Question: Greenwich plc is considering adding two new products at a subsidiary to improve its overall competitiveness. The new products are enthusiastically supported by the managers

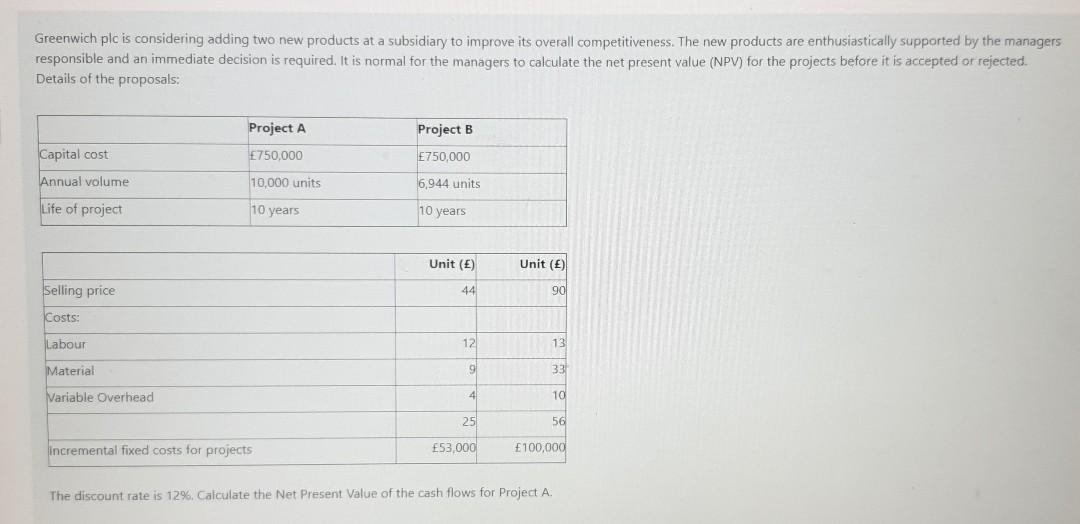

Greenwich plc is considering adding two new products at a subsidiary to improve its overall competitiveness. The new products are enthusiastically supported by the managers responsible and an immediate decision is required. It is normal for the managers to calculate the net present value (NPV) for the projects before it is accepted or rejected. Details of the proposals: Project A Project B Capital cost 750,000 750,000 Annual volume 10,000 units 6,944 units Life of project 10 years 10 years Unit () Unit () Selling price 44 901 Costs: Labour 12 13 Material 9 33 Variable Overhead 4 10 25 56 incremental fixed costs for projects 53,000 100,000 The discount rate is 12%. Calculate the Net Present Value of the cash flows for Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts