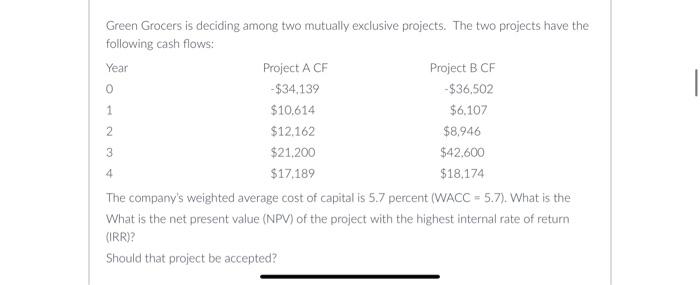

Question: Green Grocers is deciding among two mutually exclusive projects. The two projects have the following cash flows: The company's weighted average cost of capital is

Green Grocers is deciding among two mutually exclusive projects. The two projects have the following cash flows: The company's weighted average cost of capital is 5.7 percent (WACC =5.7 ). What is the What is the net present value (NPV) of the project with the highest internal rate of return (IRR)? Should that project be accepted? Should that project be accepted? \begin{tabular}{|} \hline$27,915.68; No \\ \hline$29,915.68; Yes \\ \hline$25,915,68; No \\ \hline$27,915.68; Yes \\ \hline$25,915.68; Yes \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts