Question: Great feedback instantly for correct work. QUESTION 1 Mark was seriously injured at his job. As a result of his injury, he received the following

Great feedback instantly for correct work.

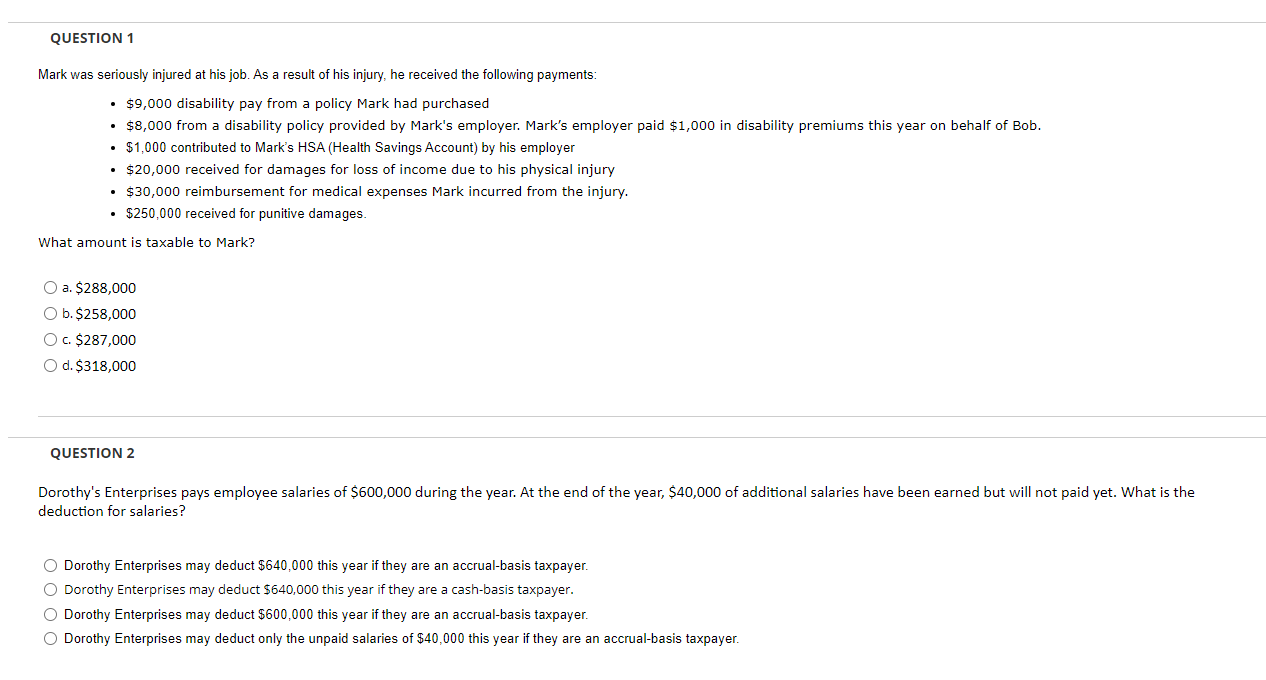

QUESTION 1 Mark was seriously injured at his job. As a result of his injury, he received the following payments: $9,000 disability pay from a policy Mark had purchased $8,000 from a disability policy provided by Mark's employer. Mark's employer paid $1,000 in disability premiums this year on behalf of Bob. $1,000 contributed to Mark's HSA (Health Savings Account) by his employer $20,000 received for damages for loss of income due to his physical injury $30,000 reimbursement for medical expenses Mark incurred from the injury. $250,000 received for punitive damages. What amount is taxable to Mark? O a. $288,000 O b. $258,000 O c. $287,000 O d. $318,000 QUESTION 2 Dorothy's Enterprises pays employee salaries of $600,000 during the year. At the end of the year, $40,000 of additional salaries have been earned but will not paid yet. What is the deduction for salaries? O Dorothy Enterprises may deduct $640,000 this year if they are an accrual-basis taxpayer. Dorothy Enterprises may deduct $640,000 this year if they are a cash-basis taxpayer. Dorothy Enterprises may deduct $600,000 this year if they are an accrual-basis taxpayer. O Dorothy Enterprises may deduct only the unpaid salaries of $40,000 this year if they are an accrual-basis taxpayer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts