Question: gross profit margin and profit margin. Assignment FULL SCREEN PRINTER VERSION BACK NEXT RCES 75 Problem 5-6A (Part Level Submission) Whispering Winds Warehouse Store has

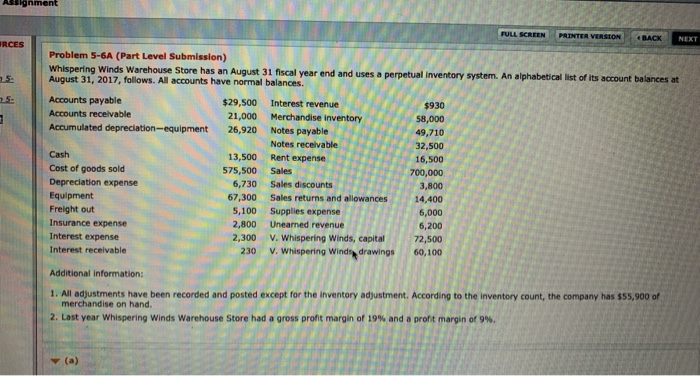

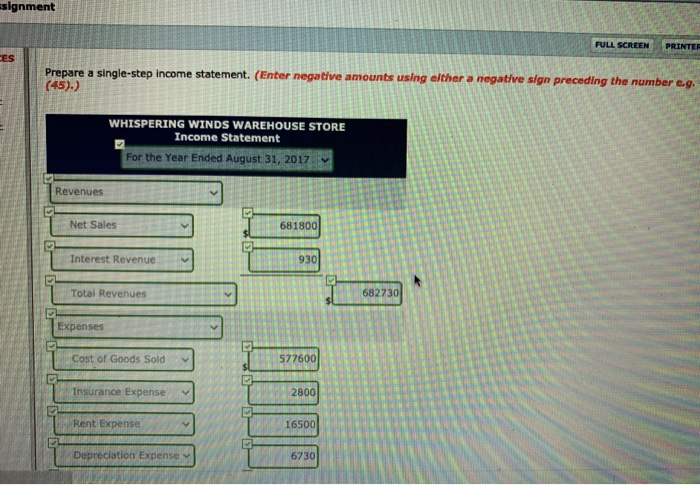

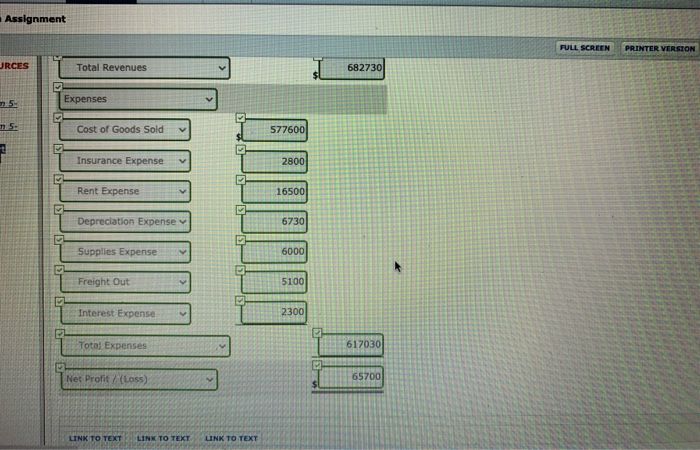

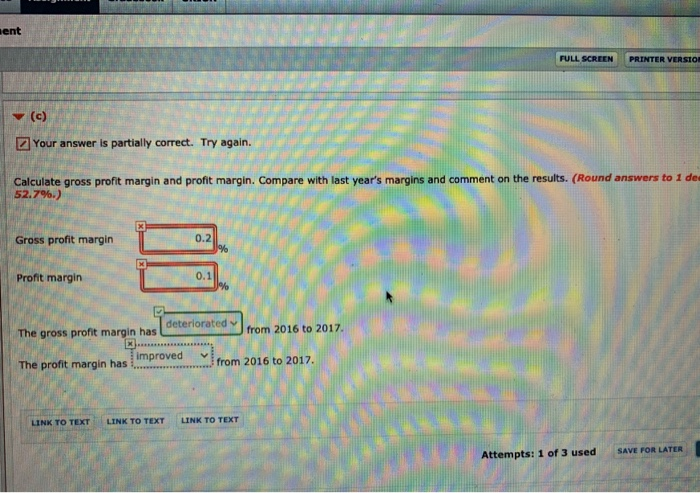

Assignment FULL SCREEN PRINTER VERSION BACK NEXT RCES 75 Problem 5-6A (Part Level Submission) Whispering Winds Warehouse Store has an August 31 fiscal year end and uses a perpetual Inventory system. An alphabetical list of its account balances at August 31, 2017, follows. All accounts have normal balances. Accounts payable $29,500 Interest revenue $930 Accounts receivable 21,000 Merchandise inventory 58,000 Accumulated depreciation-equipment 26,920 Notes payable 49,710 Notes receivable 32,500 Cash 13,500 Rent expense 16,500 Cost of goods sold 575,500 Sales 700,000 Depreciation expense 6,730 Sales discounts 3,800 Equipment 67,300 Sales returns and allowances 14,400 Freight out 5,100 Supplies expense 6,000 Insurance expense 2,800 Unearned revenue 6,200 Interest expense 2,300 V. Whispering Winds, capital 72,500 Interest receivable 230 V. Whispering Winds, drawings 60,100 Additional information: 1. All adjustments have been recorded and posted except for the inventory adjustment. According to the inventory count, the company has $55,900 of merchandise on hand. 2. Last year Whispering Winds Warehouse Store had a gross profit margin of 19% and a profit margin of 9%. (a) signment FULL SCREEN PRINTER ES Prepare a single-step income statement. (Enter negative amounts using elther a negative sign preceding the number e.g. (45).) WHISPERING WINDS WAREHOUSE STORE Income Statement For the Year Ended August 31, 2017 Revenues Net Sales 681800 Interest Revenue 930 Total Revenues 682730 Expenses Cost of Goods Sold 577600 Insurance Expense 2800 Rent Expense 16500 Depreciation Expense 6730 Assignment FULL SCREEN PRINTER VERSION JRCES Total Revenues 682730 Expenses 25 Cost of Goods Sold 577600 Insurance Expense 2800 Rent Expense 16500 Depreciation Expense v 6730 Supplies Expense 6000 Freight Out 5100 Interest Expense 2300 Total Expenses 617030 Net Profit (Loss) 65700 $ LINK TO TEXT LINK TO TEXT LINK TO TEXT sent FULL SCREEN PRINTER VERSIO! (c) Your answer is partially correct. Try again. Calculate gross profit margin and profit margin. Compare with last year's margins and comment on the results. (Round answers to 1 de 52.7%.) Gross profit margin 0.2 % Profit margin 0.1 % deteriorated The gross profit margin has from 2016 to 2017 improved The profit margin has from 2016 to 2017 LINK TO TEXT LINK TO TEXT LINK TO TEXT SAVE FOR LATER Attempts: 1 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts