Question: Good Guys Moving and Delivery is considering partnering with Amazon to provide last mile delivery of large appliances. If they do, they will have to

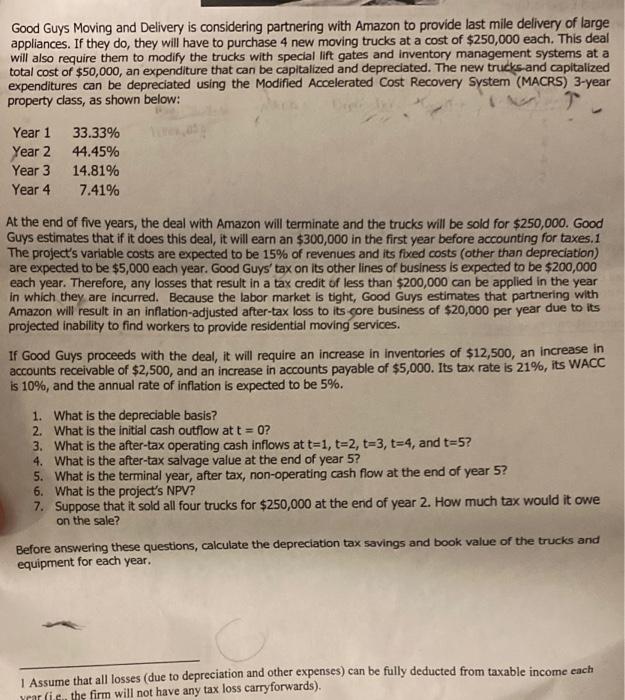

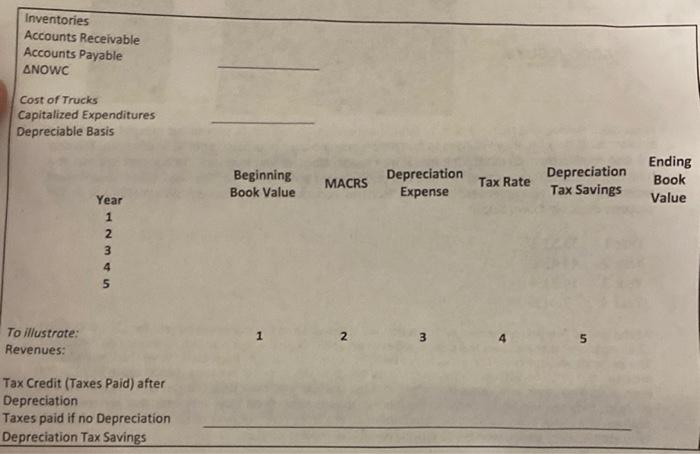

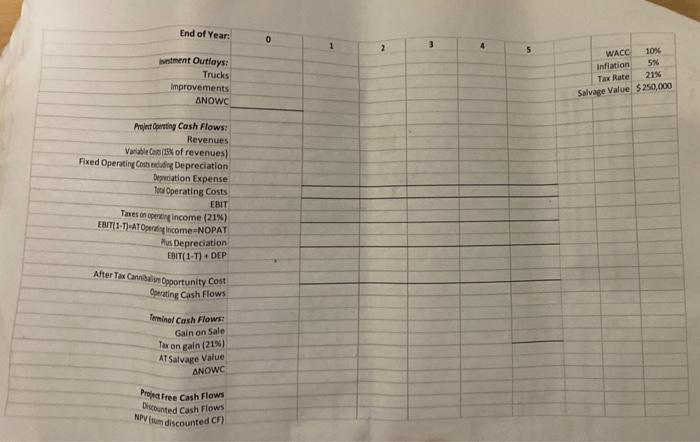

Good Guys Moving and Delivery is considering partnering with Amazon to provide last mile delivery of large appliances. If they do, they will have to purchase 4 new moving trucks at a cost of $250,000 each. This deal will also require them to modify the trucks with special lift gates and Inventory management systems at a total cost of $50,000, an expenditure that can be capitalized and depreciated. The new trucks and capitalized expenditures can be depreciated using the Modified Accelerated Cost Recovery System (MACRS) 3-year property class, as shown below: Year 1 33.33% Year 2 44.45% Year 3 14.81% Year 4 7.41% At the end of five years, the deal with Amazon will terminate and the trucks will be sold for $250,000. Good Guys estimates that if it does this deal, it will earn an $300,000 in the first year before accounting for taxes. 1 The project's variable costs are expected to be 15% of revenues and its fixed costs (other than depreciation) are expected to be $5,000 each year. Good Guys' tax on its other lines of business is expected to be $200,000 each year. Therefore, any losses that result in a tax credit of less than $200,000 can be applied in the year in which they are incurred. Because the labor market is tight, Good Guys estimates that partnering with Amazon will result in an inflation-adjusted after-tax loss to its core business of $20,000 per year due to its projected inability to find workers to provide residential moving services. If Good Guys proceeds with the deal, it will require an increase in inventories of $12,500, an increase in accounts receivable of $2,500, and an increase in accounts payable of $5,000. Its tax rate is 21%, its WACC is 10%, and the annual rate of inflation is expected to be 5%. 1. What is the depreciable basis? 2. What is the initial cash outflow at t = 0? 3. What is the after-tax operating cash inflows at t=1, t=2, t=3, t=4, and t=5? 4. What is the after-tax salvage value at the end of year 5? 5. What is the terminal year, after tax, non-operating cash flow at the end of year 5? 6. What is the project's NPV? 7. Suppose that it sold all four trucks for $250,000 at the end of year 2. How much tax would it owe on the sale? Before answering these questions, calculate the depreciation tax savings and book value of the trucks and equipment for each year. 1 Assume that all losses (due to depreciation and other expenses) can be fully deducted from taxable income each yrarlic. the firm will not have any tax loss carryforwards). Inventories Accounts Receivable Accounts Payable ANOWC Cost of Trucks Capitalized Expenditures Depreciable Basis Beginning Book Value MACRS Depreciation Expense Tax Rate Depreciation Tax Savings Ending Book Value Year 1 2 3 4 5 UAWN To illustrate: Revenues: 1 2 3 5 Tax Credit (Taxes Paid) after Depreciation Taxes paid if no Depreciation Depreciation Tax Savings End of Year: 0 estment Outloys: Trucks Improvements ANOWC WACC 10% inflation 5% Tax Rate 21% Salvage Value $250,000 Prolet Operatiny Cash Flows: Revenues Varble of revenues) Fixed Operating Contacting Depreciation Dendation Expense Trul Operating costs EBIT Tuneson operating income (215) EBIT[ 1-T) AT Operating income-NOPAT Mus Depreciation EBIT(1-T) DEP Alter Tax Cannibal Opportunity cost Operating Cash Flows Terminal Cash Flows: Gain on Sale Taxon gain (213) AT Salvage Value ANOWC Pro Free Cash Flows Discounted Cash Flows NPV(um discounted CF) Good Guys Moving and Delivery is considering partnering with Amazon to provide last mile delivery of large appliances. If they do, they will have to purchase 4 new moving trucks at a cost of $250,000 each. This deal will also require them to modify the trucks with special lift gates and Inventory management systems at a total cost of $50,000, an expenditure that can be capitalized and depreciated. The new trucks and capitalized expenditures can be depreciated using the Modified Accelerated Cost Recovery System (MACRS) 3-year property class, as shown below: Year 1 33.33% Year 2 44.45% Year 3 14.81% Year 4 7.41% At the end of five years, the deal with Amazon will terminate and the trucks will be sold for $250,000. Good Guys estimates that if it does this deal, it will earn an $300,000 in the first year before accounting for taxes. 1 The project's variable costs are expected to be 15% of revenues and its fixed costs (other than depreciation) are expected to be $5,000 each year. Good Guys' tax on its other lines of business is expected to be $200,000 each year. Therefore, any losses that result in a tax credit of less than $200,000 can be applied in the year in which they are incurred. Because the labor market is tight, Good Guys estimates that partnering with Amazon will result in an inflation-adjusted after-tax loss to its core business of $20,000 per year due to its projected inability to find workers to provide residential moving services. If Good Guys proceeds with the deal, it will require an increase in inventories of $12,500, an increase in accounts receivable of $2,500, and an increase in accounts payable of $5,000. Its tax rate is 21%, its WACC is 10%, and the annual rate of inflation is expected to be 5%. 1. What is the depreciable basis? 2. What is the initial cash outflow at t = 0? 3. What is the after-tax operating cash inflows at t=1, t=2, t=3, t=4, and t=5? 4. What is the after-tax salvage value at the end of year 5? 5. What is the terminal year, after tax, non-operating cash flow at the end of year 5? 6. What is the project's NPV? 7. Suppose that it sold all four trucks for $250,000 at the end of year 2. How much tax would it owe on the sale? Before answering these questions, calculate the depreciation tax savings and book value of the trucks and equipment for each year. 1 Assume that all losses (due to depreciation and other expenses) can be fully deducted from taxable income each yrarlic. the firm will not have any tax loss carryforwards). Inventories Accounts Receivable Accounts Payable ANOWC Cost of Trucks Capitalized Expenditures Depreciable Basis Beginning Book Value MACRS Depreciation Expense Tax Rate Depreciation Tax Savings Ending Book Value Year 1 2 3 4 5 UAWN To illustrate: Revenues: 1 2 3 5 Tax Credit (Taxes Paid) after Depreciation Taxes paid if no Depreciation Depreciation Tax Savings End of Year: 0 estment Outloys: Trucks Improvements ANOWC WACC 10% inflation 5% Tax Rate 21% Salvage Value $250,000 Prolet Operatiny Cash Flows: Revenues Varble of revenues) Fixed Operating Contacting Depreciation Dendation Expense Trul Operating costs EBIT Tuneson operating income (215) EBIT[ 1-T) AT Operating income-NOPAT Mus Depreciation EBIT(1-T) DEP Alter Tax Cannibal Opportunity cost Operating Cash Flows Terminal Cash Flows: Gain on Sale Taxon gain (213) AT Salvage Value ANOWC Pro Free Cash Flows Discounted Cash Flows NPV(um discounted CF)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts