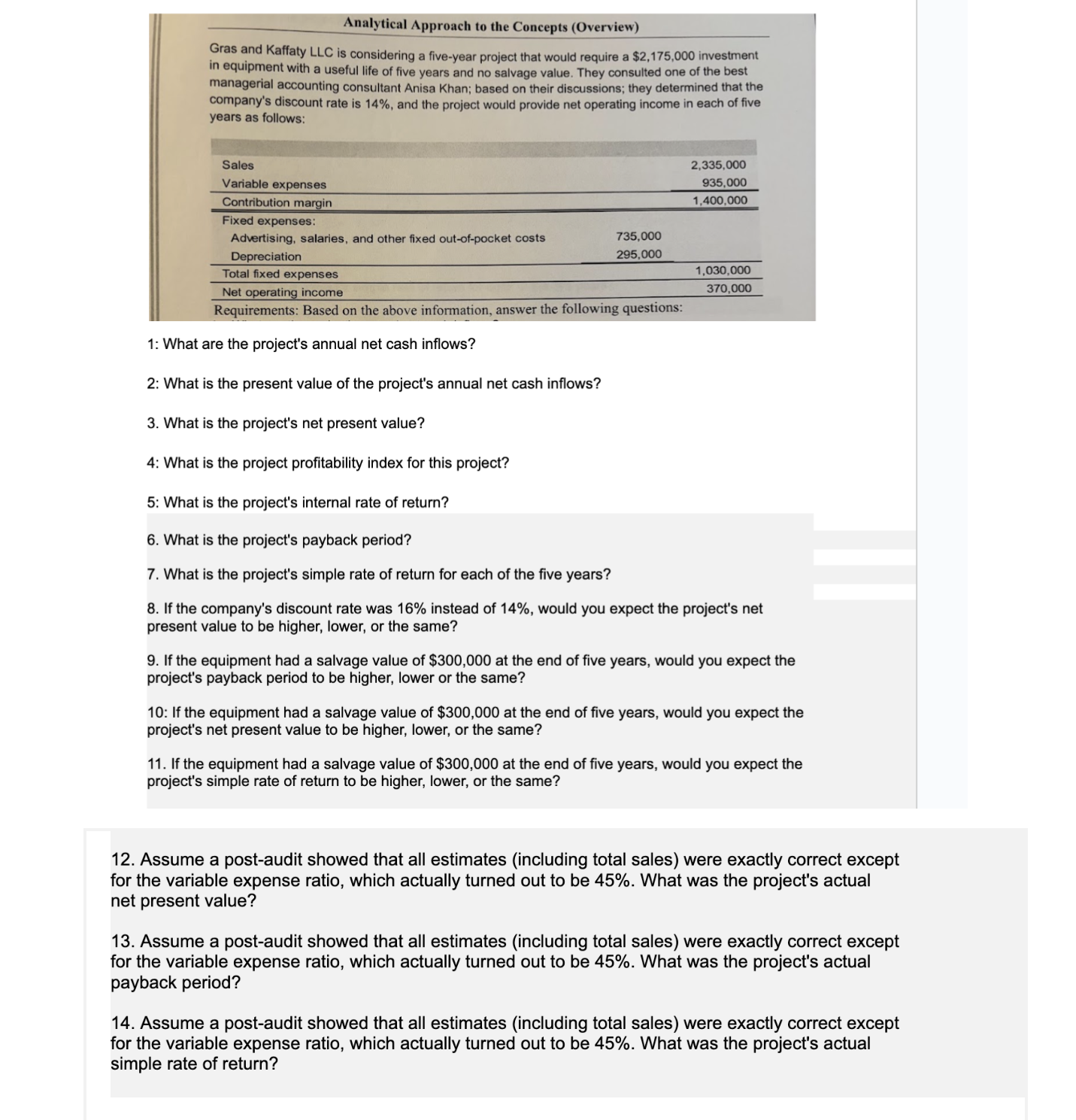

Question: Gras and Kaffaty LLC is considering a five - year project that would require a $ 2 , 1 7 5 , 0 0 0

Gras and Kaffaty LLC is considering a fiveyear project that would require a $ investment

in equipment with a useful life of five years and no salvage value. They consulted one of the best

managerial accounting consultant Anisa Khan; based on their discussions; they determined that the

company's discount rate is and the project would provide net operating income in each of five

years as follows:

: What are the project's annual net cash inflows?

: What is the present value of the project's annual net cash inflows?

What is the project's net present value?

: What is the project profitability index for this project?

: What is the project's internal rate of return?

What is the project's payback period?

What is the project's simple rate of return for each of the five years?

If the company's discount rate was instead of would you expect the project's net

present value to be higher, lower, or the same?

If the equipment had a salvage value of $ at the end of five years, would you expect the

project's payback period to be higher, lower or the same?

: If the equipment had a salvage value of $ at the end of five years, would you expect the

project's net present value to be higher, lower, or the same?

If the equipment had a salvage value of $ at the end of five years, would you expect the

project's simple rate of return to be higher, lower, or the same?

Assume a postaudit showed that all estimates including total sales were exactly correct except

for the variable expense ratio, which actually turned out to be What was the project's actual

net present value?

Assume a postaudit showed that all estimates including total sales were exactly correct except

for the variable expense ratio, which actually turned out to be What was the project's actual

payback period?

Assume a postaudit showed that all estimates including total sales were exactly correct except

for the variable expense ratio, which actually turned out to be What was the project's actual

simple rate of return?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock