Question: Good day! Can I have an answer for this one? It's 7 questions overall and I badly need an answer and explanation :( Example 1.

Good day! Can I have an answer for this one? It's 7 questions overall and I badly need an answer and explanation :(

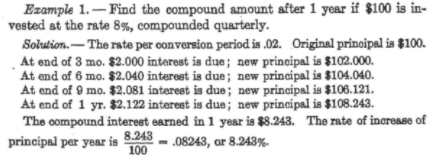

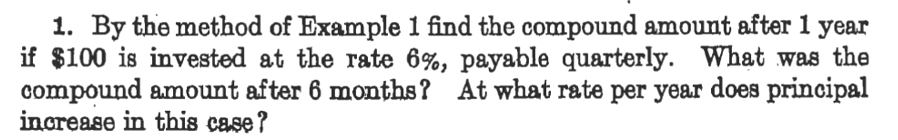

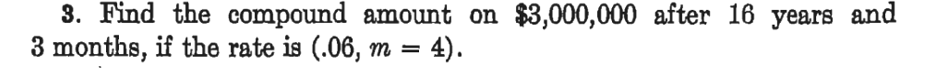

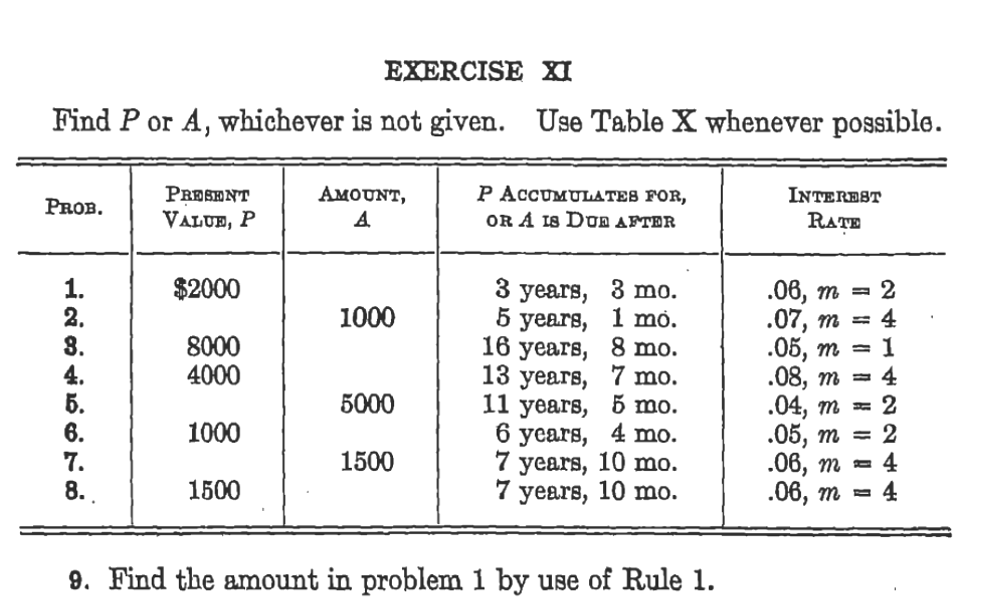

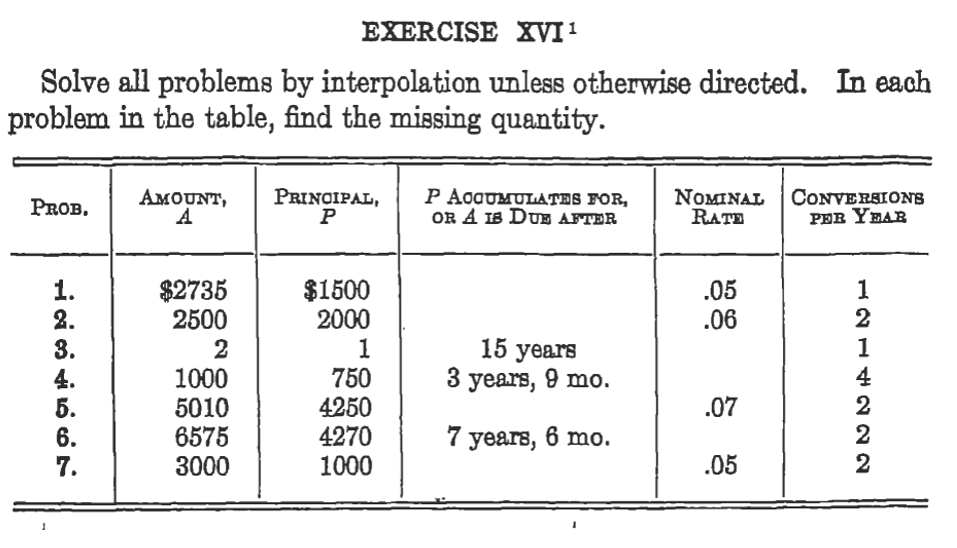

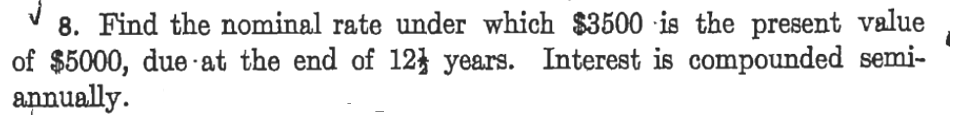

Example 1. - Find the compound amount after 1 year if $100 is in- vested at the rate 8%, compounded quarterly. Solution.- The rate per conversion period is .02. Original principal is $100. At end of 3 mo. $2.000 interest is due; new principal is $102.000. At end of 6 mo. $2.040 interest is due; new principal is $104.040. At end of 9 mo. $2.081 interest is due; new principal is $106.121. At end of 1 yr. $2.122 interest is due; new principal is $108.243. The compound interest earned in 1 year is $8.243. The rate of increase of principal per year is 8.243 -.08243, or 8.243%. 1001. By the method of Example 1 find the compound amount after 1 year if $100 is invested at the rate 6%, payable quarterly. What was the compound amount after 6 months? At what rate per year does principal increase in this case?NOTE. - Hereafter, the unqualified word interest will always refer to compound interest. If a transaction extends over more than 1 year, compound interest should be used. If the time involved is less than 1 year, simple interest generally is used.3. Find the compound amount on $3,000,000 after 16 years and 3 months, if the rate is (.06, m = 4). no. What nominal rate compounded quarterly could equitably replace the rate (.04, m = 2)? EXERCISE XI Find P or A, whichever is not given. Use Table X whenever possible. PRESENT AMOUNT, P ACCUMULATES FOR, INTEREST PROB. VALUE, P A OR A IS DUE AFTER RATE $2000 3 years, 3 mo. .06, m = 2 1000 5 years, 1 mo. .07, m = 4 8000 16 years, 8 mo. .05, m = 1 4000 13 years, 7 mo. .08, m = 4 0 N @ a !A CO NP 5000 11 years, 5 mo. .04, m = 1000 6 years, 4 mo. .05, m = 2 1500 7 years, 10 mo. .06, m = A 1500 7 years, 10 mo. 06, m = 4 9. Find the amount in problem 1 by use of Rule 1.1. If money is worth (.07, m = 2) to W, what would he pay to Y for note (a), above, 3 months after date of the note?EXERCISE XVII Solve all problems by interpolation unless otherwise directed. In each problem in the table, find the missing quantity. PROB. AMOUNT, PRINCIPAL, P ACCUMULATES FOR, NOMINAL CONVERSIONS A P OR A IS DUE AFTER RATE PER YEAR $2735 $1500 .05 2500 2000 .06 2 1 15 years 1000 750 3 years, 9 mo. NNNAHNH 5010 4250 .07 6575 4270 7 years, 6 mo. 3000 1000 .058. Find the nominal rate under which $3500 is the present value of $5000, due at the end of 123 years. Interest is compounded semi- annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts