Question: Gregory is an analyst at a wealth management firm. One of his clients holds a $7,500 portfolio that consists of four stocks. The investment allocation

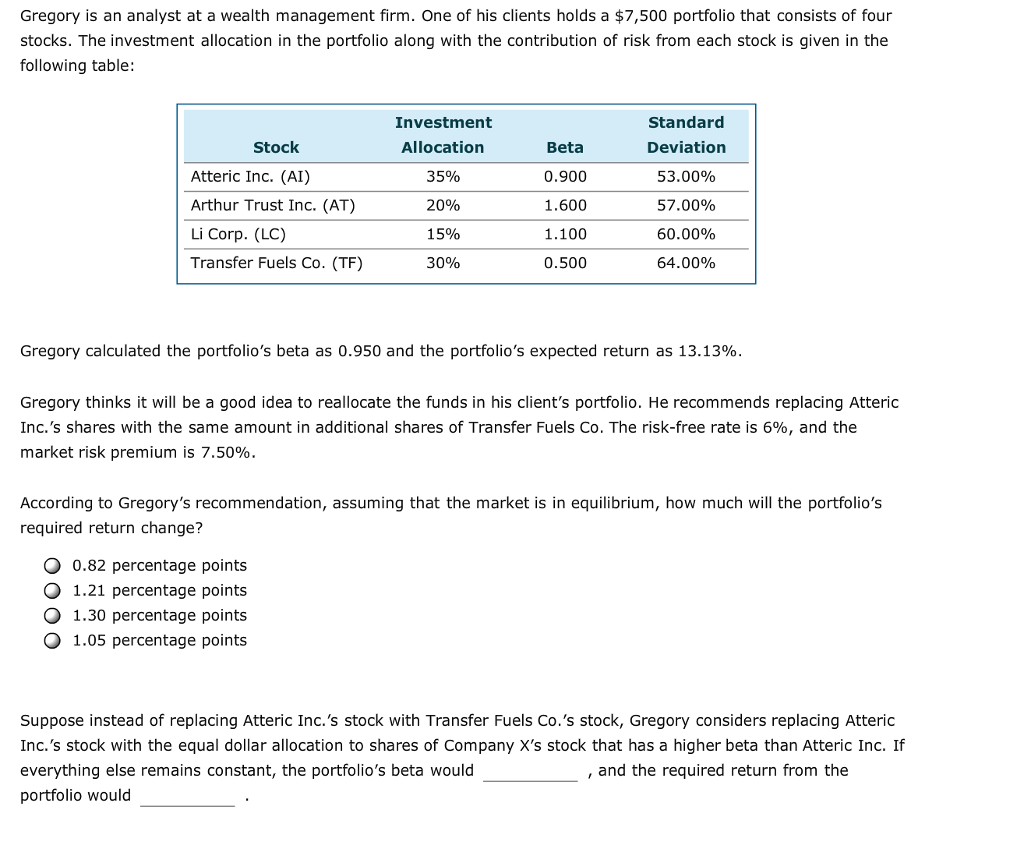

Gregory is an analyst at a wealth management firm. One of his clients holds a $7,500 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Investment Allocation 35% 2090 15% 30% Standard Deviation 53.00% 57.00% 60.00% 64.00% Stock Atteric Inc. (AI) Arthur Trust Inc. (AT) Li Corp. (LC) Transfer Fuels Co. (TF) Beta 0.900 1.600 1.100 0.500 Gregory calculated the portfolio's beta as 0.950 and the portfolio's expected return as 13.13% Gregory thinks it will be a good idea to reallocate the funds in his client's portfolio. He recommends replacing Atteric Inc.'s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 6%, and the market risk premium is 7.50% According to Gregory's recommendation, assuming that the market is in equilibrium, how much will the portfolio's required return change? O 0.82 percentage points O 1.21 percentage points O 1.30 percentage points O 1.05 percentage points Suppose instead of replacing Atteric Inc.'s stock with Transfer Fuels Co.'s stock, Gregory considers replacing Atteric Inc.'s stock with the equal dollar allocation to shares of Company X's stock that has a higher beta than Atteric Inc. If everything else remains constant, the portfolio's beta would portfolio would and the required return from the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts