Question: Great instant feedback left with correct answers. QUESTION 3 Which of the following is a NOT a deduction for AGI? O a. Alimony paid in

Great instant feedback left with correct answers.

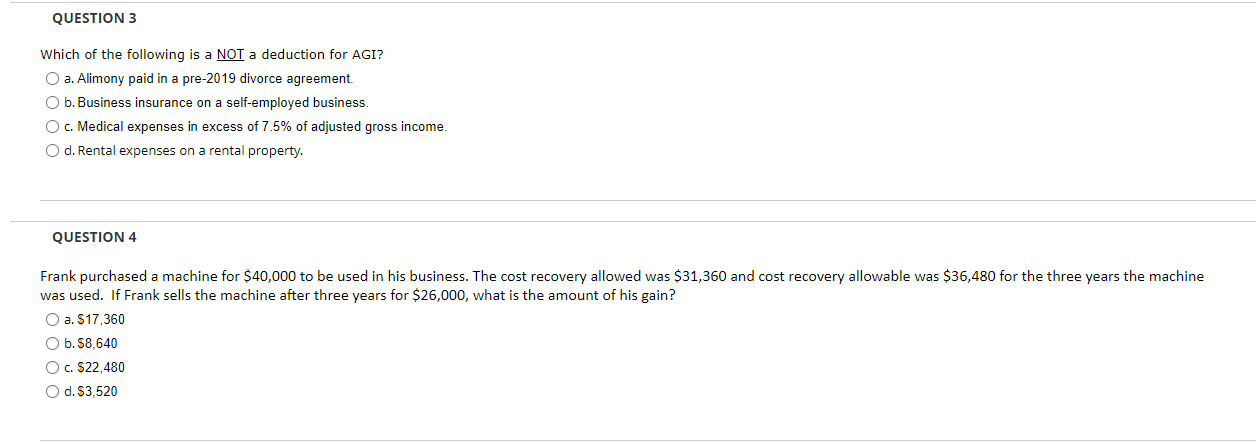

QUESTION 3 Which of the following is a NOT a deduction for AGI? O a. Alimony paid in a pre-2019 divorce agreement. Ob. Business insurance on a self-employed business. O c. Medical expenses in excess of 7.5% of adjusted gross income O d. Rental expenses on a rental property. QUESTION 4 Frank purchased a machine for $40,000 to be used in his business. The cost recovery allowed was $31,360 and cost recovery allowable was $36,480 for the three years the machine was used. If Frank sells the machine after three years for $26,000, what is the amount of his gain? O a. S17,360 O b. $8,640 O c. $22,480 O d. $3,520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts