Question: Green Gadgets Inc. is trying to decide whether to cut its expected dividend for next year from $6 per share to $3 per share in

Green Gadgets Inc. is trying to decide whether to cut its expected dividend for next year from $6 per share to $3 per share in order to have more money to invest in new projects. If it does not cut the dividend, Green Gadgets expected rate of growth in dividends is 3 percent per year and the price of their common stock will be $95 per share. However, if it cuts its dividend, the dividend growth rate is expected to rise to 6 percent in the future. Assuming that the investor's required rate of return for Green Gadgets stock does not change, what would you expect to happen to the price of its common stock if it cuts the dividend to $3? Should Green Gadgets cut its dividend? Support your answer as best you can.

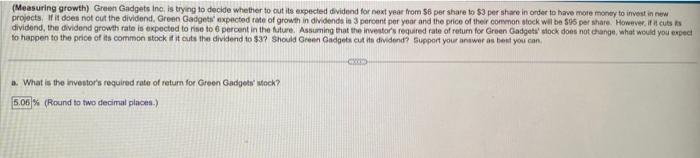

a. What is the investor's required rate of return for Green Gadgets' stock? _____%. (Round to two decimal places.)

Please help me answer all parts, thanks!

(Measuring growth) Green Gadgets inc, is tryng to decide whether to cut its expected dividend for next year from $6 per share io $3 per share in order to have mote money to invest in new projects. If it does not cut the dividend, Green Gadgeti' axpected rate of growth in dividends is 3 peroant per year and the price of their common atock wal be s 95 per share. However. if it cuts ts dividond, the dividend growth rate is expocted to rise to 6 percent in the fiture. Assuming that the inveatars required rate of return for Groen Gadgets' stock does not change, ahat would you erped to happen to the price of as common stock t it cuts the dividend to 33 ? Should Green Gadgets cut it divilend? Support your antwer as beef youi can. a. What is the investor's required rate of retum for Creen Gadgets' wheck? (Round to two decimal piaces-)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts