Question: Group Assignment Assignment objective: 1. To understand how financial statements can assist in the decision-making process. 2. Analyzing changes in Financial Statement 3. Apply ratio

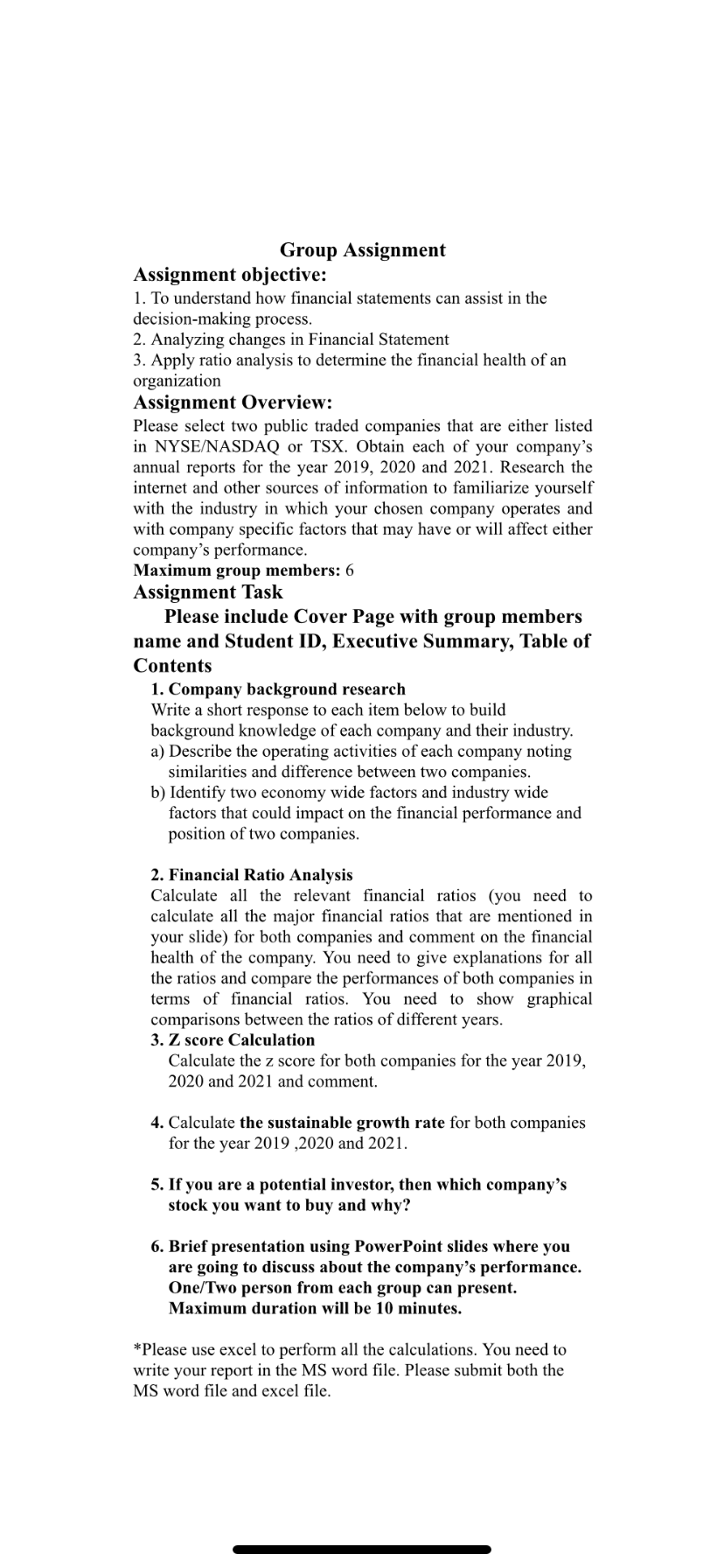

Group Assignment

Assignment objective:

1. To understand how financial statements can assist in the decision-making process.

2. Analyzing changes in Financial Statement

3. Apply ratio analysis to determine the financial health of an organization

Assignment Overview:

Please select two public traded companies that are either listed in NYSE/NASDAQ or TSX. Obtain each of your company's annual reports for the year 2019, 2020 and 2021. Research the internet and other sources of information to familiarize yourself with the industry in which your chosen company operates and with company specific factors that may have or will affect either company's performance.

Maximum group members: 6

Assignment Task

Please include Covr pge with group members name and Student ID, Executive Summary, Table of Contents

- Company background research

write down short response to each item below to build background knowledge of each company and their industry.

- Describe the operating activities of each company noting similarities and difference between two companies.

- Identify two economy wide factors and industry wide factors that could impact on the financial performance and position of two companies

2. Financial Ratio Analysis

Calculate all the relevant financial ratios (you need to calculate all the major financial ratios that are mentioned in your slide) for both companies and comment on the financial health of the company. You need to give explanations for all the ratios and compare the performances of both companies in terms of financial ratios. You need to show graphical comparisons between the ratios of different years.

3. Z score Calculation

Calculate the z score for both companies for the year 2019, 2020 and 2021 and comment.

4. Calculate the sustainable growth rate for both companies for the year 2019 ,2020 and 2021.

5. If you are a potential investor, then which company's stock you want to buy and why?

companies should be based in USA

could you plz solve this for 2019,2020,2021 ? without plag.

you can find companies and their every year balance sheets from this www.sec.gov/edgar/searchedgar/companysearch

this question is also already answered on course hero but that's for preveoius years here's the link for that

https://www.coursehero.com/tutors-problems/Finance/33932394-Group-Assignment-Assignment-Overview-Please-select-two-public/

if you can solve like this

Group Assignment Assignment objective: 1. To understand how financial statements can assist in the decision-making process. 2. Analyzing changes in Financial Statement 3. Apply ratio analysis to determine the financial health of an organization Assignment Overview: Please select two public traded companies that are either listed in NYSE/NASDAQ or TSX. Obtain each of your company's annual reports for the year 2019, 2020 and 2021. Research the internet and other sources of information to familiarize yourself with the industry in which your chosen company operates and with company specific factors that may have or will affect either company's performance. Maximum group members: 6 Assignment Task Please include Cover Page with group members name and Student ID, Executive Summary, Table of Contents 1. Company background research Write a short response to each item below to build background knowledge of each company and their industry. a) Describe the operating activities of each company noting similarities and difference between two companies. b) Identify two economy wide factors and industry wide factors that could impact on the financial performance and position of two companies. 2. Financial Ratio Analysis Calculate all the relevant financial ratios (you need to calculate all the major financial ratios that are mentioned in your slide) for both companies and comment on the financial health of the company. You need to give explanations for all the ratios and compare the performances of both companies in terms of financial ratios. You need to show graphical comparisons between the ratios of different years. 3. Z score Calculation Calculate the z score for both companies for the year 2019, 2020 and 2021 and comment. 4. Calculate the sustainable growth rate for both companies for the year 2019 ,2020 and 2021. 5. If you are a potential investor, then which company's stock you want to buy and why? 6. Brief presentation using PowerPoint slides where you are going to discuss about the company's performance. One/Two person from each group can present. Maximum duration will be 10 minutes. *Please use excel to perform all the calculations. You need to write your report in the MS word file. Please submit both the MS word file and excel file

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts