Question: Grade: Problem 1. E13-2 Changing costs and the operating breakeven point Q = FC + (P-VC) (11 points) Round up to whole number for the

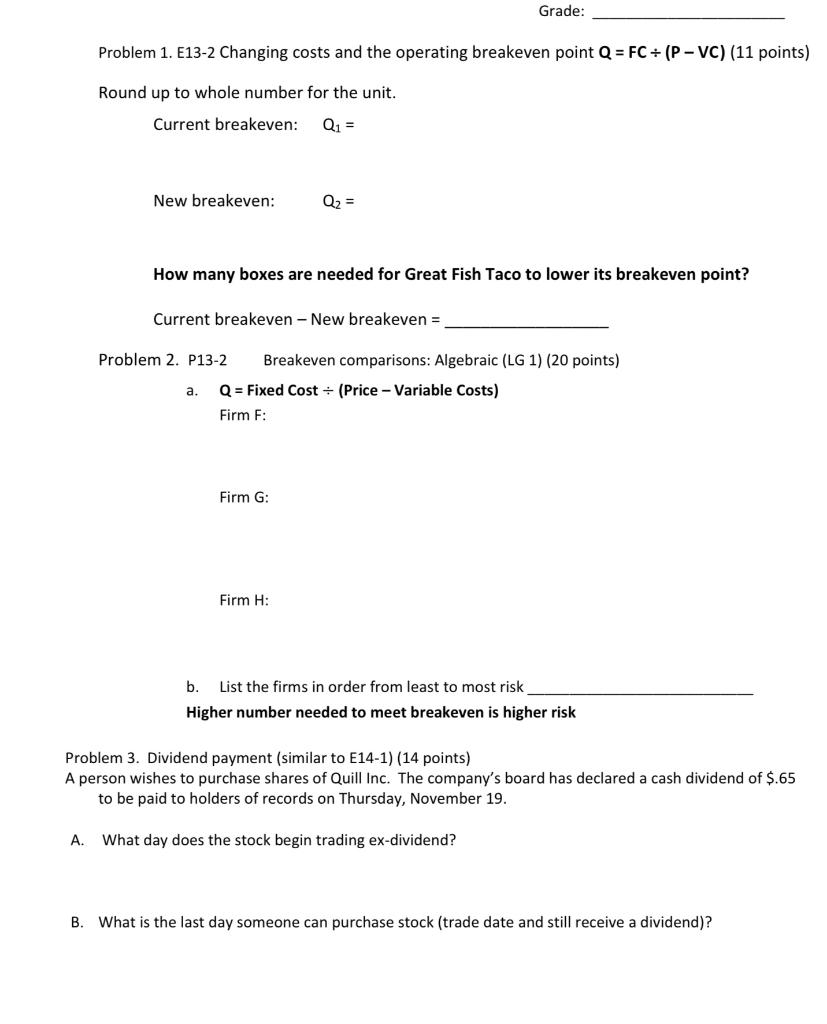

Grade: Problem 1. E13-2 Changing costs and the operating breakeven point Q = FC + (P-VC) (11 points) Round up to whole number for the unit. Current breakeven: Q1 = New breakeven: Q2 = How many boxes are needed for Great Fish Taco to lower its breakeven point? Current breakeven - New breakeven = Problem 2. P13-2 Breakeven comparisons: Algebraic (LG 1) (20 points) a. Q = Fixed Cost = (Price - Variable Costs) Firm F: Firm G: Firm H: b. List the firms in order from least to most risk Higher number needed to meet breakeven is higher risk Problem 3. Dividend payment (similar to E14-1) (14 points) A person wishes to purchase shares of Quill Inc. The company's board has declared a cash dividend of $.65 to be paid to holders of records on Thursday, November 19. A. What day does the stock begin trading ex-dividend? B. What is the last day someone can purchase stock (trade date and still receive a dividend)? Grade: Problem 1. E13-2 Changing costs and the operating breakeven point Q = FC + (P-VC) (11 points) Round up to whole number for the unit. Current breakeven: Q1 = New breakeven: Q2 = How many boxes are needed for Great Fish Taco to lower its breakeven point? Current breakeven - New breakeven = Problem 2. P13-2 Breakeven comparisons: Algebraic (LG 1) (20 points) a. Q = Fixed Cost = (Price - Variable Costs) Firm F: Firm G: Firm H: b. List the firms in order from least to most risk Higher number needed to meet breakeven is higher risk Problem 3. Dividend payment (similar to E14-1) (14 points) A person wishes to purchase shares of Quill Inc. The company's board has declared a cash dividend of $.65 to be paid to holders of records on Thursday, November 19. A. What day does the stock begin trading ex-dividend? B. What is the last day someone can purchase stock (trade date and still receive a dividend)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts