Question: Great feedback for correct work! Thanks QUESTION 12 Mark, a married (filing jointly with spouse, Beth) taxpayer, operates a printing business (not an SSTB) as

Great feedback for correct work! Thanks

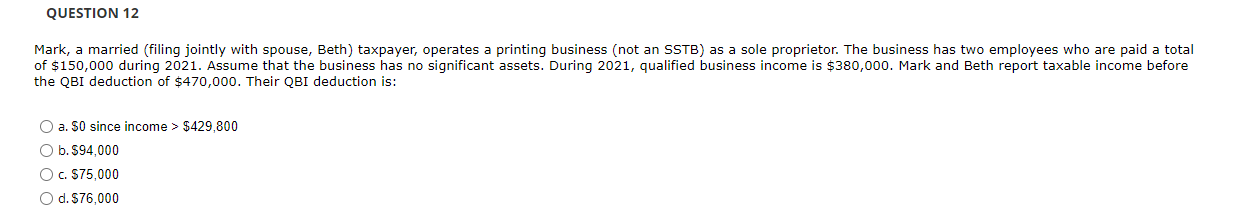

QUESTION 12 Mark, a married (filing jointly with spouse, Beth) taxpayer, operates a printing business (not an SSTB) as a sole proprietor. The business has two employees who are paid a total of $150,000 during 2021. Assume that the business has no significant assets. During 2021, qualified business income is $380,000. Mark and Beth report taxable income before the QBI deduction of $470,000. Their QBI deduction is: O a. So since income > $429,800 O b. $94,000 O c. $75,000 O d. $76,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts