Question: Grift Co is based in a country whose currency is the dollar ($). The company has legal expenses in a foreign country, Farnland, whose currency

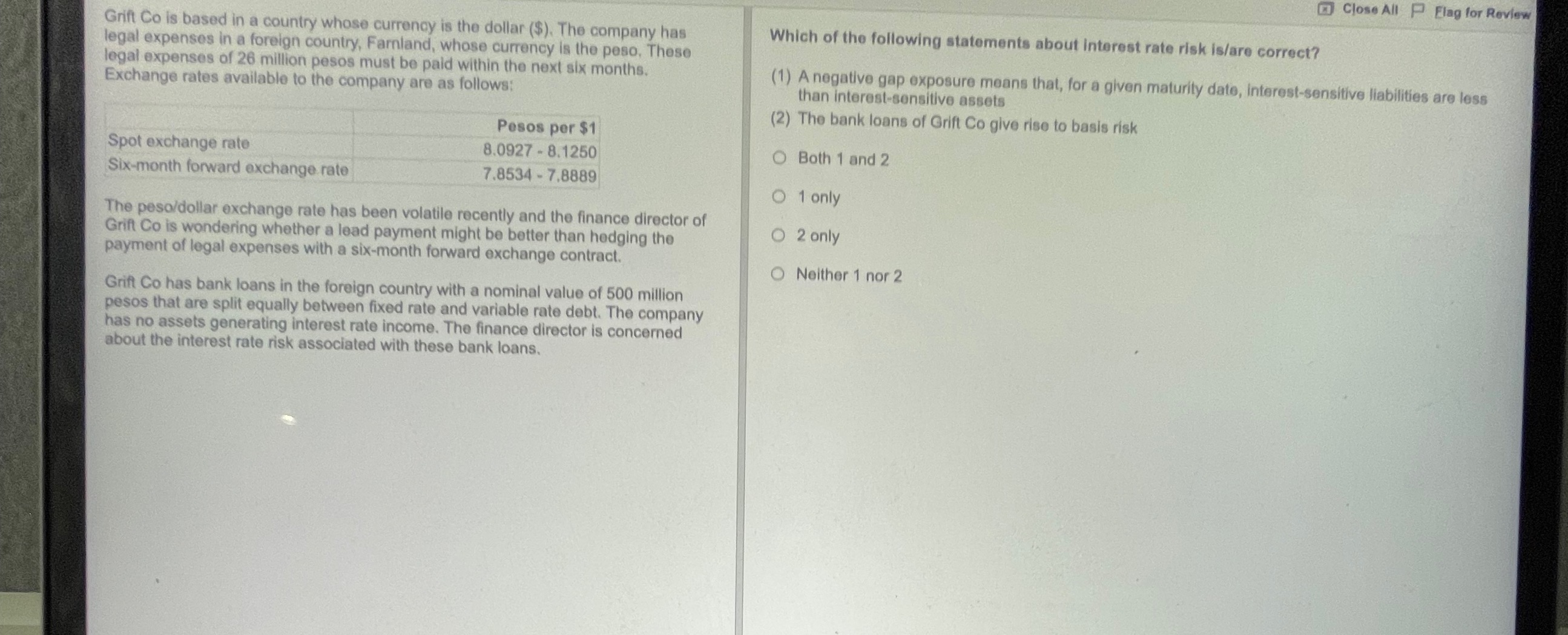

Grift Co is based in a country whose currency is the dollar (\$). The company has legal expenses in a foreign country, Farnland, whose currency is the peso, These legal expenses of 26 million pesos must be paid within the next six months. Exchange rates available to the company are as follows: The peso/dollar exchange rate has been volatile recently and the finance director of Grif Co is wondering whether a lead payment might be better than hedging the payment of legal expenses with a six-month forward exchange contract. Grift Co has bank loans in the foreign country with a nominal value of 500 million pesos that are split equally between fixed rate and variable rate debt. The company has no assets generating interest rate income. The finance director is concerned about the interest rate risk associated with these bank loans. Which of the following statements about interest rate risk is/are correct? (1) A negative gap exposure means that, for a given maturity date, interest-sensitive liabilities are less than interest-sensitive assets (2) The bank loans of Grift Co give rise to basis risk Both 1 and 2 1 only 2 only Neither 1 nor 2 Grift Co is based in a country whose currency is the dollar (\$). The company has legal expenses in a foreign country, Farnland, whose currency is the peso, These legal expenses of 26 million pesos must be paid within the next six months. Exchange rates available to the company are as follows: The peso/dollar exchange rate has been volatile recently and the finance director of Grif Co is wondering whether a lead payment might be better than hedging the payment of legal expenses with a six-month forward exchange contract. Grift Co has bank loans in the foreign country with a nominal value of 500 million pesos that are split equally between fixed rate and variable rate debt. The company has no assets generating interest rate income. The finance director is concerned about the interest rate risk associated with these bank loans. Which of the following statements about interest rate risk is/are correct? (1) A negative gap exposure means that, for a given maturity date, interest-sensitive liabilities are less than interest-sensitive assets (2) The bank loans of Grift Co give rise to basis risk Both 1 and 2 1 only 2 only Neither 1 nor 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts