Question: governmental accounting practice questions. please help! 1. As used by the GASB, interperiod equity refers to which of the following? Financial reporting should: a) Demonstrate

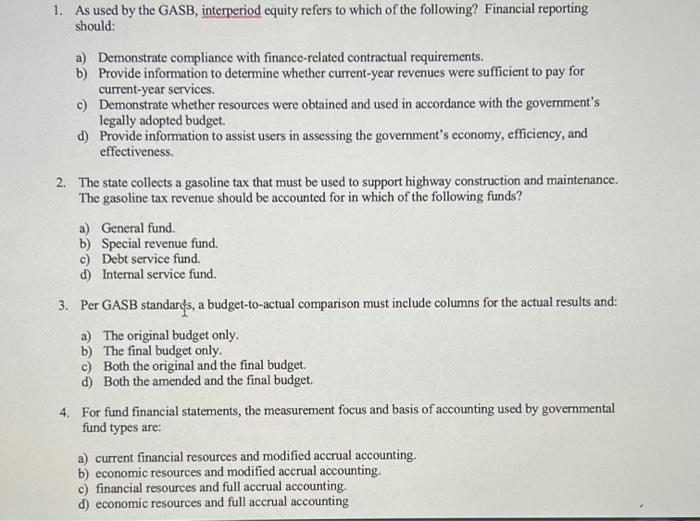

1. As used by the GASB, interperiod equity refers to which of the following? Financial reporting should: a) Demonstrate compliance with finance-related contractual requirements. b) Provide information to determine whether current-year revenues were sufficient to pay for current-year services. c) Demonstrate whether resources were obtained and used in accordance with the government's legally adopted budget. d) Provide information to assist users in assessing the government's economy, efficiency, and effectiveness. 2. The state collects a gasoline tax that must be used to support highway construction and maintenance. The gasoline tax revenue should be accounted for in which of the following funds? a) General fund. b) Special revenue fund. c) Debt service fund. d) Internal service fund. 3. Per GASB standards, a budget-to-actual comparison must include columns for the actual results and: a) The original budget only. b) The final budget only. c) Both the original and the final budget. d) Both the amended and the final budget. 4. For fund financial statements, the measurement focus and basis of accounting used by governmental fund types are: a) current financial resources and modified accrual accounting. b) economic resources and modified accrual accounting. c) financial resources and full accrual accounting. d) economic resources and full accrual accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts