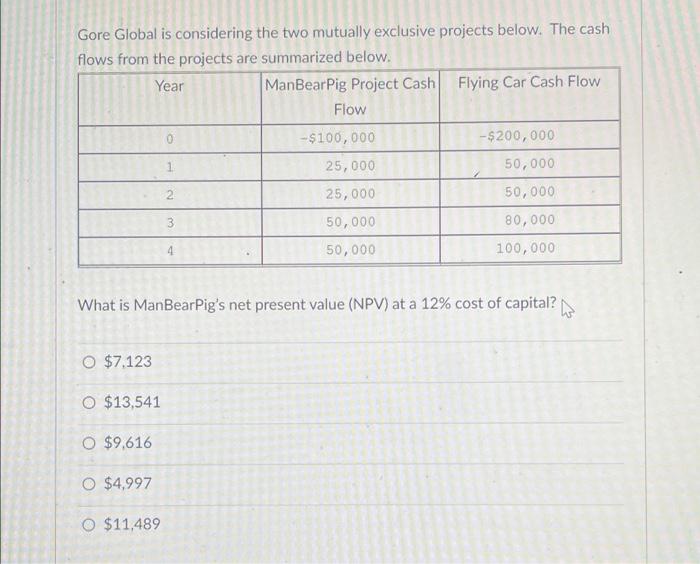

Question: Gore Global is considering the two mutually exclusive projects below. The cash flows from the projects are summarized below. Year ManBear Pig Project Cash Flying

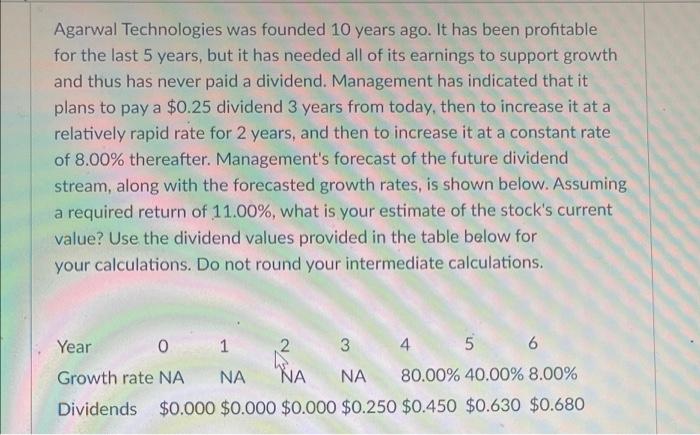

Gore Global is considering the two mutually exclusive projects below. The cash flows from the projects are summarized below. Year ManBear Pig Project Cash Flying Car Cash Flow Flow -$100,000 -$200,000 1 25,000 50,000 2 25,000 50,000 50,000 80,000 50,000 100,000 0 2 3 What is ManBearPig's net present value (NPV) at a 12% cost of capital? As $7,123 O $13,541 O $9,616 0 $4,997 O $11,489 Agarwal Technologies was founded 10 years ago. It has been profitable for the last 5 years, but it has needed all of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a $0.25 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. Management's forecast of the future dividend stream, along with the forecasted growth rates, is shown below. Assuming a required return of 11.00%, what is your estimate of the stock's current value? Use the dividend values provided in the table below for your calculations. Do not round your intermediate calculations. Year 0 1 2 3 4 5 6 Growth rate NA NA NA NA 80.00% 40.00% 8.00% Dividends $0.000 $0.000 $0.000 $0.250 $0.450 $0.630 $0.680

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts