Question: Great Adventures Problem AP6-1 please help me solve this question. Now that operations for outdoor clinics and TEAM events are running smoothly, Suzie thinks of

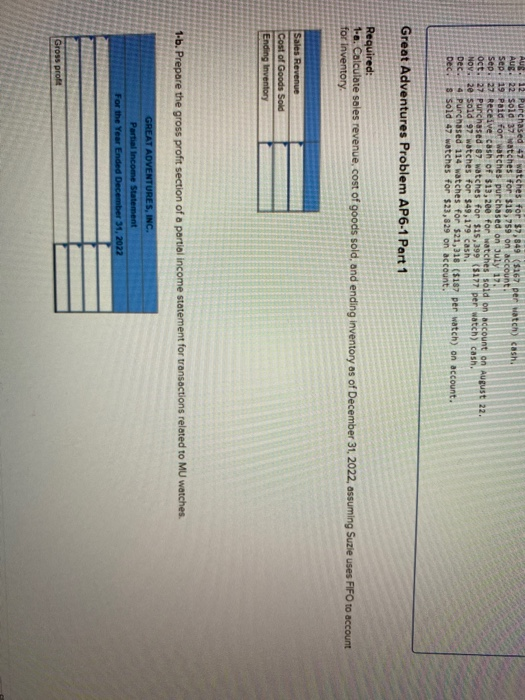

Aug. 12 Purchased 47 watches for 37,849 ($167 per Match cash. Aug. 22 Sold 37 Watches for $18,759 on account Sep. 19 Paid for watches purchased on July 12 Sep. 27 Receive cash of $13,200 for watches sold on account on August 22. oct. 27 Purchased 87 watches for $15,399 (5177 per watch) cash. Nov. 2e sold 97 watches for $49,179 cash. Dec 4 Purchased 114 watches for $21,318 ($187 per watch) on account. Dec , $ Sold 47 watches for $23,329 on account. Great Adventures Problem AP6-1 Part 1 Required: 1-a. Calculate sales revenue, cost of goods sold, and ending inventory as of December 31, 2022, assuming Suzie uses FIFO to account for Inventory. Sales Revenue Cost of Goods Sold Ending Inventory 1-b. Prepare the gross profit section of a partial income statement for transactions related to MU watches. GREAT ADVENTURES, INC. Partial Income Statement For the Year Ended December 31, 2022 Gross prof

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts