Question: Google spreadsheet or excel Solve for the unknown variables (identified with a ?) based on the information provided. Principal / . Maturity I Present Value

Google spreadsheet or excel

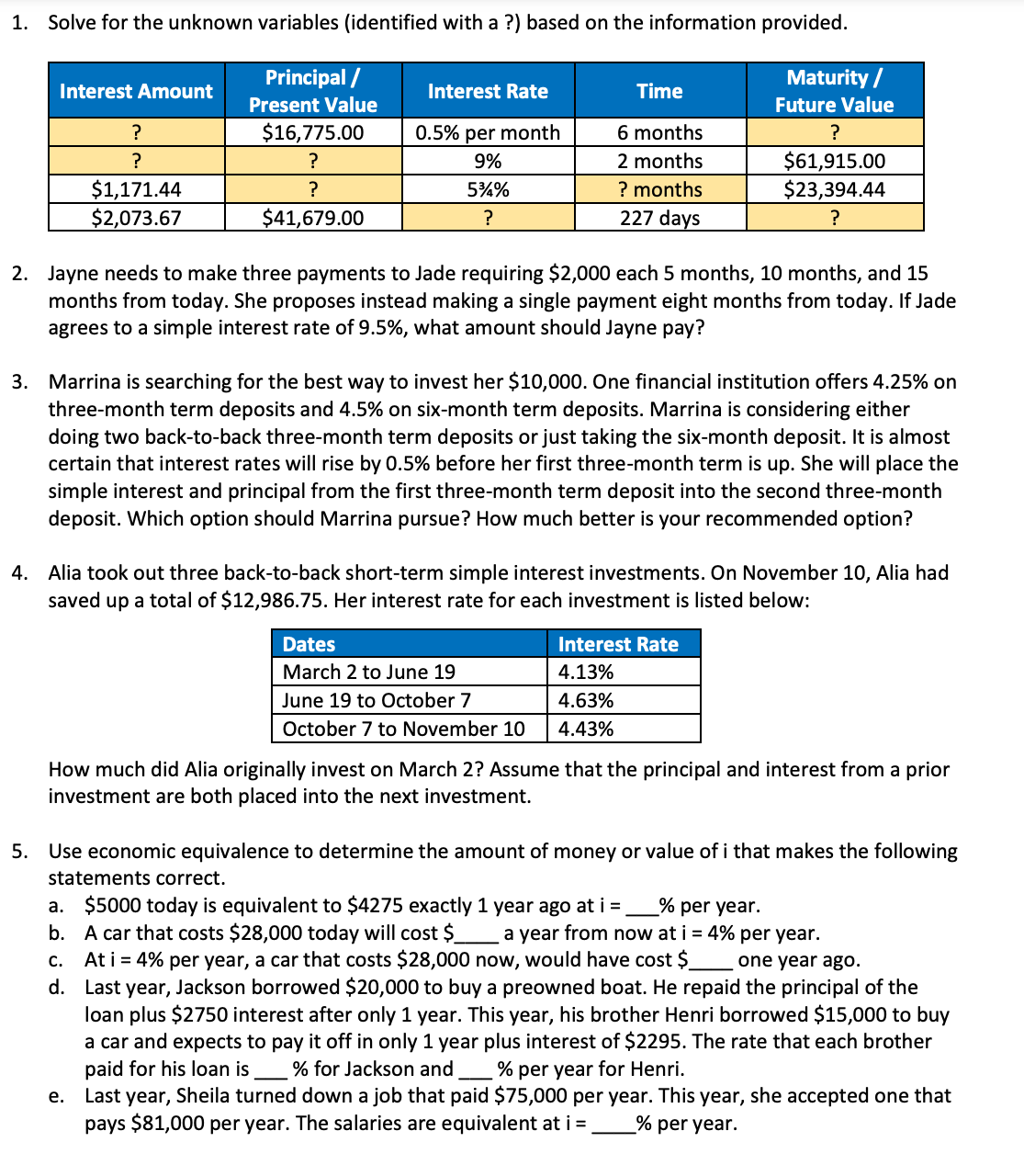

Solve for the unknown variables (identified with a ?) based on the information provided. Principal / . Maturity I Present Value Interest Rate Tlme Future Value $15,775.00 05% per month Im lnterest Amount "m 561315-00 131471-44 5%% $23,394-44 $2,073.57 $41,579.00 227 da 5 Jayne needs to make three payments to Jade requiring $2,000 each 5 months, 10 months, and 15 months from today. She proposes instead making a single payment eight months from today. If Jade agrees to a simple interest rate of 9.5%, what amount should Jayne pay? Marrina is searching for the best way to invest her $10,000. One nancial institution offers 4.25% on three-month term deposits and 4.5% on six-month term deposits. Marrina is considering either doing two back-to-back three-month term deposits or just taking the six-month deposit. It is almost certain that interest rates will rise by 0.5% before her rst three-month term is up. She will place the simple interest and principal from the rst three-month term deposit into the second three-month deposit. Which option should Marrina pursue? How much better is your recommended option? Alia took out three back-to-back shortterm simple interest investments. On November 10, Alia had saved up a total of $12,986.75. Her interest rate for each investment is listed below: Dates Interest Rate March 2 to June 19 4.13% June 19 to October 7 4.63% October 7 to November 10 4.43% How much did Alia originally invest on March 2? Assume that the principal and interest from a prior investment are both placed into the next investment. Use economic equivalence to determine the amount of money or value ofi that makes the following statements correct. a. $5000 today is equivalent to $4275 exactly 1 year ago at i = _% per year. b. A car that costs $28,000 today will cost $ a year from now at i = 4% per year. c. At i = 4% per year, a car that costs $28,000 now, would have cost $_ one year ago. d. Last year, Jackson borrowed $20,000 to buy a preowned boat. He repaid the principal of the loan plus $2750 interest after only 1 year. This year, his brother Henri borrowed $15,000 to buy a car and expects to pay it off in only 1 year plus interest of $2295. The rate that each brother paid for his loan is _ % for Jackson and _ % per year for Henri. e. Last year, Sheila turned down a job that paid $75,000 per year. This year, she accepted one that pays $81,000 per year. The salaries are equivalent at i = _% per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts