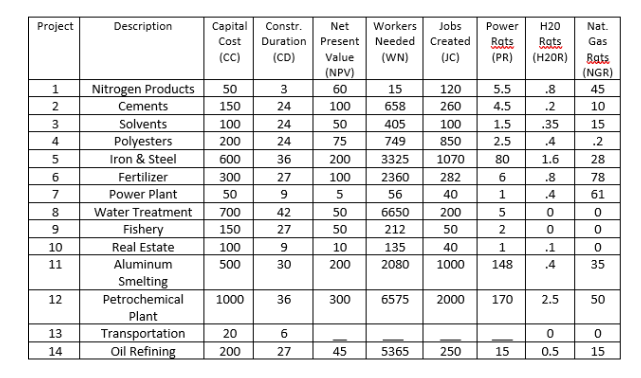

The following table provides information regarding 14 projects under consideration with estimates of capital costs (CC) in $million, construction duration (CD) in months, present value of net benefits (NPV) in $mil, employment during construction (WN) in man years, new permanent jobs created for operation on completion (JC), power consumption (PR) in mw, water consumption (W) in mil. Gallons and natural gas consumption (NG) in mil. ft3/day.  Define the decision variables as xj = 1 if project I is chosen, 0 otherwise The following are goals: 1. The goal is to have the total NPV 1050 as much as possible. 2. Projects 8, 9, and 13 are infrastructure projects. The goal is to complete as many of these as far as is possible. 3. Projects 1, 7 and 10 are unfinished projects at the start of the plan period. The amount of completion at the beginning of this funding cycle are: .2, .3, .1, respectively. This goal is to complete each of these outstanding projects as far as possible. 4. The budget available for capital costs is 3500. It is desired to have the total capital costs be this budget as much as possible and cannot exceed 3750 overall (This is a hard constraint). 5. Total jobs needed by the construction is desired to be 20,000 person-years or greater as far as is possible. Total employment generated by construction is not allowed to go below 15,000 (This is a hard constraint). 6. Number of new jobs created after selected projects are completed are desire to be 6000 as far as possible. 7. In order to utilize the natural resource base, it is desired to have Natural Gas exceed 350 as far as possible. 8. It is desired to invest in at least two foreign exchange earnings projects other than petrochemicals (these are projects 2, 4, 5, 6, 11 and 12) as far as possible. 9. There is a desire to keep the sum of the fractional investments in the two projects 5 and 11 of the high-risk category 1, as far as possible. 10. There is a desire to keep the power consumption for the selected projects to be 400 as far as possible. 11. There is a desire to keep the water consumption for the selected projects to be 9.0 as far as possible. QUESTION A. Formulate this goal-programming problem for determining the optimal x vector in this problem by taking the weights for deviations from the goals 1 through 11 to be 10, 10, 10, 8, 8, 8, 6, 6, 6, 4, 4. For this part, please provide an algebraic formulation that a technical manager can read and understand. In this part of the project, the variables are allowed to be fractional, that is, your xi variables are allowed to take on values between zero and one.

Define the decision variables as xj = 1 if project I is chosen, 0 otherwise The following are goals: 1. The goal is to have the total NPV 1050 as much as possible. 2. Projects 8, 9, and 13 are infrastructure projects. The goal is to complete as many of these as far as is possible. 3. Projects 1, 7 and 10 are unfinished projects at the start of the plan period. The amount of completion at the beginning of this funding cycle are: .2, .3, .1, respectively. This goal is to complete each of these outstanding projects as far as possible. 4. The budget available for capital costs is 3500. It is desired to have the total capital costs be this budget as much as possible and cannot exceed 3750 overall (This is a hard constraint). 5. Total jobs needed by the construction is desired to be 20,000 person-years or greater as far as is possible. Total employment generated by construction is not allowed to go below 15,000 (This is a hard constraint). 6. Number of new jobs created after selected projects are completed are desire to be 6000 as far as possible. 7. In order to utilize the natural resource base, it is desired to have Natural Gas exceed 350 as far as possible. 8. It is desired to invest in at least two foreign exchange earnings projects other than petrochemicals (these are projects 2, 4, 5, 6, 11 and 12) as far as possible. 9. There is a desire to keep the sum of the fractional investments in the two projects 5 and 11 of the high-risk category 1, as far as possible. 10. There is a desire to keep the power consumption for the selected projects to be 400 as far as possible. 11. There is a desire to keep the water consumption for the selected projects to be 9.0 as far as possible. QUESTION A. Formulate this goal-programming problem for determining the optimal x vector in this problem by taking the weights for deviations from the goals 1 through 11 to be 10, 10, 10, 8, 8, 8, 6, 6, 6, 4, 4. For this part, please provide an algebraic formulation that a technical manager can read and understand. In this part of the project, the variables are allowed to be fractional, that is, your xi variables are allowed to take on values between zero and one.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts