Question: Good explanations to the problem please Q4. The optimal capital stock. A leasing firm is in the business of borrowing money to buy capital and

Good explanations to the problem please

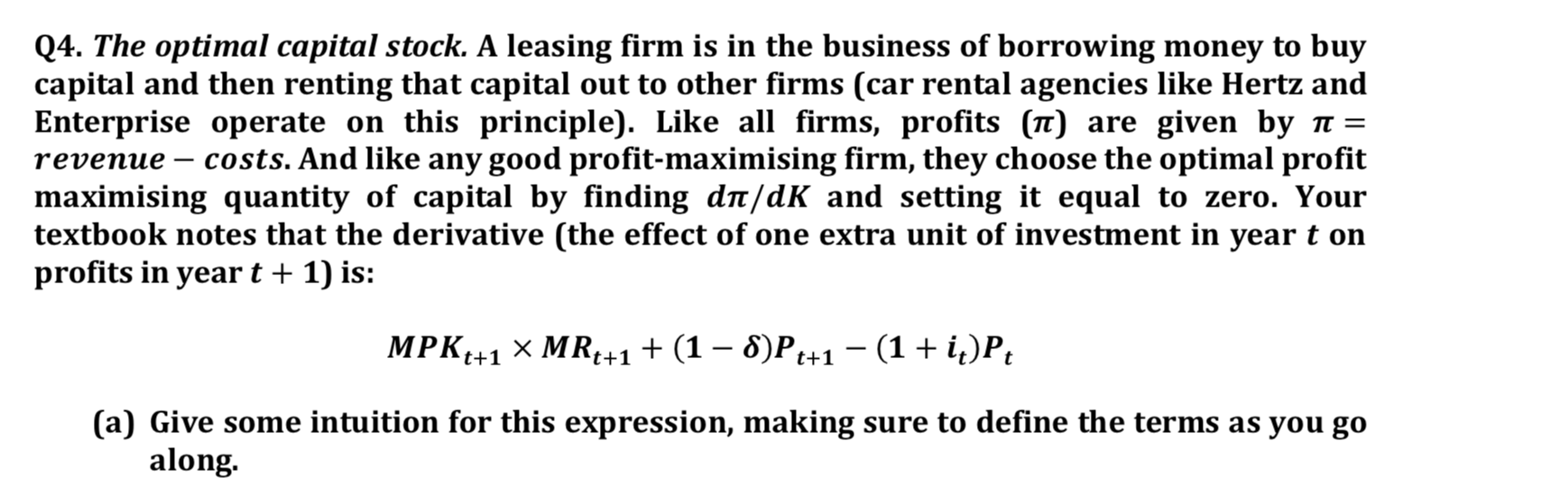

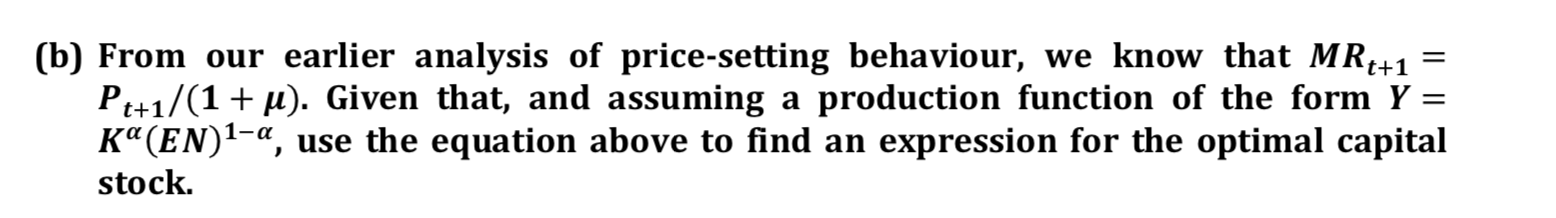

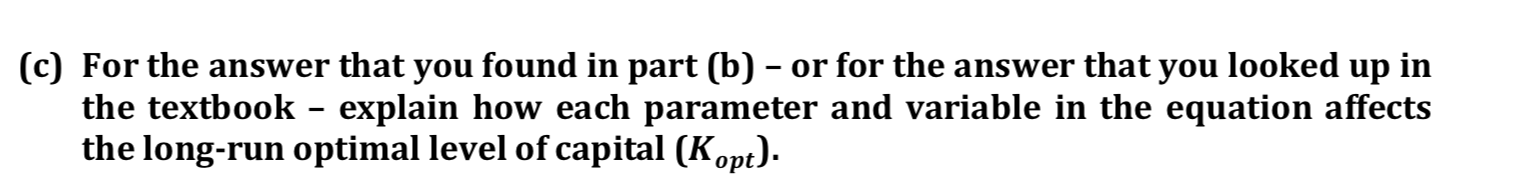

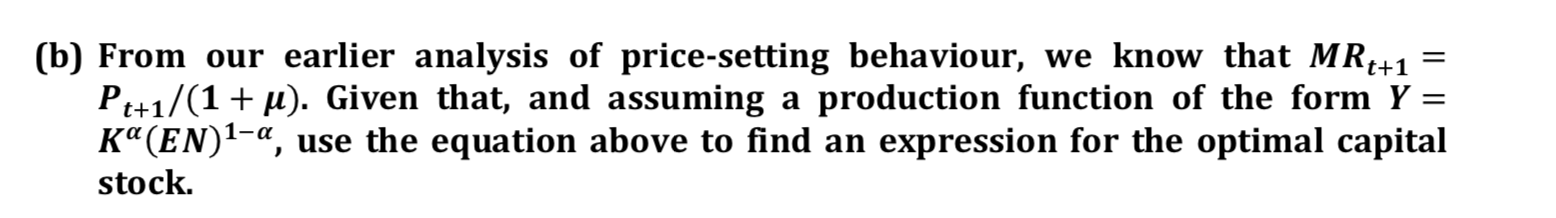

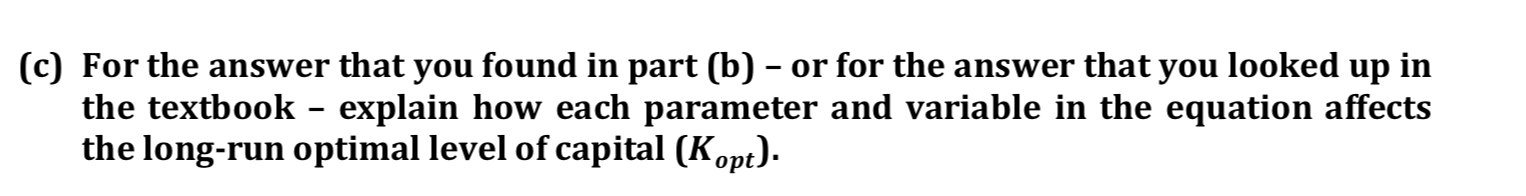

Q4. The optimal capital stock. A leasing firm is in the business of borrowing money to buy capital and then renting that capital out to other firms (car rental agencies like Hertz and Enterprise operate on this principle). Like all firms, profits (x) are given by It = revenue - costs. And like any good profit-maximising firm, they choose the optimal profit maximising quantity of capital by finding du/dK and setting it equal to zero. Your textbook notes that the derivative (the effect of one extra unit of investment in year t on profits in year t + 1) is: MPKt+1 X MRt+1 + (1-8)Pt+1 - (1+i.)P. (a) Give some intuition for this expression, making sure to define the terms as you go along.(b) From our earlier analysis of price-setting behaviour, we know that MRt+1 = Pt+1/(1 + .10. Given that, and assuming a production function of the form Y = K \"(EN)1'\(c) For the answer that you found in part (b) or for the answer that you looked up in the textbook explain how each parameter and variable in the equation affects the long-run optimal level of capital (Kept)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts