Question: GOT THE ANSWER WRONG NEED RIGHT ANSWER AND SHOW WORK SO I CAN STUDY PLEASE value: 100.00 points Hamilton Company uses a periodic inventory system.

GOT THE ANSWER WRONG NEED RIGHT ANSWER AND SHOW WORK SO I CAN STUDY PLEASE

GOT THE ANSWER WRONG NEED RIGHT ANSWER AND SHOW WORK SO I CAN STUDY PLEASE

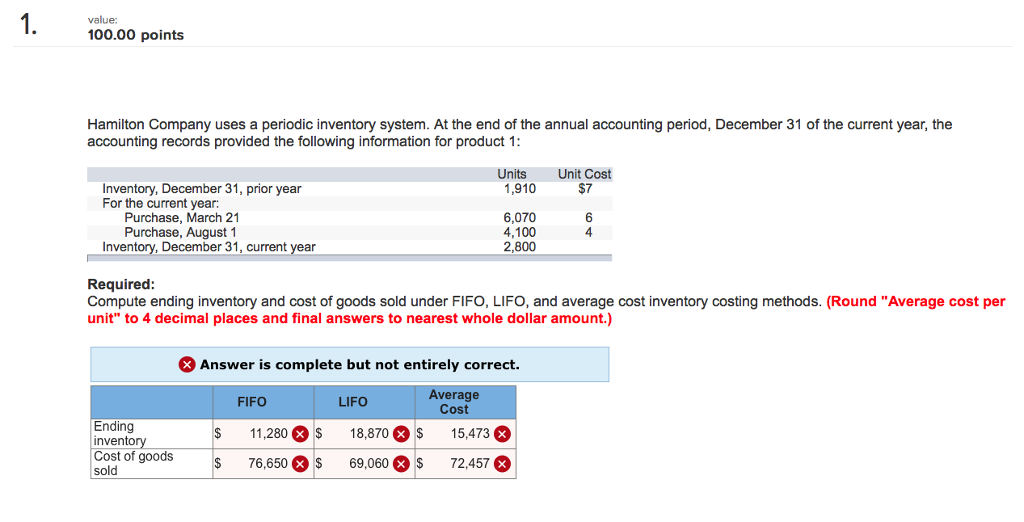

value: 100.00 points Hamilton Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1 Units Unit Cost $7 1,910 Inventory, December 31, prior year For the current year: 6,070 4,100 2,800 Purchase, March 21 Purchase, August1 4 Inventory, December 31, current year Required Compute ending inventory and cost of goods sold under FIFO, LIFO, and average cost inventory costing methods. (Round "Average cost per unit" to 4 decimal places and final answers to nearest whole dollar amount.) Answer is complete but not entirely correct. Average Cost FIFO Ending invento Cost of goods sold LIFO $ 11,280 x $ 18,870 X S 15,473 $ 76,650 x $ 69,060 72,457

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts