Question: Grade 1 2 Case Study: 2 0 2 4 AuqustQuestion PoperGrade 1 2 Case Study: 2 0 2 4 AuqustOuestion PoperTOTAL MARKS: 7 0 7

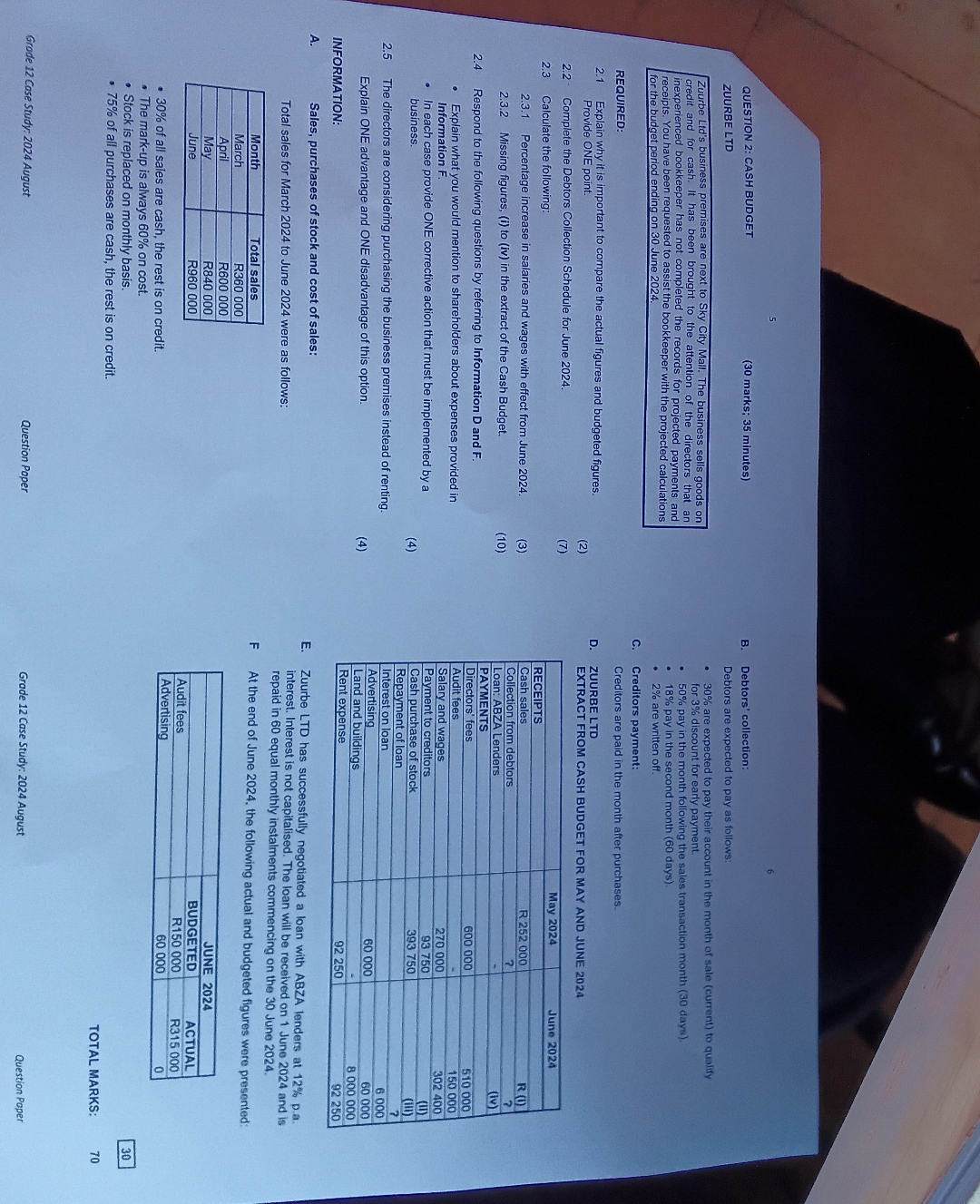

Grade Case Study: AuqustQuestion PoperGrade Case Study: AuqustOuestion PoperTOTAL MARKS: of all purchases are cash, the rest is on credit. Stock is replaced on monthly basis The markup is always on cost of all sales are cash, the rest is on credit.AdvertisingAudit feesRRMayAprilBUDGETEDRJUNE RACTUALMarchRRMonthTotal salesAt the end of JuneTotal sales for March to June were as follows:ASales, purchases of stock and cost of sales:Frepaid in equal monthly instalmentsINFORMATION:Rent expenseLand and buildingsExplain ONE advantage and ONE disadvantage of this option.The directors are considering purchasing the business prermises instead of rentin.AdvertisingInterest on loanRepayment of loanCash ditorsd wagesObusineSsstockInrormaton Explain what you would mention to shareholders about expenses providedincase provide ONE corrective action that must be implemnented by aRespond to the following questions by referring to Information D and FAudit feesDirectors' feesPAYMENTS Missing figures, i to iv in the extract of the Cash Budget.Percentage increase in salaries and wages with effect from June Loan: ABZA LendersCollection from debtorsivCash salesRR Calculate the following:RECEIPTSMay June Complete the Debtors Collection Schedule for June Provide ONE point.Explain why it is important to compare the actual figures and budgeted figures.EXTRACT FROM CASH BUDGET FOR MAY AND JUNE ZUURBE LTDREQUIRED:Creditors are paid in the month after purchases.CCreditorsDUSfor the budget period ending on June s premises are next to Skyreceiots, You havebeen requested are written off pay in the second month days pay in the month following the sales transaction month daysya nefor discount for early payment. are expe cted to pay their account inZUURBE LTDDebtors are expected to pay as follows:QUESTION : CASH BUDGETBDebtors' collection: the following actual andbudgeted figures werepresented:commencing on the June Zuurbe LTD has successfully negotiated a loan with ABZA lenders at interest. Interest is not capitalised. The loan will be received on June and is Opayment:to assist thebookkeeper with theprojected calculationsinexperienced bookkeeper has not completed the records for nroiocted pcredit and for cash. It has hoon brobtbusiness sells goods onthe month of sale current to qualifymarks; minutes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock