Question: Group 4 Problem 2A (Ray and Maria Gomez) Chapter 2, pages 2-66 & 2-67INSTRUCTIONS: Prepare a form 1040 and Schedule 1 for Ray and Maria

Group 4 Problem 2A (Ray and Maria Gomez) Chapter 2, pages 2-66 & 2-67INSTRUCTIONS: Prepare a form 1040 and Schedule 1 for Ray and Maria Gomez using the information beginning on page 2-66 of your textbook. You can first prepare the return using the paper form in Appendix F of your textbook. Use the forms for 2021 from the IRS web site (www.irs.gov) for your final document. Transfer your information to an electronic 1040 and Schedule 1 and submit the completed forms for credit. Be sure to fill in all appropriate data such as taxpayer names, address, Social Security numbers, and occupations, and check the correct box for filing status.The lottery winnings should be entered on line 8b of Schedule 1. Schedule 1 is also to be used for any adjustments to income such as alimony paid. These amounts are then transferred to the 1040. See Schedule 1 for the proper line to which the amounts should be transferred on the 1040.Use the tax tables in Appendix A in the back of your book to find the tax for line 16. Do not use dollar signs or cents on returns. Leave blank any lines that are not needed. Do not fill in with zeros. Use commas for all amounts 1,000 and over. Add your name in parentheses after Gomez in the taxpayer name box. Example: Gomez (Student Name).Check Figures: AGI line 11 = 61,976; Refund line 35a = 1,582

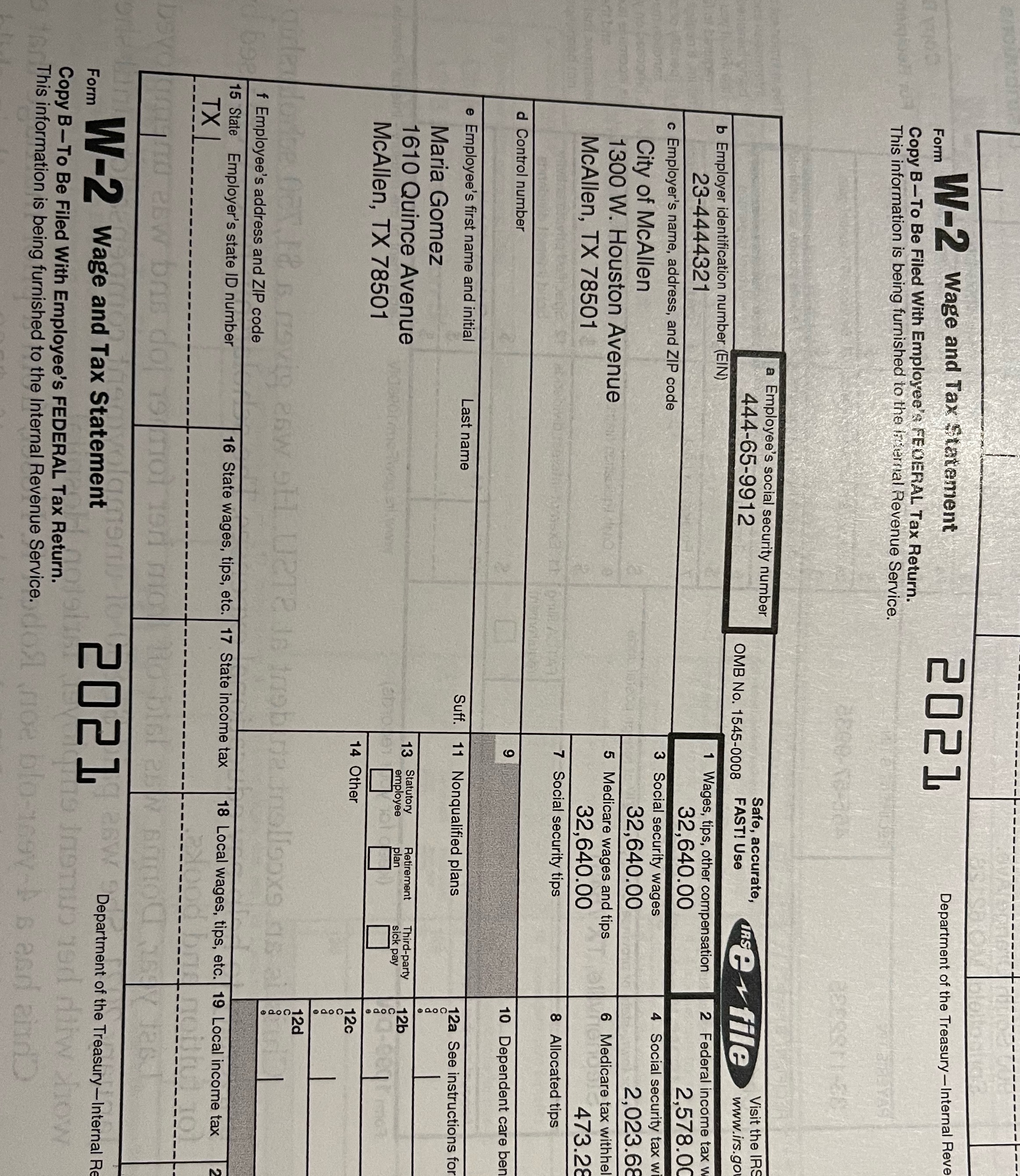

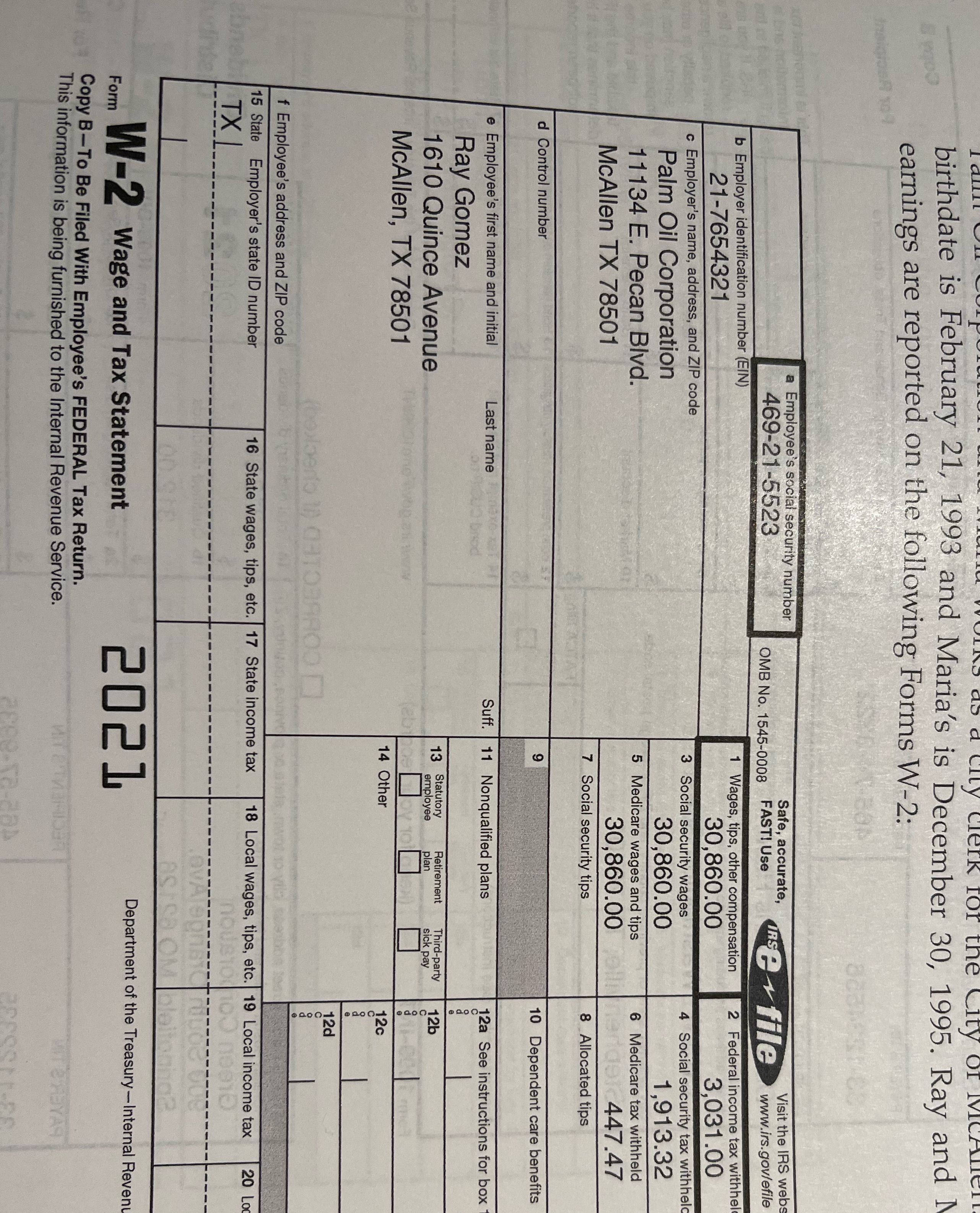

Form W-2 Wage and Tax Statement 2021 Department of the Treasury -Internal Reve Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the internal Revenue Service. PIPEYAS a Employee's social security number Visit the IR 444-65-9912 Safe, accurate, OMB No. 1545-0008 FAST! Use TRSe file www.irs.go b Employer identification number (EIN) 1 Wages, tips, other compensation Federal income tax 23-4444321 32,640.00 2,578.0 c Employer's name, address, and ZIP code Social security wages 4 Social security tax w City of McAllen 32.640.00 2,023.68 1300 W. Houston Avenue 5 Medicare wages and tips 6 Medicare tax withhe McAllen, TX 78501 32,640.00 473.28 7 Social security tips Allocated tips d Control number 10 Dependent care be e Employee's first name and initial Last name F. | 11 Nonqualified plans 12a See instructions fo Soon Maria Gomez 1610 Quince Avenue 13 Statutory Retirement Third-party employee plan sick pay McAllen, TX 78501 14 Other 120 oooo ON. 18 B movin esw SHL USTe In trieb na mollooks as a f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax X Webw bas dot is mol Ten mo Form . W-2 wage and Tax Statement 2021 Department of the Treasury - Internal R Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. Jo noe blu-ray Is end ahandbirthdate is February 21, 1993 and Maria's is December 30, 1995. Ray and earnings are reported on the following Forms W-2: Employee's social security number Safe, accurate Visit the IRS web 469-21-5523 OMB No. 1545-0008 FAST! Use IAse ~ file www.irs.gov/efile b Employer identification number (EIN) Wages, tips, other compensation 2 Federal income tax withhe 21-7654321 30,860.00 3,031.00 c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld Palm Oil Corporation 30,860.00 1,913.32 11134 E. Pecan Blvd. 5 Medicare wages and tips 6 Medicare tax withheld McAllen TX 78501 30,860.00 447.47 7 Social security tips 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 1040 brad Ray Gomez 1610 Quince Avenue 13 Statutory Retirement Third-party employee plan sick pay GOOD McAllen, TX 78501 14 Other f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 L hae 159 ON Form W-2 wage and Tax Statement 2021 Department of the Treasury -Internal Reven Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. MIT C'HEYAS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts