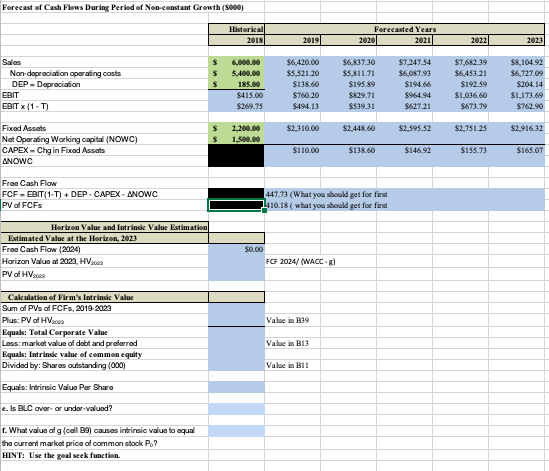

Question: Green cells are given info.. blue is answer tabs... Through excel please. Forecast of Cash Flows During period of Non-constant Growth (S000) Histerkeal 2019 2020

Green cells are given info.. blue is answer tabs...

Through excel please.

Forecast of Cash Flows During period of Non-constant Growth (S000) Histerkeal 2019 2020 2021 Sales Non depreciation operating costs DEP - Depreciation 6,000.00 5.400.00 $6,420.00 S5,521.20 SI18.60 S76020 $49.13 $6X1730 S5,811.71 $195.89 ST 24754 6,087.93 $194.66 S964.94 S627.21 ST.682.39 $6,453.21 $19259 $1,036.60 SAT3.79 $8.104.92 $6,727.09 S204.14 $1,173.09 S762.90 EBIT S415.00 $269.75 EBIT (1-T) $53931 $2,310.00 $2,448.60 $2,595.52 $2,751.25 $2,916.32 $ $ 2,200.00 1.500.00 Fixed Assets Net Operating Working capital (NOWC) CAPEX - Chain Fixed Assets ANOWC $110.00 $138.00 $146.92 $155.73 $165.07 Free Cash Flow FCF - EBIT(1-T) +DEP-CAPEX - ANOWC PV of FCFS 447.73 (What you should get for first 1410.18 ( what you should get for first Horizon Value and intrinck Value Estimation Estimated Value at the Horizon 2023 Free Cash Flow (2024 Horizon Value 2021 HV. PV HV.. FOF 2024/ ( WACC ) Value in 19 Cakulation of Firm's Intrinske Value Sum of PVs of FCFs, 2019-2023 Plus: PV of HV2. Equals: Total Corporate Value Less: market value of debt and preferred Equals: Intrinske value of common equity Divided by: Shares outstanding (000) Vala B13 Valee in B11 Equals: Intrinsic Value Per Share c. Is BLC over- or under valued? 1. What value of g (call B9) causes intrinsic value to equal the current market price of common stock P.? HINT: Use the goal seek function. Forecast of Cash Flows During period of Non-constant Growth (S000) Histerkeal 2019 2020 2021 Sales Non depreciation operating costs DEP - Depreciation 6,000.00 5.400.00 $6,420.00 S5,521.20 SI18.60 S76020 $49.13 $6X1730 S5,811.71 $195.89 ST 24754 6,087.93 $194.66 S964.94 S627.21 ST.682.39 $6,453.21 $19259 $1,036.60 SAT3.79 $8.104.92 $6,727.09 S204.14 $1,173.09 S762.90 EBIT S415.00 $269.75 EBIT (1-T) $53931 $2,310.00 $2,448.60 $2,595.52 $2,751.25 $2,916.32 $ $ 2,200.00 1.500.00 Fixed Assets Net Operating Working capital (NOWC) CAPEX - Chain Fixed Assets ANOWC $110.00 $138.00 $146.92 $155.73 $165.07 Free Cash Flow FCF - EBIT(1-T) +DEP-CAPEX - ANOWC PV of FCFS 447.73 (What you should get for first 1410.18 ( what you should get for first Horizon Value and intrinck Value Estimation Estimated Value at the Horizon 2023 Free Cash Flow (2024 Horizon Value 2021 HV. PV HV.. FOF 2024/ ( WACC ) Value in 19 Cakulation of Firm's Intrinske Value Sum of PVs of FCFs, 2019-2023 Plus: PV of HV2. Equals: Total Corporate Value Less: market value of debt and preferred Equals: Intrinske value of common equity Divided by: Shares outstanding (000) Vala B13 Valee in B11 Equals: Intrinsic Value Per Share c. Is BLC over- or under valued? 1. What value of g (call B9) causes intrinsic value to equal the current market price of common stock P.? HINT: Use the goal seek function

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts