Question: great feedback for correct work. thanks QUESTION 17 Kyle is a mechanic who conducts his practice as a single-member LLC, so income is reported as

great feedback for correct work. thanks

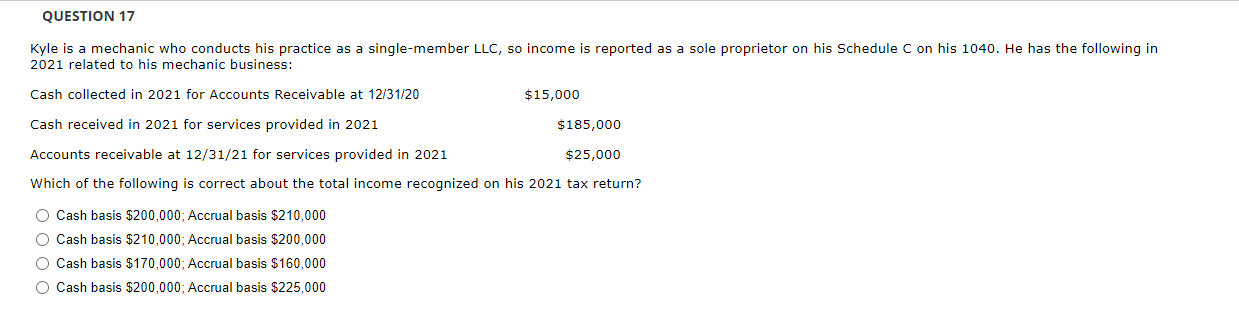

QUESTION 17 Kyle is a mechanic who conducts his practice as a single-member LLC, so income is reported as a sole proprietor on his Schedule C on his 1040. He has the following in 2021 related to his mechanic business: Cash collected in 2021 for Accounts Receivable at 12/31/20 $15,000 Cash received in 2021 for services provided in 2021 $185,000 Accounts receivable at 12/31/21 for services provided in 2021 $ 25,000 Which of the following is correct about the total income recognized on his 2021 tax return? O Cash basis $200,000; Accrual basis $210,000 O Cash basis $210,000; Accrual basis $200,000 O Cash basis $170,000: Accrual basis $160,000 O Cash basis $200,000; Accrual basis $225,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts