Question: GR Inc is a US based MNC that conducts a part of its business in Singapore. Its US sales are denominated in US dollars while

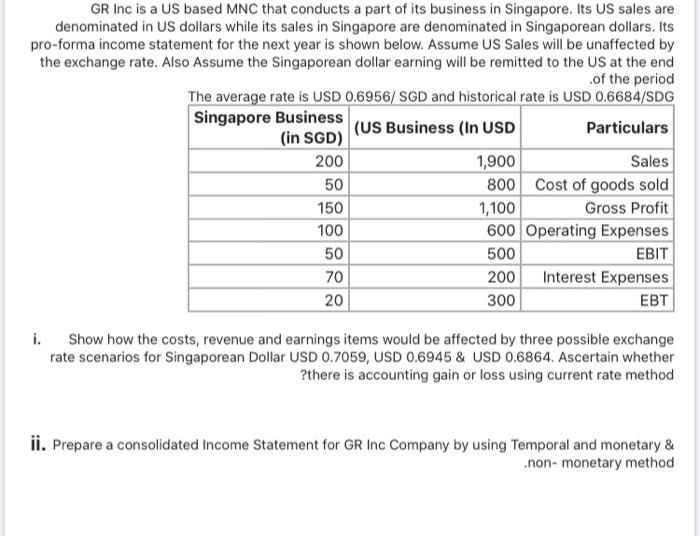

GR Inc is a US based MNC that conducts a part of its business in Singapore. Its US sales are denominated in US dollars while its sales in Singapore are denominated in Singaporean dollars. Its pro-forma income statement for the next year is shown below. Assume US Sales will be unaffected by the exchange rate. Also Assume the Singaporean dollar earning will be remitted to the US at the end of the period The average rate is USD 0.6956/ SGD and historical rate is USD 0.6684/SDG Singapore Business (US Business (In USD (in SGD) Particulars 200 1,900 Sales 50 800 Cost of goods sold 150 1,100 Gross Profit 100 600 Operating Expenses 500 EBIT 70 200 Interest Expenses 300 50 20 EBT i. Show how the costs, revenue and earnings items would be affected by three possible exchange rate scenarios for Singaporean Dollar USD 0.7059, USD 0.6945 & USD 0.6864. Ascertain whether ?there is accounting gain or loss using current rate method ii. Prepare a consolidated Income Statement for GR Inc Company by using Temporal and monetary & .non- monetary method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts