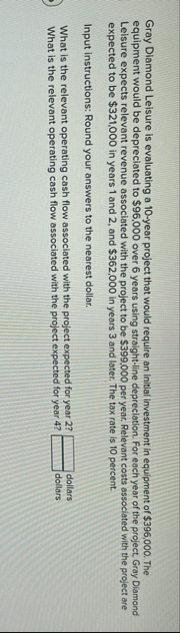

Question: Gray Diamond Leisure is evaluating a 1 0 - year project that would require an initial investment in equipment of $ 3 9 6 ,

Gray Diamond Leisure is evaluating a year project that would require an initial investment in equipment of $ The equipment would be depreciated to $ over years using straightline depreciation. For each year of the project, Gray Diamond Leisure expects relevant revenue associated with the project to be $ per year. Relevant costs associated with the project are expected to be $ in years and and $ in years and later. The tax rate is percent.

Input instructions: Round your answers to the nearest dollar.

What is the relevant operating cash flow associated with the project expected for year What is the relevant operating cash flow associated with the project expected for year dollars dollars

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock