Question: Greetings, Kindly answer the WRONG ANSWER IN RED, and please make sure it is correct so I would definitely give you a BIG LIKE. Thank

Greetings,

Kindly answer the WRONG ANSWER IN RED, and please make sure it is correct so I would definitely give you a BIG LIKE. Thank you

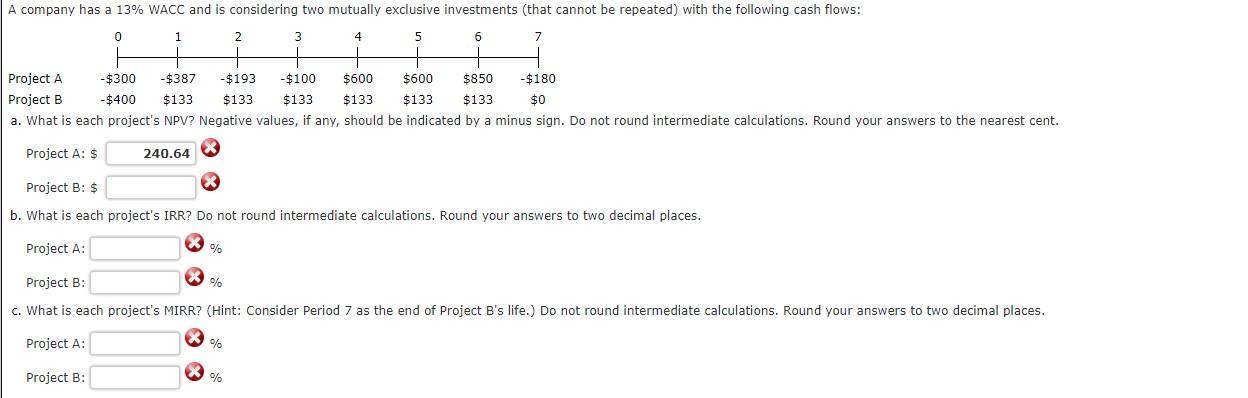

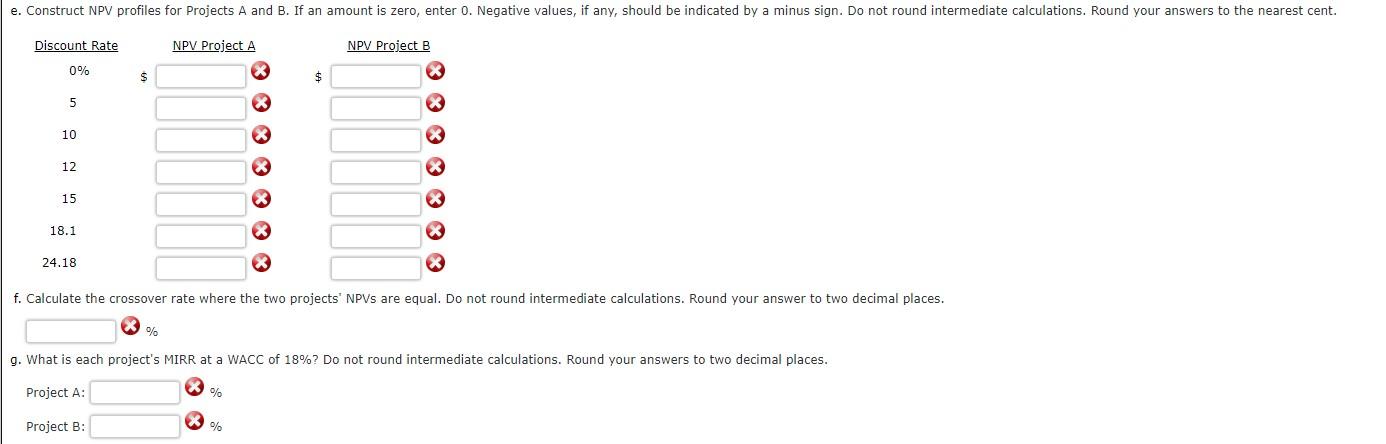

A company has a 13% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: 0 1 2 3 4 5 6 7 Project A -$300 -$387 -$193 -$100 $600 $600 $850 -$180 Project B -$400 $133 $133 $133 $133 $133 $133 $0 a. What is each project's NPV? Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: $ 240.64 Project B: $ b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % C. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % e. Construct NPV profiles for Projects A and B. If an amount is zero, enter O. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest cent. Discount Rate NPV Project A NPV Project B 0% S $ 5 X 10 X X 12 X X 15 X 18.1 24.18 f. Calculate the crossover rate where the two projects' NPVs are equal. Do not round intermediate calculations. Round your answer to two decimal places. % 9. What is each project's MIRR at a WACC of 18%? Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts