Question: Good evening, I am having issues with this question. Can I get some assistance? Image transcription text Required information File following information applies to the

Good evening, I am having issues with this question. Can I get some assistance?

![Required information [The following information applies to the questions displayed below.] On](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/03/65f3888735dcd_1710459013102.jpg)

Image transcription text

Required information File following information applies to the questions displayed below] On January1. Mitzu Company pays a lump—sum amount of$2,?50,000for landr Building 1. Building 2, and Land Improvements 1. Building 'I has no value and will be demolished. Building 2 will be an office and is appraised at $630,000, with a useful life of20 years and a $30,000 salvage value. Land Improvements 1 is valued at $570,000 and is expected to last another 1'3 years with no salvage value. The land is valued at $1,800,000. The company also incurs the following additional costs. Cost to demolish Building 1 $ 343,466 Cost of additional land grading 195,466 Cost to construct Building 3, having a useful life of 25 years and a $466,666 salvage value 2,362,666 Cost of new Land Improvements 2, having a 26—year useful life and no salvage value l?8,606

Image transcription text

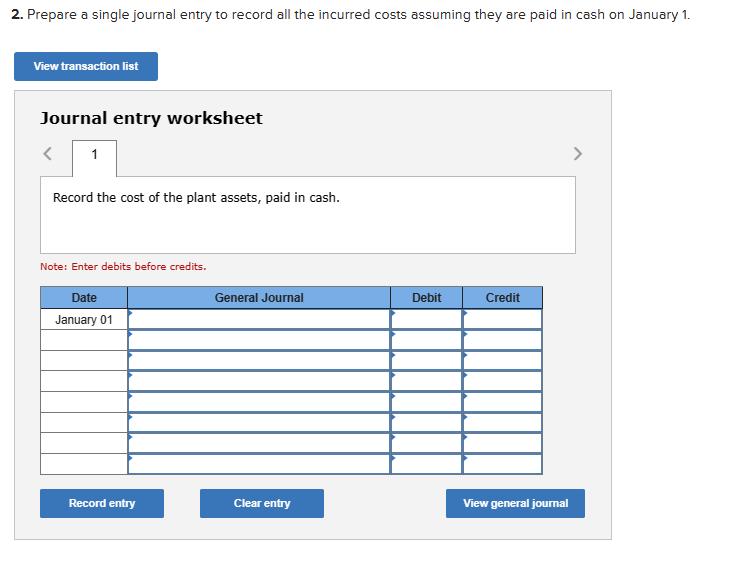

2. Prepare a single journal entry to record all the incurred costs assuming they are paid in cash on January 1. View transaction list Journal entry worksheet Record the cost of the plant assets, paid in cash. Note: Enter debits before credits. Date General Journal Debit Credit January 01 Record entry Clear entry View general journal

Image transcription text

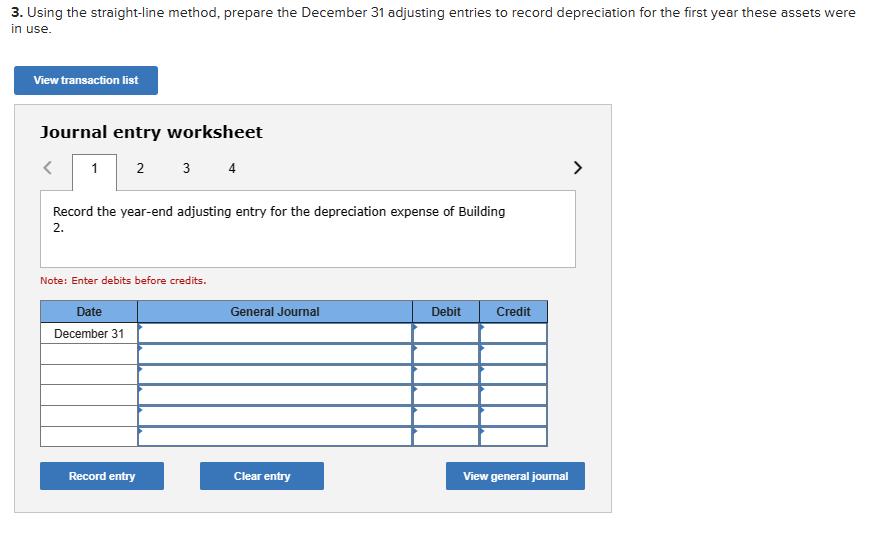

3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet 2 3 4 Record the year-end adjusting entry for the depreciation expense of Building 2. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal

Image transcription text

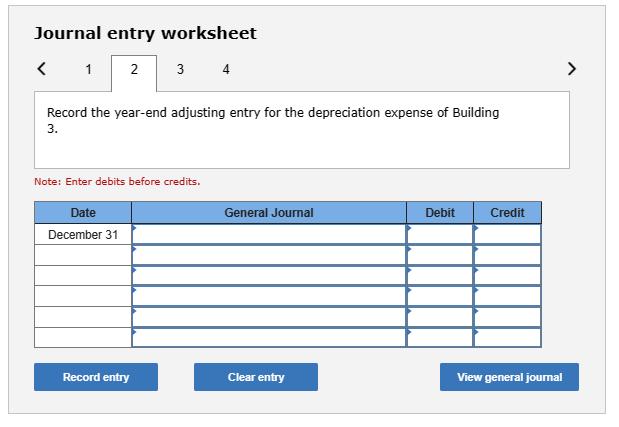

Journal entry worksheet 2 3 4 Record the year-end adjusting entry for the depreciation expense ofBuilding 3. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record

entry Clear entry View general journal

Image transcription text

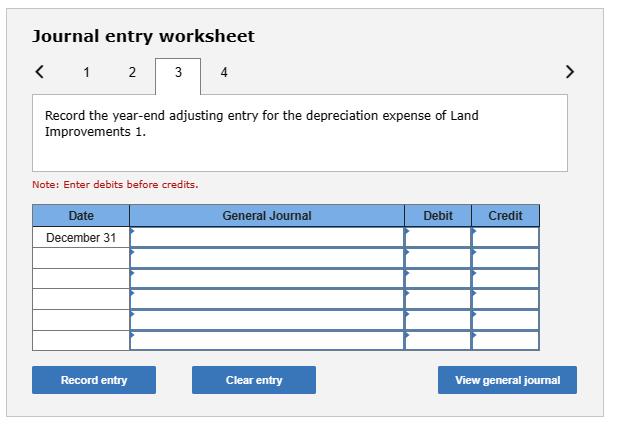

Journal entry worksheet A 2 Record the year-end adjusting entry for the depreciation expense of LandImprovements 1. Note: Enter debits before credits. Date General Journal Debit Credit December 31

Record entry Clear entry View general journal

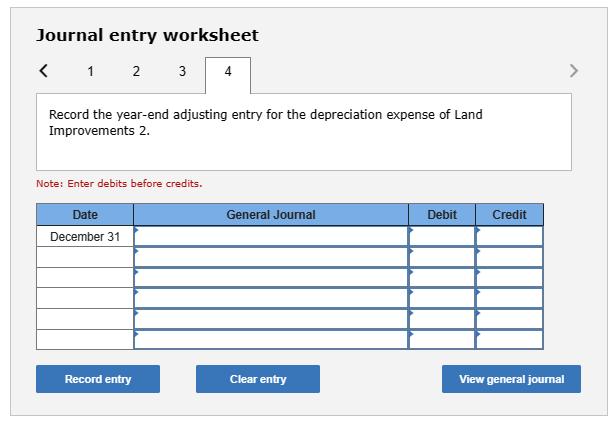

Image transcription text

Journal entry worksheet Land Improvements 2. Note: Enter debits before credits. Date General Journal Debit Credit December31 Record entry Clear entry View general journal

thank you so very much for your help!!

Required information [The following information applies to the questions displayed below.] On January 1, Mitzu Company pays a lump-sum amount of $2,750,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $630,000, with a useful life of 20 years and a $80,000 salvage value. Land Improvements 1 is valued at $570,000 and is expected to last another 19 years with no salvage value. The land is valued at $1,800,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $400,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value $ 343,400 195,400 2,302,000 178,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts