Question: Good Eats is considering a project with an initial cost of $211, 600. The project will not produce any cash flows for the first three

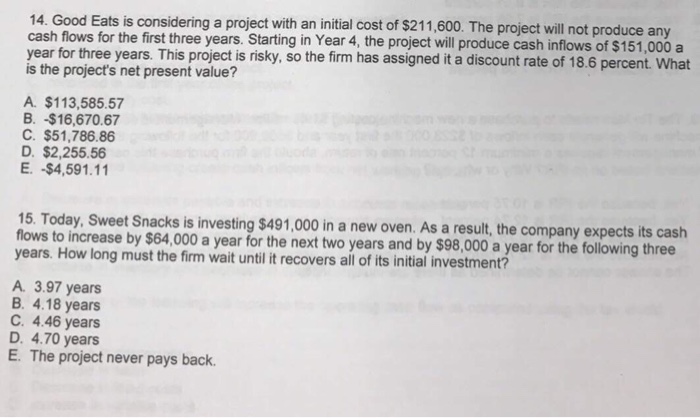

Good Eats is considering a project with an initial cost of $211, 600. The project will not produce any cash flows for the first three years. Starting in Year 4, the project will produce cash inflows of $151,000 a year for three years. This project is risky, so the firm has assigned it a discount rate of 18 6 percent. What is the project's net present value? A $113, 585 57 B -$16, 670.67 C $51, 786.86 D $2, 255 56 E. -$4, 591.11 Today, Sweet Snacks is investing $491,000 in a new oven As a result, the company expects its cash flows to increase by $64,000 a year for the next two years and by $98,000 a year for the following three years How long must the firm wait until it recovers all of its initial investment? A. 3.97 years B 4 18 years C. 4 46 years D 4.70 years E. The project never pays back

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts