Question: Gregoyle Ltd. a large oil refining company jointly processes purchased hydrocarbons to generate 3 non-saleable intermediate products: ICR8, ING4 and XGE3. Gregoyle's joint processing

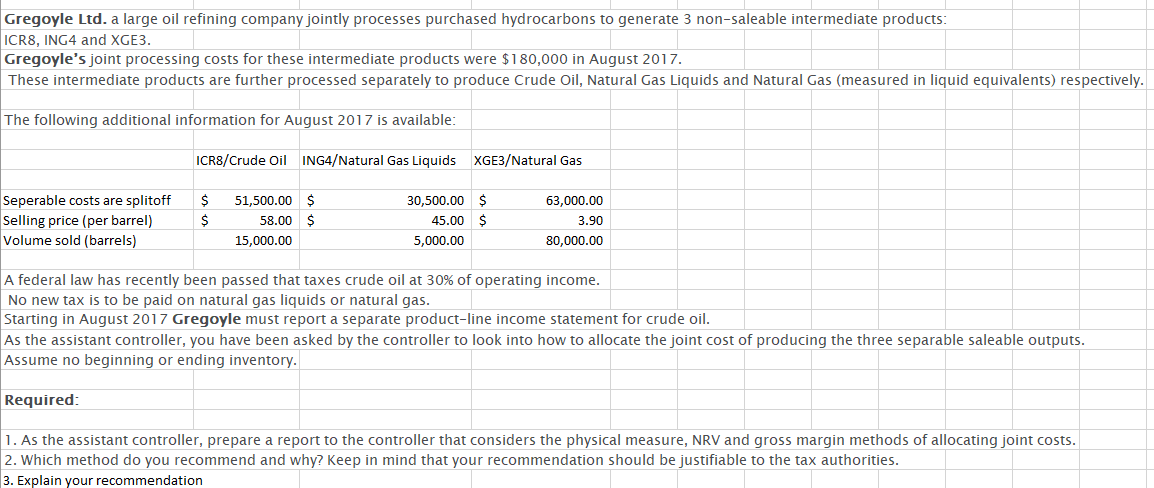

Gregoyle Ltd. a large oil refining company jointly processes purchased hydrocarbons to generate 3 non-saleable intermediate products: ICR8, ING4 and XGE3. Gregoyle's joint processing costs for these intermediate products were $180,000 in August 2017. These intermediate products are further processed separately to produce Crude Oil, Natural Gas Liquids and Natural Gas (measured in liquid equivalents) respectively. The following additional information for August 2017 is available: ICR8/Crude Oil ING4/Natural Gas Liquids XGE3/Natural Gas Seperable costs are splitoff $ 51,500.00 $ Selling price (per barrel) $ Volume sold (barrels) 58.00 $ 15,000.00 30,500.00 $ 45.00 $ 5,000.00 63,000.00 3.90 80,000.00 A federal law has recently been passed that taxes crude oil at 30% of operating income. No new tax is to be paid on natural gas liquids or natural gas. Starting in August 2017 Gregoyle must report a separate product-line income statement for crude oil. As the assistant controller, you have been asked by the controller to look into how to allocate the joint cost of producing the three separable saleable outputs. Assume no beginning or ending inventory. Required: 1. As the assistant controller, prepare a report to the controller that considers the physical measure, NRV and gross margin methods of allocating joint costs. 2. Which method do you recommend and why? Keep in mind that your recommendation should be justifiable to the tax authorities. 3. Explain your recommendation

Step by Step Solution

There are 3 Steps involved in it

Understanding the Problem and Data Problem Gregoyle Ltdjointly processes hydrocarbons into three intermediate products These intermediates are further processed into three final productsCrude OilNatur... View full answer

Get step-by-step solutions from verified subject matter experts