Question: gold creek mining company has two competing proposals: a processing mill and an electric shovel. both pieces of equipment have an initial investment of $840,000.

gold creek mining company has two competing proposals: a processing mill and an electric shovel. both pieces of equipment have an initial investment of $840,000. The net cash flows estimated for the two proposals are as follows:

......................................NET CASH FLOWS.............................

Year................Processing Mill.................Electric Shovel

1......................$280,000.........................$350,000

2......................250,000............................325,000

3......................250,000............................300,000

4......................200,000............................300,000

5......................150,000

6......................125,000

7......................100,000

8......................100,000

The estimated residual value of the processing mill at the end of Year 4 is $350,000.

Determine which equipment should be favored, comparing the net present values of the two proposals and assuming a minimum rate of return of %15.

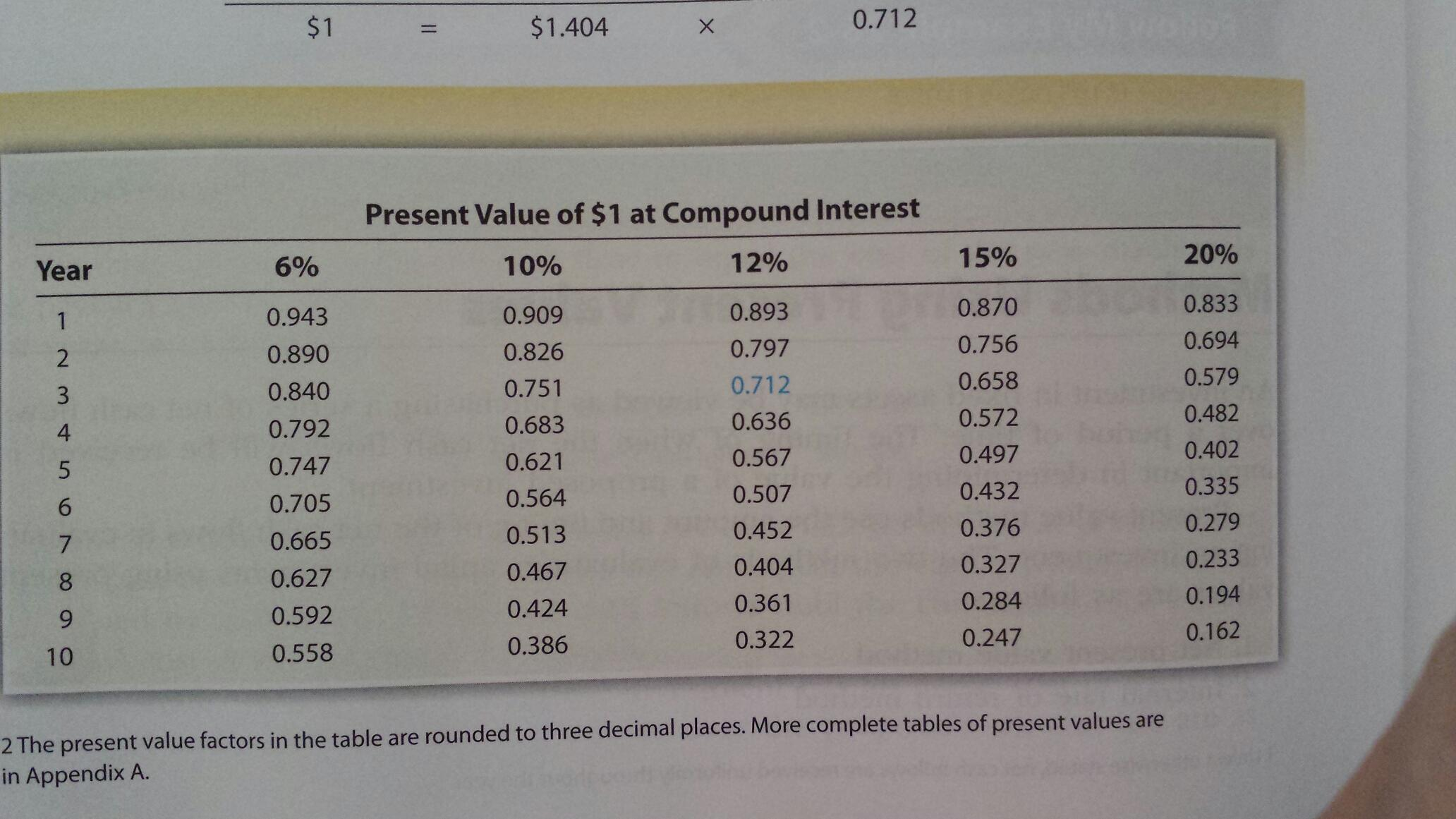

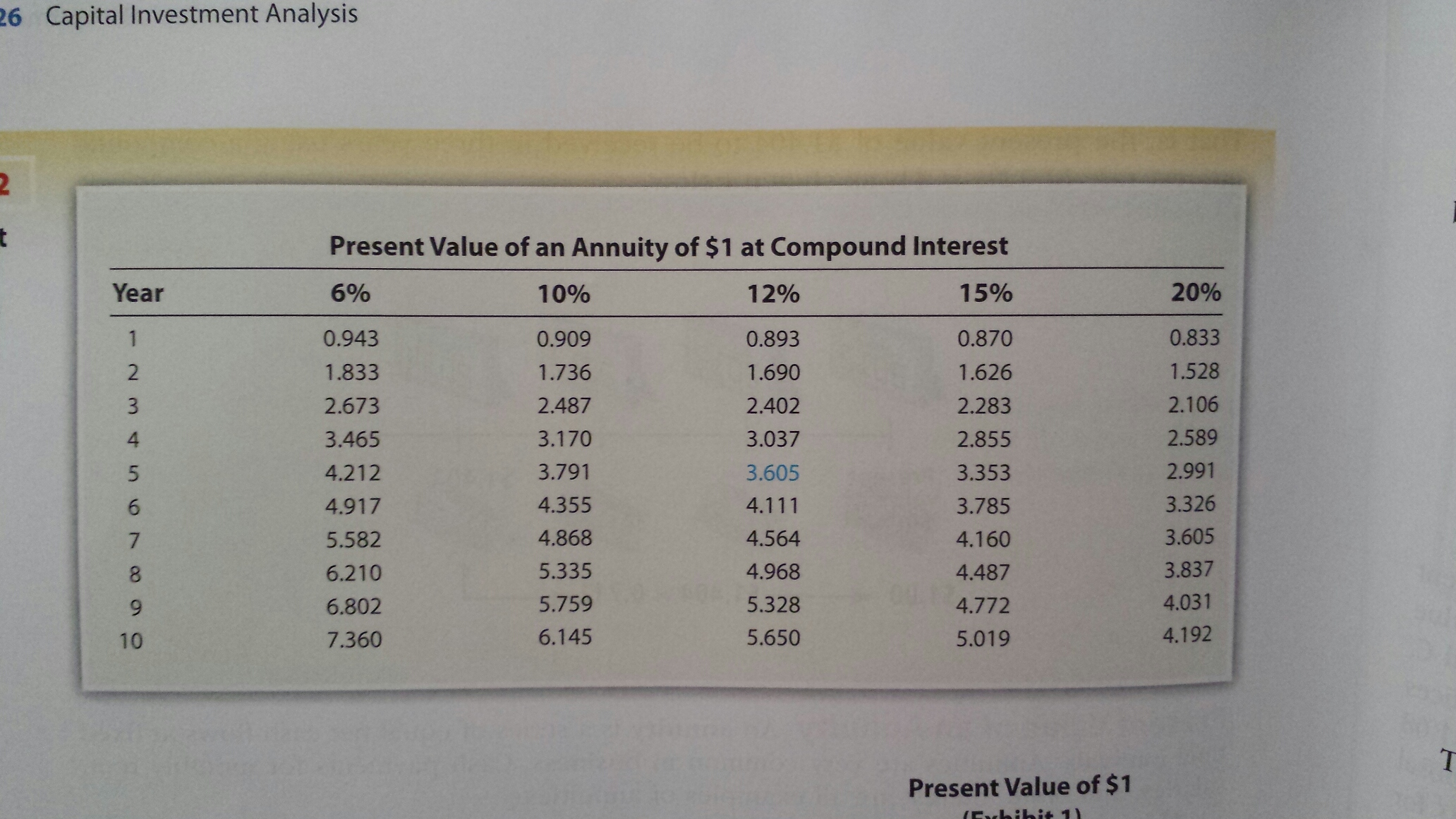

Use the present value tables below

gold creek mining company has two competing proposals: a processing mill and an electric shovel. both pieces of equipment have an initial investment of $840,000. The net cash flows estimated for the two proposals are as follows: The estimated residual value of the processing mill at the end of Year 4 is $350,000. Determine which equipment should be favored, comparing the net present values of the two proposals and assuming a minimum rate of return of %15. Use the present value tables below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts