Question: governmental accounting please help in solving this question thank you so much Following transaction took place in in Help Log (a NFP) during year 2022:

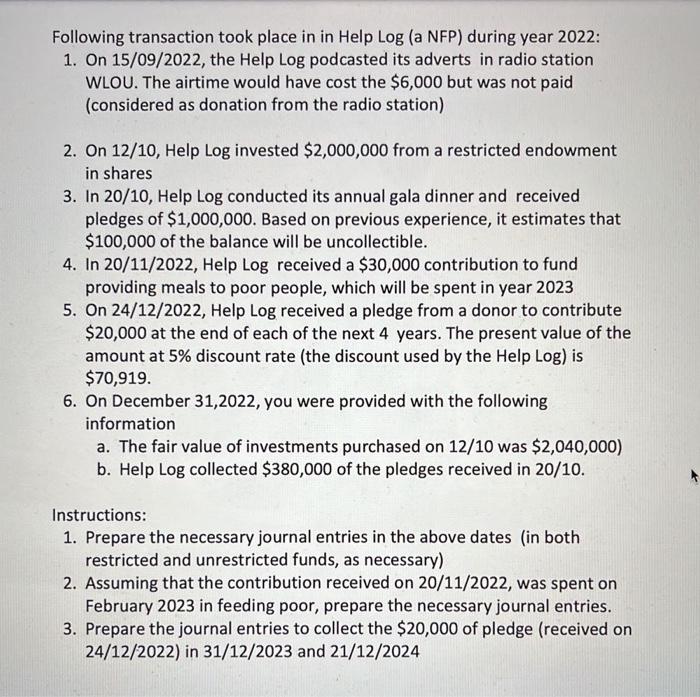

Following transaction took place in in Help Log (a NFP) during year 2022: 1. On 15/09/2022, the Help Log podcasted its adverts in radio station WLOU. The airtime would have cost the $6,000 but was not paid (considered as donation from the radio station) 2. On 12/10, Help Log invested $2,000,000 from a restricted endowment in shares 3. In 20/10, Help Log conducted its annual gala dinner and received pledges of $1,000,000. Based on previous experience, it estimates that $100,000 of the balance will be uncollectible. 4. In 20/11/2022, Help Log received a $30,000 contribution to fund providing meals to poor people, which will be spent in year 2023 5. On 24/12/2022, Help Log received a pledge from a donor to contribute $20,000 at the end of each of the next 4 years. The present value of the amount at 5% discount rate (the discount used by the Help Log) is $70,919. 6. On December 31,2022 , you were provided with the following information a. The fair value of investments purchased on 12/10 was $2,040,000 ) b. Help Log collected $380,000 of the pledges received in 20/10. Instructions: 1. Prepare the necessary journal entries in the above dates (in both restricted and unrestricted funds, as necessary) 2. Assuming that the contribution received on 20/11/2022, was spent on February 2023 in feeding poor, prepare the necessary journal entries. 3. Prepare the journal entries to collect the $20,000 of pledge (received on 24/12/2022 ) in 31/12/2023 and 21/12/2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts